Among many other things, the digital revolution has tremendously decreased the requirements to enter the trading world. In 2023, becoming a trader requires having a Wi-Fi connection and the ability to learn fast from the experience of others. This seemingly luxurious and exclusive industry has opened its gates to anyone willing to learn and put in the hours.

However, aspiring traders should make it their mission to learn every lucrative strategy in the market, as the trading field is quite unforgiving and hostile. This article will explore the theta gang strategy - one of the most fascinating strategies in the current climate.

[[aa-key-takeaways]]

[[/a]]

Before diving into the inner workings of the theta strategy, let’s explore the term itself. Theta in trading stands for the concept of value erosion that is directly linked to the price of various trading options. While it might seem counterintuitive to think that options decline in value with time, this phenomenon is quite logical. To further visualise this concept, let’s imagine a simplified scenario.

Suppose a call option X is related to the stock market share Y. If the call option is priced at $100 valuation months before its deadline. It will start a slow price decline in the following months. But why is that happening? To understand this, it is important to grasp the concept of options contracts. These mechanisms allow traders to buy or sell various tradable assets at a fixed price (also known as strike price). Buying or selling options contracts is to make money from the differences between the strike price and actual market valuation.

As time goes by, it becomes more unlikely that the asset’s predetermined price will differ from the market value, which diminishes the value of the acquired options contract. Simply put, the closer the option is to achieving its maturity, the less possible profits can be generated. Thus, the option price gradually deteriorates with time. This process is referred to as the theta variable in trading and is a cornerstone of the theta gang strategies across the market.

In practice, the theta metric is always negative since it showcases the average decay of the time value for the specified stocks. The erosion, in this case, is minuscule when largely removed from the expiration date and exponential when the deadline inches closer. This is a logical progression since trading options have much less wiggle room when they are nearing their due dates. It is less likely to profit from options when the apparent market value is only a few weeks away.

It is no wonder that the theta concept is wildly popular in the trading market, as investors are interested in the time-value metrics for trading options. After all, trading with various options contracts has become the go-to strategy for investors with limited funds since they no longer have to purchase the underlying stock to make profits.

Thus, the family of trading tactics acquired a fresh member - the theta gang strategies. There are numerous ways to learn more about this method, including the theta gang strategy channel on Reddit, with thousands of experienced investors sharing their knowledge and past mistakes. These concepts outline the possibilities to utilise the theta phenomenon to drive profits reliably. Let’s explore the most prominent ones in the current climate.

This strategy is considered by many to be a gateway tactic in the theta gang strategy tree. It is the simplest strategy to execute without diving too deep into the complex inner workings of theta options trading. Call credit spread requires traders to purchase and sell call options simultaneously to acquire a more favourable position and profit from the transaction instead of capitalising on the expiration date of their call option.

As a quick example, trader A owns a call option on a stock valued at $50 in the current market. The tradable asset is expected to drop in valuation in the coming months. In this case, it is profitable to exchange the owned call option for a more valuable contract and gain a commission premium in the process. Suppose trader A’s call option is valued at $35 and a contract premium of $1. Trader A can search the market to acquire a highly positioned call option, let’s say at $40 and a premium of $3.

If trader A executes this contract exchange, they will net a profit of $200 ($100 X 3 - $100 X 2) after executing both transactions. Now, the entire point is to wait for the expiration date and bank on the possibility that the asset price will not exceed $35 at the expiration date. However, in most cases, the actual profits will be slightly less than $200 since the actual asset value is unlikely to reach such lows quickly.

The loss scenario, in this case, is quite simple. If trader A is incorrect and the stock price does not plummet closer to $35, they will have to execute the contract and incur losses. Let’s say the final price is $38; in this case, they will incur a $100 loss ($200 - $ 3 X 100). In this case, the maximum amount of losses is $300, as this number is the net difference between the two call options minus the premium acquired from the trade.

Thus, it is easy to see why the credit call spread is an effective strategy. While there are unlimited risks involved in theory, the entire process is much less risky in practice, as the numerous tradable assets have a reliable downgrade with time. The theta principle tells us that it is always possible to exchange two call options and profit from a commission of the exchange.

The trick after that is to guess the correct direction of the asset price movement and benefit from credit spreads without actually purchasing or selling the underlying assets. Thus, the call credit spread is a bearish strategy and quite popular. Still, it has recently lost popularity due to the rise of another ingenious theta gang tactic - the wheel.

