The liquidity provider niche has dramatically improved the circulation and growth metrics of the forex field. Companies that accumulate and distribute liquidity to market participants are responsible for filling the supply and demand holes wherever and whenever necessary. As a result, the market remains liquid and doesn't experience numerous problems.

However, the realm of liquidity provision is layered and includes many different types of LPs. Each type handles the process of providing liquidity through different channels and is packaged with unique complementary offerings. This article will discuss two of the most crucial players in this landscape - Prime of Prime liquidity providers and prime brokers.

[[aa-key-takeaways]]

[[/a]]

As the name suggests, a forex prime broker is one of the most influential and powerful players in the entire LP sector. These massive companies have access to fund pools that could rival the budget of small countries, and they distribute these funds according to the economic shifts in the forex market.

JP Morgan, Morgan Stanley, HSCB and Citi Bank are great examples of prime brokers possessing colossal funds and supplying the forex market to the best of their ability.

Other types of prime brokers include investment banks and other large financial institutions. All prime brokers provide services to high-profile clients regardless of their company form. The rendered services can range from asset management, high-level consultation, borrowings, securities lending and even the complete takeover of the portfolio management duties.

Due to the size and quality of their offerings, prime brokers mostly serve large institutional clients, including hedge funds and investment banks. The price for these services is appropriately high since they all require extensive human resources, high-level expertise and access to massive liquidity pools.

As discussed, FX prime brokers are large organisations with accumulated experience, elite-level workforce and long-standing relationships in the forex field, giving them access to large amounts of liquidity and borrowing sources. PBs mainly offer bundled deals to their clients, allowing them to acquire a competitive advantage in the field and strengthen their forex-related operations on several fronts.

For that reason, most of the prime broker companies are also active in other fields, including investment, commercial banking and outsourcing. This allows the PBs to allocate their resources efficiently if the foreign exchange prime brokerage services take a dip in a certain period.

In most cases, prime brokers also share the role of market makers. They provide liquidity to markets through forex assets and earn spread income from these activities.

This revenue stream is similar to prime brokerage clients that require liquidity, with the only difference being that for market makers, the client is the general market.

Prime brokers' biggest competitive advantage is their service quality and diversity, a far cry from the retail broker agencies and their respective offerings. First and foremost, the PBs are famous for their extensive lending capabilities, either directly or, in most cases, through various investment funds and other liquidity pools.

They allow multiple institutions, companies and whale traders to accumulate a massive forex capital, sufficient for virtually any operational need.

However, prime brokers don't just limit their aid to providing funding sources. Instead, they often bundle this service with research, consultation and asset management.

Research is quite straightforward, helping companies like hedge funds to acquire more in-depth knowledge on their respective niche and local markets. Consultation is often mixed with research, as PBs provide detailed reports of their findings and analyse the client companies thoroughly.

As a result, they provide guidance on the biggest opportunities and potential or factual weaknesses to resolve. PBs often provide comprehensive consultation services, presenting possible challenges or issues to clients and offering corresponding solutions to them.

Finally, hands-on asset management is an option to outsource the entire portfolio management process to PBs effectively. This service is an excellent option for institutions that don't have a lot of time or in-house expertise to handle a forex portfolio.

As analysed above, forex PBs provide comprehensive support for their clients, virtually satisfying their needs within the forex landscape, including a complete portfolio takeover. On the other side, we have regular broker agencies who provide trade execution and processing services.

In some cases, regular broker agencies can provide complementary services, including digital platforms, analytics tools and live data feeds. However, the personalisation and the scope of services differ wildly in this case.

Regular brokers are designed to handle retail clients, whereas prime brokers facilitate growth for industry leaders. Naturally, these broker types have drastically different target audiences and their services are tailored accordingly.

It would not make sense for an institutional client to utilise basic brokerage services, as they would simply not have enough liquidity and lending capabilities to satisfy their demands.

Conversely, retail clients can't afford to partner with prime brokerages, as each of their tailored services starts at a five-figure pricing fee. So, the market has sorted itself once again, creating retail brokers for up-and-coming clients and delegating PB services to industry giants.

But what happens to the middle of the market? Companies that are large enough to use the PB offerings but don't quite fit the bill in terms of their size and scale. This is where the PoP model comes into play.

