A prime brokerage is a set of services investment banks, or other financial entities provide to hedge funds and other major investment clients that borrow securities or cash to achieve absolute returns. In this article, we will discuss what prime brokers are, how they work and why they differ from market makers and other brokers.

[[aa-key-takeaways]]

[[/a]]

Let us start with the prime brokerage definition.

Prime Brokerage (PB) is a set of services financial organisations provide to hedge funds and other big investment clients, enabling them to borrow securities or cash to engage in netting to attain absolute returns. Nowadays, clients also prefer holding a crypto PB account because it provides advanced market data and tools.

PBs are the largest liquidity providers. It is a big financial organisation that enables a market participant to enter the financial market.

Simply put, a prime broker is an intermediary between a trader and the market.

Prime brokers in the Forex market are the highest-level liquidity providers. These can be big financial organisations like investment banks, such as Barclays Capital and Bank of America, or financial conglomerates like Morgan Stanley.

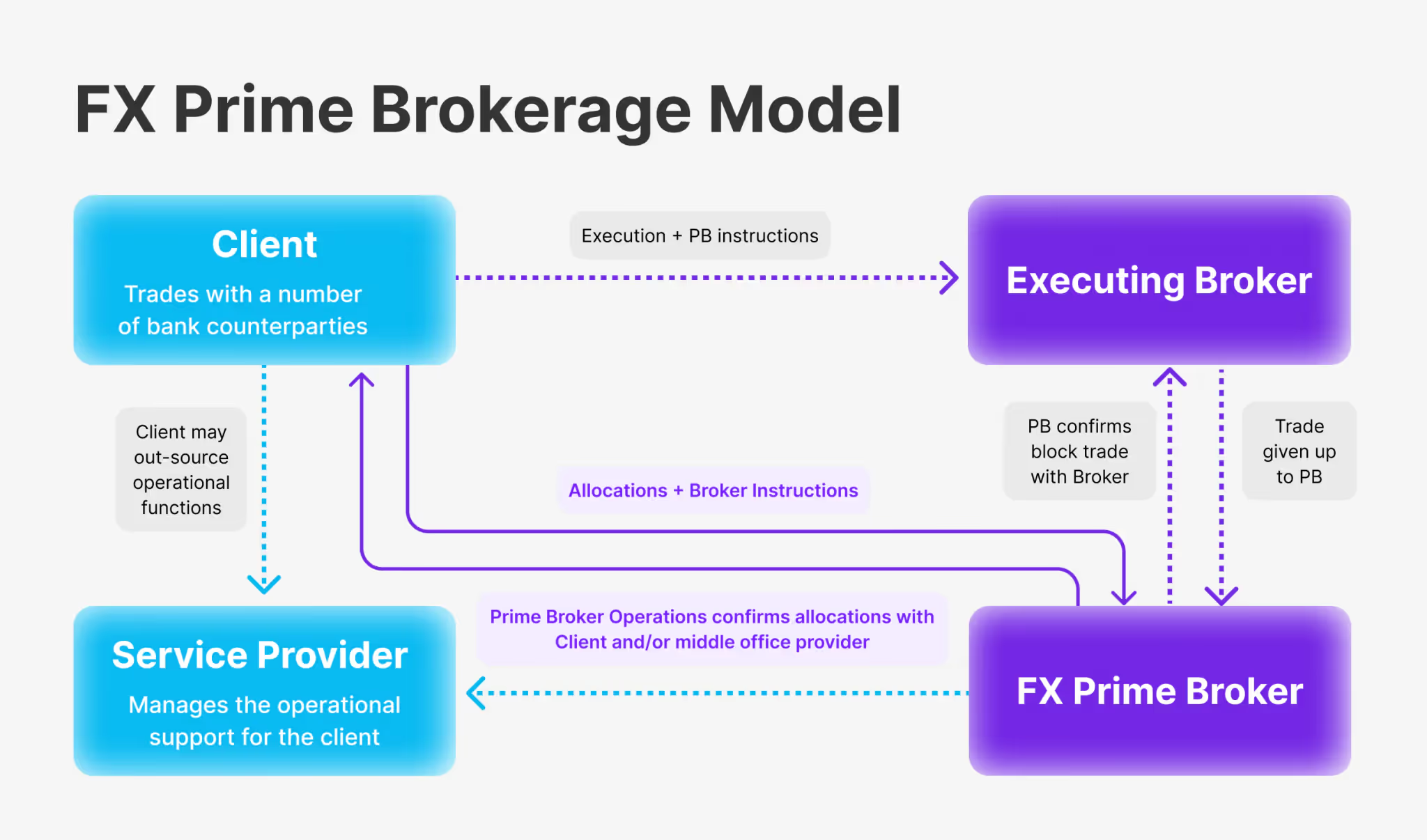

Smaller banks, hedge funds and various broker and investment companies enter into agreements with prime brokers who perform transactions on behalf of the smaller companies.

A prime broker serves as a guarantor for the smaller organisations in the Forex market: smaller brokers, private traders and investors need a mediator to make transactions in the interbank market independently.

After a PB closes its client order, an opposite order is automatically opened in the interbank market. Such activity of prime brokers helps eliminate possible risks for all parties to a transaction.

Transactions are brought to the interbank market in the following way: brokerage companies sum them up before transferring transactions and conclude contracts with the primary broker.

Let’s discuss what prime brokers do and what services they provide.

PB services are various, with the most popular being the following:

Clearing is a procedure for conducting non-cash payments between financial entities for goods, services, shares, etc. With such countertrade, the netting of security and obligations is valued. A prime broker offers clearing services for transactions in both cash and securities. It is a complex process that requires a specialised organisation to act as a mediator to ensure transactions are secure and properly settled.

Securities lending includes all types of securities available in the financial industry. The broker charges a commission for this service. The total cost of the commission consists of the borrowing rates and any interest specified by the contract. A prime broker rewards securities holders who allow borrowers to short-trade their securities.