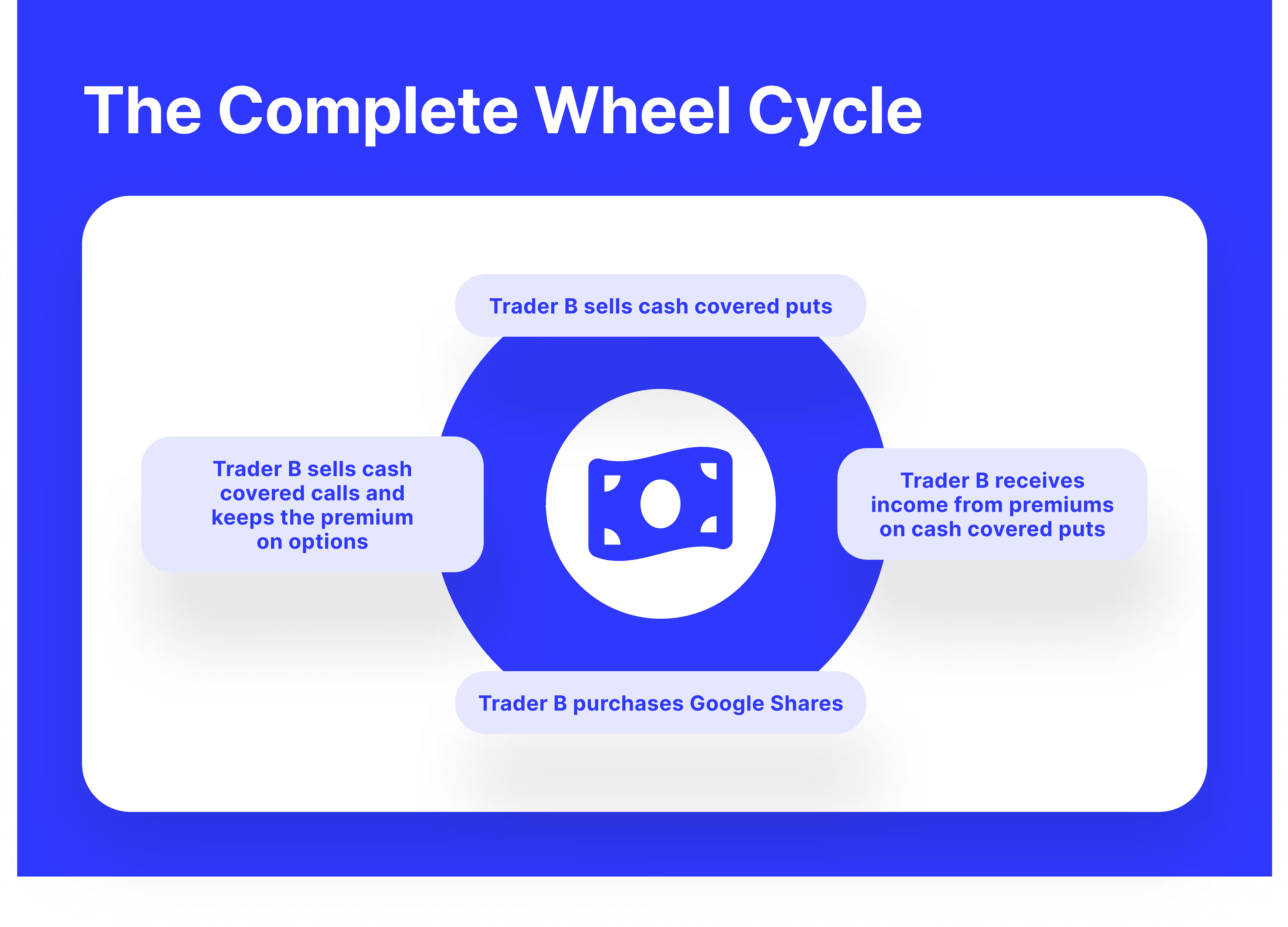

The wheel strategy is aptly named as it allows traders to adjust their options trading methods and benefit from rising and falling prices. So, no matter how the wheel spins, this strategy can produce profits regardless. But how is that possible? Suppose a simple scenario, with Trader B owning an initial capital of cash of $100,000 to purchase 1,000 Google shares. The first step here is to sell cash-secured put options rigorously.

This contract will obligate Trader B to purchase the Google shares at a predetermined price and date. However, exercising this option is only profitable for the counterparties if the Google share strike price exceeds the market valuation. Google is valued at $100 at the expiration date, and the strike price is $950. In this case, the option will expire worthless since the second party is not motivated to purchase it, as they would incur losses.

Thus, Trader B will profit from the put option premiums and will not have to do anything else. As the wheel keeps spinning, Trader B will receive premium profits by selling cash-secured puts.

But what if the wheel turns in the opposite direction, and Google’s value will go below the predetermined strike price?

In this case, Trader B will be forced to purchase the Google shares. While many might consider this to be the end of the line, this is where the excellence of the wheel strategy kicks in! Now, Trader B will start to sell covered calls on Google shares. This contract implies that Trader B sells the option to sell the Google shares to a third party at a predetermined price.

Trader B must keep the premiums from selling a covered call if the share valuation exceeds the strike price. If the strike price is reached or exceeded by the share valuation, Trader B will now exercise it and complete the single-wheel cycle.

This is why the wheel strategy is so popular in the current climate. Traders can hedge their risks in both directions and equally profit from both directions in the share price movement. In between the price changes, investors get to accumulate a lot of option premiums. When conducted diligently, the wheel strategy is profitable and secure simultaneously, which is quite a luxury in the trading landscape.

One concern related to this strategy is finding ample liquidity for initial funds for a wheel strategy. After all, this process requires massive initial investment to be profitable in the long run. In this case, traders can receive funding from liquidity providers or market makers, jumpstarting their wheel strategy and buying back the premium on acquired funds from their received premiums. The crucial factor here is ensuring that the loan interest does not exceed the generated premiums, as it would make the entire strategy unprofitable.

Theta gang strategy is the bread and butter of individual traders across the globe. While this concept might seem confusing, it is worth diving into, as it drastically benefits traders from market price fluctuations. So, if you are considering entering the realm of theta trading, the first step is to understand this concept thoroughly and apply it diligently to online trading.