The PoP model was created due to a market inefficiency. As the forex market progressed in the 21st century, a new niche of digital companies entered. These organisations grew exponentially in short periods thanks to the globalisation and digitalisation of forex.

Despite their impressive size and extent of operations, most of these companies were still not eligible for a prime brokerage partnership, which created an apparent demand-supply gap in the market.

PoPs emerged to fill this supply gap and serve clients without almost any restrictions in scope and size. PoPs create a symbiotic relationship on the market, harnessing the power of larger investment companies and liquidity pools and distributing these funds to satisfy market demands.

As a result, PoPs have managed to create a thriving forex market and make the liquidity provision process more efficient across the board.

[[aa-fast-fact]]

Prime of Prime firms are mostly technology-driven and often provide access to their custom platform, making it easier to retrieve liquidity and manage different options dynamically.

[[/a]]

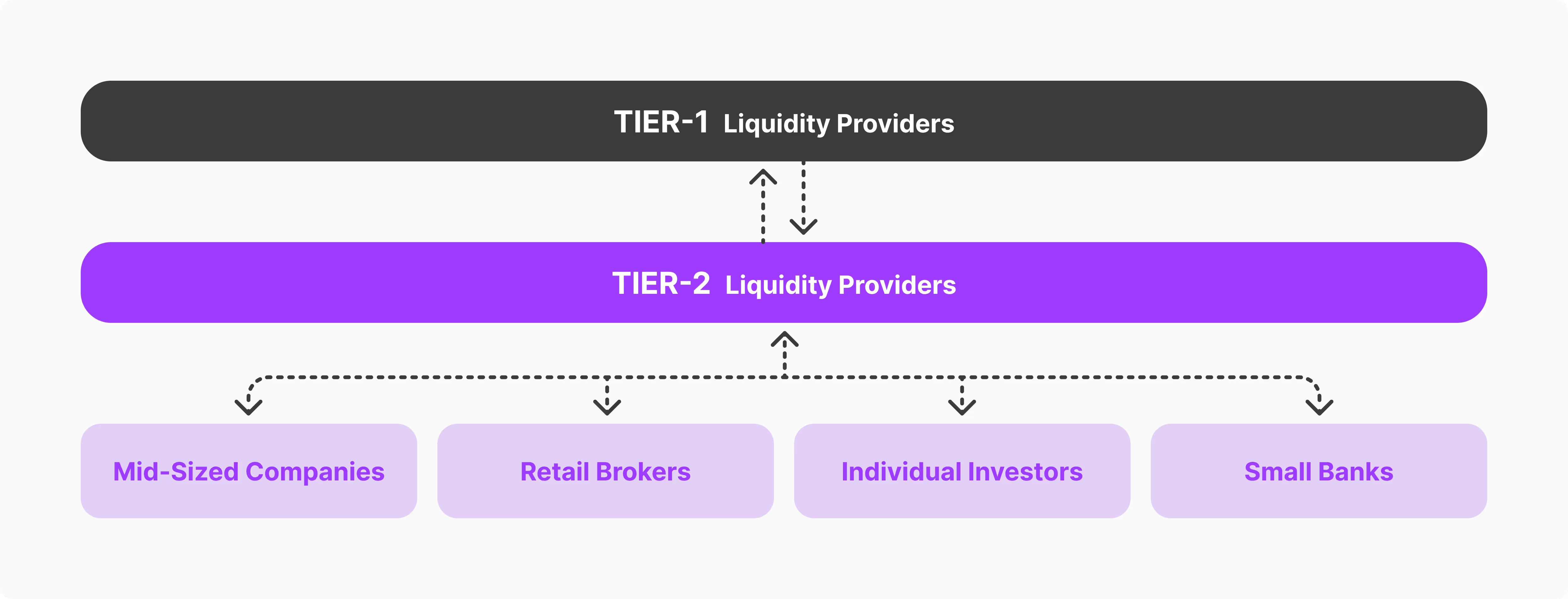

Prime brokers are tier-1 liquidity providers in terms of resource access and operational prowess. They occupy the top spot within the liquidity provision niche in forex. PoPs, on the other hand, are tier-2 liquidity providers, meaning they have indirect access to tier-1 liquidity through various prime broker partnerships.