Cash management aims at accumulating and handling the cash flows of organisations and individuals, thus ensuring a company’s efficiency and well-being. Moreover, a PB account provides institutional investors and hedge funds with greater availability of liquidity and assets.

A custodian is a financial institution holding its clients’ securities like bonds and options for protection. It generally holds high-value securities in both electronic and physical forms.

Custodial service is the most essential function provided by PBs to hedge funds.

The prime brokers provide the following custodial services:

Prime brokers provide a set of different services, including holding and safeguarding assets, executing trades and providing liquidity. This may lead to a misunderstanding. So, what is the difference between prime brokers and other financial entities, such as market makers, custodians or executing brokers?

In simple words, the main difference between a prime broker and an executing broker is the set of services each of them provides.

Executing brokers execute specific asset types, such as futures or forex bonds, on behalf of clients. They do not offer financing, securities lending or risk management services. Also, executing brokers primarily execute trades for retail investors or smaller institutional investors.

Prime brokers’ set of services goes beyond just trade execution. They do not typically offer the scope of services a prime broker provides, such as financing or securities lending.

The custody provider, or custodian, keeps possession and safeguards assets on behalf of clients. Though today stocks’ safekeeping is handled electronically, a while back, when stock certificates were printed on paper, custodians used to actually store them.

Prime brokers also keep and safeguard clients’ assets, but they additionally provide a range of services to institutional investors. Prime brokers, however, can access the stocks in custody, but only with a client’s consent.

Both Prime brokers and market makers are major financial institutions.

Market makers provide liquidity to markets by means of regularly buying and selling assets. Thus, they help ensure enough liquidity in the markets to guarantee seamless trading and sufficient trading volume. Market makers help keep the market functioning; without them, the market would be illiquid.

On the other hand, Prime brokers do not focus on ensuring market liquidity. They aim to provide a suite of services to institutional investors.

Among the largest Prime Brokers in the financial markets, we can name J.P. Morgan, ActivTrades, Goldman Sachs, IG and Plus500. Let’s take a closer look at each of them.

