Fixed-income investment is becoming popular day by day in the contemporary world. Among them, bond exchange-traded funds (ETFs) have materialised as indispensable tools for modern investors. Combining stability, diversification, and intra-day liquidity, ETFs like the iShares Core U.S. Aggregate Bond ETF (AGG) and the Vanguard Total Bond Market ETF (BND) have accumulated significant attention. With combined assets under management (AUM) surpassing $381 billion as of September 2023, these ETFs stand as titans in the bond market.

Let's delve into AGG vs BND, studying their strategies, performances, and key metrics to determine the best bond ETF for 2024.

[[aa-key-takeaways]]

[[/a]]

The AGG ETF, or iShares Core U.S. Aggregate Bond ETF, is one of the prominent exchange-traded funds in the fixed-income market. It was introduced by BlackRock, a leading asset management firm, in 2003.

Managed by seasoned portfolio managers James Mauro and Karen Uyehara, AGG enjoys the backing and resources of the world's largest money manager. The fund is designed to track the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, which serves as a benchmark for the U.S. investment-grade bond market.

The AGG ETF invests in a diversified portfolio of U.S.investment-grade bonds, including government, corporate, and mortgage-backed securities. Its composition mirrors that of the Bloomberg Barclays U.S. Aggregate Bond Index, which includes Treasury securities, agency bonds, mortgage-backed securities (MBS), asset-backed securities (ABS), and investment-grade corporate bonds.

The strategy of AGG ETF is to provide investors with exposure to the broad U.S. bond market while maintaining diversification and liquidity. It aims to achieve this by tracking the performance of its underlying index through investing in a representative selection of bonds.

The BND ETF, or Vanguard Total Bond Market ETF, is a widely recognised ETF managed by Vanguard, a renowned investment management company. It was launched in 2007 with the aim of providing investors with exposure to the entire U.S. investment-grade bond market. The fund is designed to track the performance of the Bloomberg Barclays U.S. Aggregate Float Adjusted Index, which includes a diverse range of fixed-income securities.

BND ETF invests in a broad spectrum of U.S. investment-grade bonds, including government, corporate, and mortgage-backed securities. Its portfolio encompasses Treasury bonds, agency securities, corporate bonds, asset-backed securities, and other fixed-income instruments. The fund follows a passive investment strategy, seeking to replicate the performance of its underlying index by holding a representative selection of bonds.

The strategy of BND ETF is grounded in diversification and cost-effectiveness. By investing in a wide array of bonds across different sectors and maturities, the fund aims to provide investors with exposure to the overall U.S. bond market while minimising individual issuer risk. Additionally, as a passively managed ETF, BND tends to have lower expense ratios compared to actively managed bond funds, making it an attractive choice for cost-conscious investors.

Both ETFs track the Bloomberg U.S. Aggregate Bond Index, but BND holds a distinct advantage in terms of AUM, commanding $302.4 billion compared to AGG's $97.3 billion as of November 2023.

