Modern trading business today is a high-tech, fast-paced ecosystem driven by digital platforms and advanced technologies where individual investors can now access sophisticated financial tools previously reserved only for institutional traders. Options trading has become a powerful tool for savvy investors looking to maximise their financial strategies.

Imagine being able to protect your investments, create additional income streams, or capitalise on market trends - all through the strategic use of calls and puts. This comprehensive guide includes everything you need to know about these versatile financial instruments, offering insights that can transform your approach to trading.

[[aa-key-takeaways]]

[[/a]]

Options are like special financial "passes" that give you the flexibility to buy or sell something at a set price without forcing you to do so. Think of them as reservation tickets for financial assets that you can choose to use or let expire. Let's break down the basics:

When you buy an option, you're essentially purchasing potential future trading flexibility. Unlike directly buying stocks, options let you control risk by limiting your potential loss to just the initial premium paid. It's like buying an insurance policy for potential market moves - you're protected while maintaining the opportunity to profit.

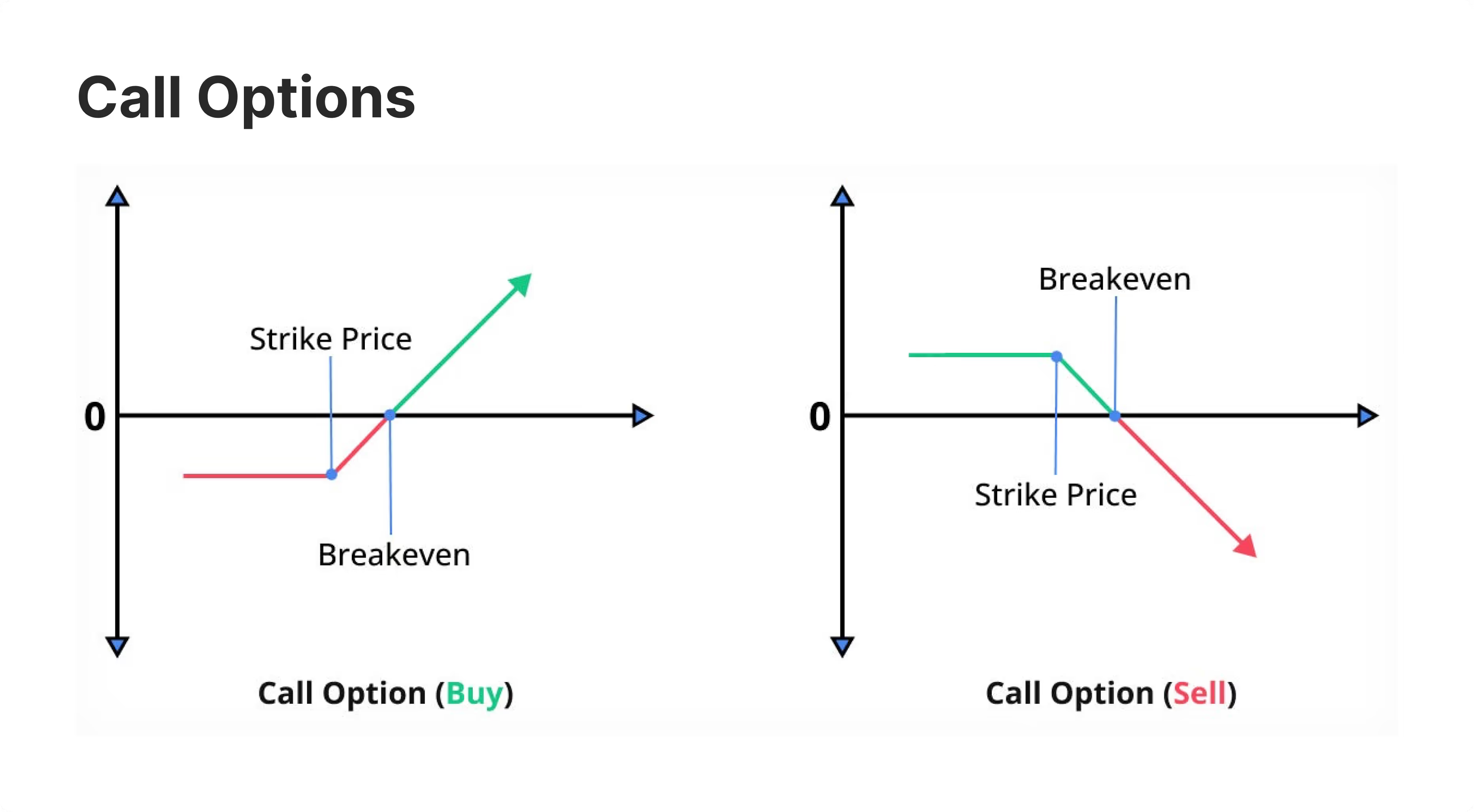

A call option represents the right to buy an underlying asset at a predetermined price. Here's what you need to know:

Put options give the right to sell an underlying asset at a specific price. Key characteristics include:

Understanding the difference between calls and puts is critical for making informed trading decisions.

Imagine wanting to buy a stock, but you're unsure if the price will rise in the future. A call option allows you to lock in the purchase price (strike price) until expiration. If the stock price rises above the strike price, you can exercise the option to buy the stock at a lower price, potentially profiting from the difference.

For example, You buy a call option on a stock with a strike price of $50 and an expiration date of 3 months. If the stock price rises to $60, you can exercise the option and buy the stock for $50, then immediately sell it at the market price of$60, pocketing a $10 profit per share (minus the option premium paid).

Conversely, puts offer protection when you believe a stock price will fall. By buying a put option, you secure the right to sell the underlying asset at the strike price, regardless of the actual market price. This allows you to limit your potential losses if the stock price falls.