This format allows PoP clients to acquire substantial amounts of liquidity even if they are not qualified to sign up with a prime brokerage institution. PoPs, on their part, obtain access to tier-1 liquidity and distribute it on the market, allowing smaller players to benefit from extensive liquidity offerings in the process.

The tier-1 PBs get their fair share of the commission from this process, increasing their operational efficiency and profitability.

Without PoPs, many mid-sized companies would struggle to satisfy their growing liquidity needs on the forex market. Suppose we have a company X that has started as a scrappy forex startup platform. In the beginning period, company X could get by with a minimum amount of financing and liquidity pools satisfied by retail brokerage agencies or individual investors.

Company X managed to climb the market ranks and increase its market share rapidly, entering the global sector in a few years. Despite their success, company X is still considered a mid-sized entity, not quite eligible for the top honours. However, their liquidity needs are now above anything on a retail level and below anything on a tier-1 level.

Without the Pop-PB partnership, company X and all similar entities would find it dramatically harder to obtain liquidity from a single source.

Instead, they would require financing from numerous sources, creating a complex web of relationships, vendors and high interest rates. Many companies have struggled in this teenage phase of their global expansion, finding dependable partners with sufficient liquidity pools. However, with PoPs, companies of this scale can obtain tier-1 liquidity portions without any significant complications.

In the end, all three entities involved in this relationship benefit from the PoP model. Tier-1 providers acquire new revenue streams without any material expenses, and mid-sized companies get access to sufficient liquidity and tailored services.

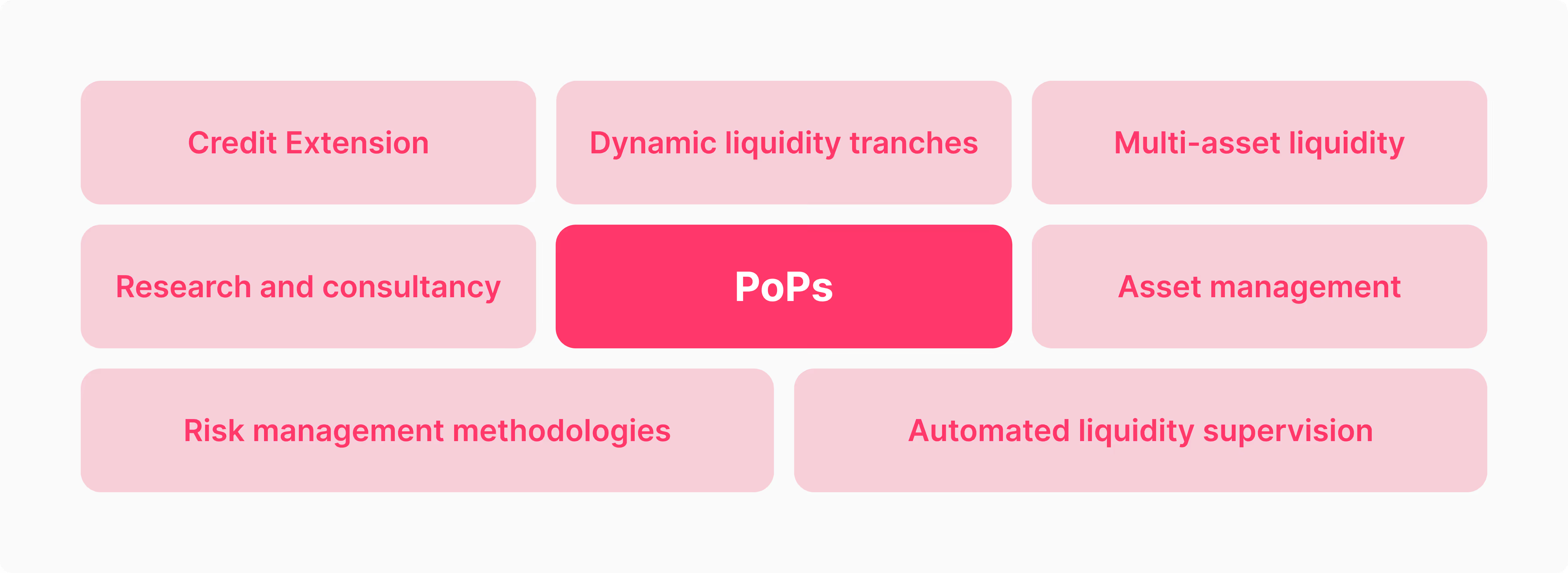

To an untrained eye, Prime of Prime firm offerings are quite similar to the Prime brokerage model. However, PoP companies serve a more diverse client base and accommodate various demands. PoPs provide all the familiar services of tier-1 prime brokers, including research, consultation, asset management and liquidity sourcing. However, all of these services have been modified to fit the needs of smaller entities.