Goldman Sachs is one of the best prime brokers, the world’s major investment company, and a leader in hedge funds and PB services. It delivers services to corporations, financial institutions, governments, and high-net-worth individuals. Since September 20, 2013, Goldman Sachs has been included in the Dow Jones Industrial Average.

Among the many PB services provided by Goldman Sachs, we can mention the following:

According to the Prime Brokerage survey, Goldman Sachs averaged 7.0 for foreign exchange PB in 2021.

Goldman Sachs is a leading investment firm with 150 years of banking history. It offers customised client services, competitive rates, and stability of borrowing.

Considering the company’s sheer size, it does not suit smaller hedge funds.

J.P. Morgan is the bank that provides a wide range of financial and banking services for legal entities, including opening and maintaining bank accounts, conversion operations, financial market operations, operations with securities and derivative financial instruments, custody services, and trade finance.

Regarding PB, J.P. Morgan is considered Goldman Sachs’ closest competitor. It provides such prime services as insights, derivatives clearing and mediation, provision of financial solutions and customer services.

J.P. Morgan is a stable firm with extended history. It is one of the most prominent players in prime brokerage and operates in 30 countries.

However, some clients claim that the firm does not provide extensive support to smaller accounts hedge funds, preferring to focus on big-cap companies.

ActivTrades is a traditional CFD broker. It provides services to retail and institutional traders via the ActivTrader, MetaTrader 4 and MetaTrader 5 electronic trading platforms. ActivTrades is regulated by the FCA, CSSF and SCB.

The broker uses the most advanced technology to improve users’ trading efficiency, such as automatic trading and trading apps based on ActivTrades technology. The company also offers one of the best execution speeds in the industry.

Among many advantages of ActivTrades, the most remarkable are the elimination of commissions, tight spreads and the absence of minimum deposit at the start.

ActivTrades takes care of its customers by providing customer support in 14 languages and via different means such as email, chat or telephone. The company also provides its clients with various educational materials such as webinars, manuals, etc.

ActivTrades’ customers can choose from over 1,000 CFDs or spread betting instruments across forex, shares, commodities or ETFs. The company also offers investing solutions for institutional partners.

However, among the disadvantages of ActivTrades is the absence of copy trading and the fact that it is unavailable for US clients.

IG is a share trading platform. Being one of the world’s biggest CFD and spread betting brokers, IG offers over 10,000 instruments to trade on MetaTrader 4.

The IG platform is ideal for beginner traders since it provides clients with a vast range of educational resources, a demo account and a user-friendly and intuitive interface.

IG has access to over 17,000 markets and can be used to invest in thousands of global shares and ETFs.

However, the share trading platform charges relatively high trading fees and requests a minimum deposit requirement when paying by credit/debit card or PayPal.

Plus500 is a global fintech company that provides online trading services for CFDs, stocks, futures and options.

The company was founded in 2008 and is now considered a high-trust broker: it is regulated by FCA and ASIC and is listed on the London Stock Exchange.

Plus500 offers its platform to trade CFDs, forex pairs and stocks.

Plus500 is renowned for offering tight spreads, fast order execution, real-time quotes and advanced analytical tools. It allows users to trade over 2,800 instruments and charges no buy-and-sell commissions.

Nevertheless, Plus500 does not provide access to MetaTrader platforms and requires a relatively high minimum entry deposit.

Prime brokers provide essential services to large institutions and thus help them boost their business and outsource some activities to prioritize their core responsibilities. Prime brokerage service is a vital and integral part of the financial sector since it greatly contributes to the economy. For many large entities, a prime broker can be an optimal tool for making their business more manageable.

[[aa-faq]]

Prime brokers can profit from custodial fees, interest on loans and commissions.

A broker is an individual or entity that helps investors to buy or sell securities. A prime broker is a large organisation that provides various services for other large institutions.

A PB agreement is an agreement that describes the obligations of the prime broker in terms of providing services and charging applicable fees.

[[/a]]