For example, You own 100 shares of a stock currently trading at $40. Worried about a potential price decline, you buy a put option with a strike price of $40 and a 6-month expiration date. If the stock price drops to $30, you can exercise the put option and sell your shares for $40 (the strike price), mitigating your losses.

Both the call buyer and put buyer aim to capitalise on price movements, but their strategies differ based on market forecasts and risk tolerance.

Understanding how options are priced is crucial for any options trader. Options pricing involves several key components and factors that work together to determine an option's premium. Let's break down these essential elements to help you make more informed trading decisions.

An option's total price (premium) consists of two main components: intrinsic value and time value. Understanding the difference between these components is fundamental to options trading.

Intrinsic value represents the actual built-in value of an option. It's the amount an option would be worth if it expired today. For call options, intrinsic value is the difference between the current and strike prices (when the stock price is higher). For put options, it's the difference between the strike price and the current stock price (when the stock price is lower).

For example:

Time value, also known as extrinsic value, is the additional premium above the intrinsic value that traders are willing to pay for the potential future value of the option. It represents the possibility that the option will increase in value before expiration. Time value is highest when an option is at-the-money and decreases as the option moves either in-the-money or out-of-the-money.

Several key factors influence option prices, commonly known as price determinants:

Options traders use "The Greeks." to measure how option prices may change when various factors change:

Volatility plays a crucial role in options pricing through two forms:

Options trading offers a variety of strategies to match different market outlooks and risk tolerances. Here are some of the most popular and useful options strategies that traders commonly employ, ranging from basic to more complex approaches.

A covered call is one of the most popular and conservative options strategies. It involves:

This strategy:

Example: If you own 100 shares of XYZ trading at $50, you might sell a $55 call option expiring in 30 days for $1.00. This provides $100 in premium income but limits your upside if the stock rises above $55.

Also known as a "married put," this strategy acts like insurance for your stock position:

Benefits include:

Example: If you own 100 shares of ABC at $75, you might buy a $70 put for $2.00 to protect against any significant price decline below $70.

This vertical spread strategy is used when you're moderately bullish on a stock:

Key characteristics:

Example: With XYZ at $100, buy the $100 call for $3.50 and sell the $105 call for $1.50. Maximum profit is $3.00 ($5.00 spread minus $2.00 net debit).

Similar to bull call spreads but for bearish outlooks:

Advantages include:

Example: With ABC at $80, buy the $80 put for $3.00 and sell the $75 put for $1.00. Maximum profit is $3.00 ($5.00 spread minus $2.00 net debit).

These strategies are used when you expect significant price movement but are unsure of the direction.

Example: With stock at $60, buy both the $60 call and $60 put. You profit if the stock moves significantly above or below $60.

Example: With the stock at $50, buy the $55 call and $45 put. Cost is lower than a straddle, but stock needs to move more to be profitable.

Remember that each strategy has its own risk/reward profile and is suited to specific market conditions and objectives. It's essential to thoroughly understand these characteristics before implementing any options strategy.

[[aa-fast-fact]]

In the late 19th century, Russel Sage began creating calls and puts options that could be traded over the counter in the United States. There was still no formal exchange market, but Sage created an activity that was a significant breakthrough for options trading.

[[/a]]

To profit from rising market prices, investors can follow these steps:

For example, if an investor expects Apple's stock price to rise from $180 to $200, they can buy a call option with a strike price of $185.

For bearish strategies, investors can follow these steps:

For instance, if a trader expects XYZ stock to drop from $50 to $40, they can buy a put option at a $45 strike price.

While options offer exciting possibilities, they also come with inherent risks.

If you're intrigued by the potential of options trading, here are some steps to get started responsibly:

Remember, options trading is not a get-rich-quick scheme. It requires discipline, patience, and a willingness to accept risk.

Successful options trading requires more than just understanding calls and puts – it demands a comprehensive understanding of common pitfalls that can significantly impact your trading outcomes.

One of the most frequent mistakes newcomers make is undertaking options trading without knowing the Greeks, such as Delta and Theta, which are crucial indicators that measure different aspects of option price movement and time decay.

Another critical error is overtrading or employing excessive leverage, which can quickly use up your trading capital, especially when market conditions become volatile. Many traders also underestimate the importance of implied volatility, failing to recognise how this metric affects option premiums and potentially leads to overpaying for options contracts.

A surprisingly common oversight is trading without a clear exit strategy – successful options traders always know their profit targets and stop-loss levels before entering a position, as options' time-sensitive nature demands precise planning.

Finally, traders often neglect to factor in transaction costs, including commissions and bid-ask spreads, which can significantly harm profits, particularly when trading frequently or with multiple contracts. Understanding and actively avoiding these mistakes can mean the difference between consistent profitability and unnecessary losses.

Mastering calls and puts provides investors with powerful tools for portfolio management and profit generation. While the basics are straightforward, successful options trading requires continuous learning and careful risk management. Start with simple strategies and gradually progress to more complex approaches as your understanding grows.

Remember that options trading carries substantial risk, and it's essential to thoroughly understand these instruments before incorporating them into your investment strategy. Consider consulting with a financial advisor to determine if options trading aligns with your investment goals and risk tolerance.

[[aa-faq]]

Call options let you buy an asset, while put options let you sell an asset.

If you think the stock price will increase, buy a call option or sell a put option. If you believe the stock price will stay stable, sell a call or put option. If you think the stock price will decrease, buy a put option or sell a call option.

Yes, you can start trading options with just a few hundred dollars.

ITM (In The Money) options are those where the strike price is more advantageous than the current market price, giving them intrinsic value. Conversely, OTM (Out Of The Money) options have a strike price that is less favourable relative to the current market price.

[[/a]]