It doesn't make sense to provide massive research and consultation services to a mid-sized company that operates in a more limited region and has a lower competition level than industry leaders. So, PoPs have a more flexible approach to offering services, which positively impacts their pricing packages.

Unlike prime brokers, PoPs modify their scale and size according to the client's needs. They don't employ hundreds of research experts or consultants. Instead, they employ enough to serve the mid-sized niche in forex. As a result, PoP services are often much less expensive than prime brokerages.

A more accessible price tag does not equal less quality services, though. Instead, PoPs have a dynamic approach to their client needs, increasing and decreasing their service scope according to customer needs. Their smaller size and specialist approach make PoPs much more flexible than gigantic prime brokerage firms, enabling them to keep their service quality high despite lower fees.

As outlined above, the most significant appeal of PoPs is their ability to partner with PB institutions and attain their massive liquidity pools. This process is quite layered and cleverly constructed when analysed closely.

In simple terms, PoPs understand that most of their clients require a fraction of the massive tier-1 liquidity pools. Their monetary capabilities are correspondingly lower. So, to satisfy both parties, PoPs have devised a model to divide the liquidity pools into smaller tranches and package them for mid-sized businesses.

For example, a single massive tier-1 client could be divided into ten or more smaller clients of PoPs, each utilising their tranche of the liquidity pool and paying smaller fees. For tier-1 PBs, the result is practically the same, as they receive a similar amount of commission charges from PoP intermediaries.

Conversely, mid-sized companies pay just a small fraction of what they would have to in case of partnering with tier-1 organisations. The tranche size is dynamic, allowing businesses to increase or decrease their credit lines by their market demands and budgetary capabilities.

The PoP firms employ numerous technology advancements to make this process smoother and more efficient for everyone involved. The automated market maker (AMM) systems and various algorithms allow them to distribute liquidity resources to their client base automatically.

Naturally, large credit extensions are not instant, as the PoPs need to analyse the client's capabilities. But overall, digital innovations and automation tools greatly support the PoP companies in distributing the fund pools efficiently.

To decide between the PoPs and prime brokerages, you must understand that these two entities are complementary instead of being each other's substitutes. They serve different tiers of companies across the forex and financial markets. So, to choose the best option, you must analyse your specific business capabilities first.

If your scope and size are still considered on the lower or middle end of the forex market, PoP firms are the best option overall. They will supply your forex company with sufficient liquidity, consultation and risk management services at an affordable price, producing a net profit.

However, PoPs have limitations and might not be the best option for forex clients on the top of their respective niches. If your circulation is well in the millions and your budgetary capabilities exceed six-figure monthly costs, PoPs might not have enough resources to accommodate your colossal needs.

In this case, the best prime brokers available on the market will provide research, top-tier consultation, virtually limitless liquidity pools and a hefty price tag to boot.

Prime of Prime firms and prime brokerages have an excellent relationship that benefits the entire forex market. These two entities ensure that liquidity pools accumulated through various institutions are distributed evenly across the market and don't stay dormant due to unmatching supply and demand.

Deciding between these two service offerings entirely depends on your size and scale of operations. However, for the majority of the market, PoPs are a superior choice, offering a slightly downsized but equally effective package of services at an affordable price.

[[aa-faq]]

Retail brokers mostly provide trade execution and processing services, whereas prime brokers offer full-stop forex services, ranging from liquidity sources and consultancy to portfolio management.

PoP firms level the playing field for mid-sized forex companies that wish to acquire large liquidity reserves and other tailored services of tier-1 brokerages but don’t quite meet the eligibility requirements.

While PoPs are considerably less costly than tier-1 firms, their pricing package is still considerable and should be examined carefully. The price tag is mostly suitable for mid-sized companies in the forex niche.

[[/a]]