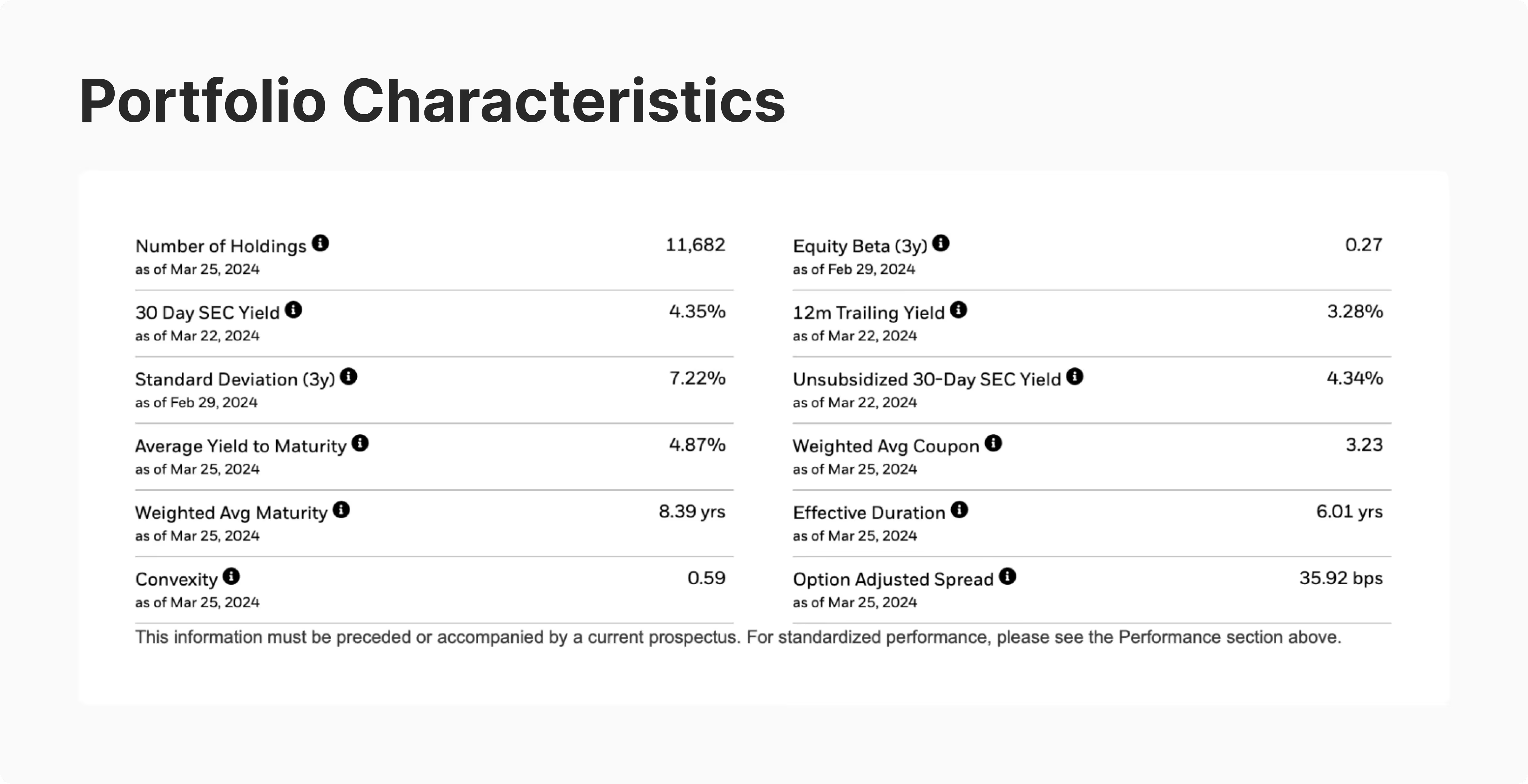

Both AGG and BND adopt passive management strategies, aligning closely with the benchmark Bloomberg U.S. Aggregate Bond Index. With a focus on cost-efficiency, these bond ETFs aim to minimise expenses, making them attractive to discerning investors. While BND tracks a float-adjusted version of the index, AGG maintains a marginally longer average duration of approximately 6.3 years compared to BND's 5.9 years.

Despite these differences, both ETFs exhibit similar weighted average maturity and yield to maturity (YTM), ensuring comparable risk-return profiles.

As with any bond-backed fund, AGG and BND face inherent counterparty risks with similar risk profiles. While AGG moves towards A.A. and AAA-rated bonds, BND emphasises government bonds, reflecting nuanced differences in risk exposure.

Nevertheless, both ETFs contend with common challenges such as inflation and interest rate risks, factors that can influence investor returns. Despite these risks, both AGG and BND have demonstrated consistent performance, with AGG boasting an average annual return of 1.34% over the past decade compared to BND's 1.35%.

Expert opinion generally favours both AGG and BND, with Morningstar assigning three stars to each ETF. This consensus underscores the suitability of both funds as core holdings for retirement-conscious investors or satellite options for those seeking exposure to high-grade domestic bonds. However, given prevailing low yields and modest returns, younger or more aggressive traders may seek opportunities elsewhere.

Both AGG and BND boast a low expense ratio of 0.03%, making them cost-effective options for investors. Additionally, both ETFs typically pay dividends on a regular schedule, with frequencies ranging from monthly to quarterly. However, investors should remain aware of tax implications, as dividends and capital gains from these ETFs may be subject to taxation at varying rates.

[[aafast-fact]]

In the year-to-date period, BND achieves a -0.80% return, which is significantly higher than AGG's -0.86% return. Both investments have delivered pretty close results over the past ten years, with BND having a 1.49% annualised return and AGG not far ahead at 1.54%.

[[/a]]

Let's delve deeper into the factors that you should consider while determining the best bond index funds.

Consider your investment horizon and sensitivity to interest rate fluctuations. AGG ETF may be preferable for shorter-term goals or for investors with lower risk tolerance, as it tends to have a slightly shorter duration compared to BND ETF, potentially making it less sensitive to interest rate changes.

Evaluate whether your primary objective is income generation or total return. Although the AGG ETF and BND ETF offer similar yields, their total returns and capital appreciation potential may vary slightly due to differences in portfolio composition and duration.

Assess your existing portfolio holdings and determine if you need specific exposure to certain sectors or credit qualities. Both AGG ETF and BND ETF provide broad diversification across the U.S. investment-grade bond market, but there may be subtle differences in sector allocations or credit quality that could influence your decision.

Consider whether you prefer exposure solely to U.S. bonds (BND ETF) or if you desire broader geographic diversification that includes international bonds (AGG ETF holds a small portion of non-U.S. bonds).

Evaluate the tax efficiency of each ETF, particularly if you are investing in a taxable account. While both AGG ETF and BND ETF are tax-efficient compared to actively managed funds, there may be differences in their distributions and tax treatment.

If you're in a higher tax bracket or seeking tax-exempt income, consider whether you need exposure to municipal bonds. BND ETF may include a small percentage of municipal bonds, but AGG ETF does not typically include them. If tax-exempt income is a priority, you might consider adding a municipal bond ETF or fund to your portfolio alongside AGG ETF or BND ETF.

In the endless debate of AGG vs BND, investors are confronted with two formidable options for gaining exposure to the U.S. bond market. While AGG embodies the legacy of BlackRock's expertise, BND stands tall as Vanguard's flagship offering.

Both ETFs offer broad coverage, low expenses, and consistent performance, making them suitable choices for a diverse range of investors. Ultimately, the decision between AGG and BND hinges on individual preferences, risk tolerance, and investment objectives.