The financial markets are currently experiencing a renaissance in trading, presenting lucrative prospects for expanding capital and establishing thriving Forex companies that operate through trading platforms.

The trading platform infrastructure is a sophisticated network that integrates various programs and systems to facilitate the seamless creation, placement, and execution of orders. Within a trading platform, a mechanism known as a Forex bridge connects traders with liquidity providers to facilitate transactions effectively.

In this article, you will find answers to questions about what a Forex bridge is, what functions it performs, and what types exist. You will also learn what to consider when choosing an FX bridge server. In the end, you will learn about the best FX bridge liquidity providers.

[[aa-kay-takeaways]]

[[/a]]

A Forex bridge, also known as a liquidity bridge, is a technological tool in the foreign exchange market. Its primary role is to establish a connection between a trader's trading platform and various liquidity sources, which can include banks, non-bank liquidity suppliers, and other market participants. Acting as a bridge enables a seamless and efficient process for executing Forex trades.

The key objective of an FX bridge is to streamline the flow of trade orders and market data between the trader's platform and the liquidity providers. Through this connectivity, traders can access real-time pricing information, carry out trades promptly, receive confirmations for their trades, and other pertinent details. Ultimately, the Forex bridge enhances the overall trading experience by ensuring smooth communication and interaction between traders and the FX trading platform.

Here's a simplified overview of what functions Forex bridge typically performs:

When a trader submits a trade order through their trading platform, the Forex bridge receives it and relays it to the liquidity sources connected to it.

The Forex bridge aggregates liquidity from multiple liquidity sources, combining their price quotes, depth of market information, and execution capabilities into a consolidated view. This allows traders to access a larger liquidity pool and obtain better pricing.

The Forex bridge compares the trader's order with the available liquidity and executes the trade at the best price. It ensures the trade is routed to the liquidity provider offering the most favourable terms, considering cost, order size, and execution speed.

The Forex bridge sends trade confirmations and relevant information back to the trader's platform once the trade is executed. This includes details such as execution price, trade volume, and associated fees or commissions.

Forex bridges are typically utilised by brokers, financial institutions, and other market players who require access to deep liquidity and efficient trade execution. They help ensure quick and reliable order routing, reduce latency, and enhance the overall trading experience for market participants.

[[aa-fast-fact]]

The performance of a liquidity bridge is expressed in terms of throughput, which is an absolute measure of the speed of data transfer between servers.

[[/a]]

Advancements in electronic FX trading have yielded noteworthy results, particularly in infrastructure systems and liquidity bridges. These bridges serve as a link between liquidity providers and brokers, allowing them to maintain trading volumes.

Forex brokerage houses utilise two different types of bridges: STP (Straight Through Processing) and ECN (Electronic Communication Network):

STP bridge (or protocol) streamlines communication between brokerage firms and banks, enabling direct trading on the interbank market. This allows clients' orders to be executed directly by liquidity providers such as banks and other entities, leading to more efficient transactions.

With access to real-time markets and the option for instant execution without needing a dealer, traders find the STP system highly attractive. Eliminating intermediaries in the trading process enhances transparency and effectiveness, making it a preferred choice for those seeking efficient and direct access to the interbank market.

ECN is a vital link between brokers and multiple liquidity suppliers, creating an internal liquidity pool. This system efficiently directs traders' transactions to various liquidity providers within the ECN network, ensuring access to the most favourable prices available. Additionally, the ECN system is the counterparty to all trades, further enhancing its functionality.

Many FX brokers looking to grow their business and cater to high-volume traders rely on a liquidity bridge as a crucial element in their trading setup. To ensure the bridge's successful implementation, it is imperative to consider the following factors.

The reliability of a liquidity bridge is of utmost importance to ensure flawless trade execution. The server's location also plays a substantial role in achieving this goal. By selecting a server hosted in a data centre strategically positioned in a financial hub, you can maintain optimal connectivity and minimize latency, enabling your liquidity bridge to operate efficiently.

It is crucial to consider security when selecting the most suitable server for your liquidity bridge. It is advisable to choose a location that reduces vulnerability to natural disasters and ensures that the data centre you select possesses all the necessary certifications and complies with regulatory standards.

Furthermore, it is essential to equip your server with the required security measures to effectively mitigate the potential risks of data breaches. Additionally, protection against DDoS attacks, prevalent in the financial industry, should be prioritised.

Ensure that the Forex bridge is compatible with your trading platform or software. It should offer seamless integration, allowing for smooth transmission of trade orders and market data. Consider the APIs or protocols supported by the bridge and verify that they align with your technology infrastructure.

Assess the liquidity sources connected to the Forex bridge provider. Look for bridges that provide access to a diverse range of liquidity providers, including Tier 1 banks, non-bank liquidity suppliers, and other market players. The more liquidity sources available, the better the chances of obtaining competitive pricing and deep liquidity.

Bridge technology has become a vital necessity, so many companies have started to develop their own solution that allows, thanks to certain advantages, to greatly facilitate the trading process. Here is the list of companies whose professionalism in Forex bridge technology has been proven over time.

B2Broker company is one of the recognized experts in the field of liquidity technology and trading solutions for various fields, from crypto to CFDs. With extensive experience in developing applications and services, particularly for the FX niche, it also offers a liquidity gateway with connectivity to a wide range of providers, including itself.

Match-Trade's advanced bridging solution provides a wide range of connections to well-known LPs. Using this solution, brokers can aggregate multiple price streams and manage hedge settings in real time without restarting servers or editing client groups.

Bridge by Match-Trade allows brokers to customise risk management settings at the account or group level (routing rules, coverage rules, etc.). Additional execution parameters protect the brokerage house from adverse trading conditions.

Brokeree's liquidity bridge aggregator is a versatile solution that serves as a bridge and consolidates quotes from various trading platforms and liquidity providers. This comprehensive product proves particularly beneficial when dealing with multiple quotes or market data sources. Additionally, it empowers brokers to precisely configure the execution model by leveraging the advantages of a-book, b-book, and hybrid systems.

FX Bridge Technologies Corporation is an internationally recognized provider of cutting-edge financial technology solutions for institutional traders. Renowned banks and brokers in the foreign exchange and capital markets rely on FX Bridge's software applications. The company offers solutions to enhance trading strategies, manage risks effectively, and establish liquidity bridges connecting multiple sources seamlessly.

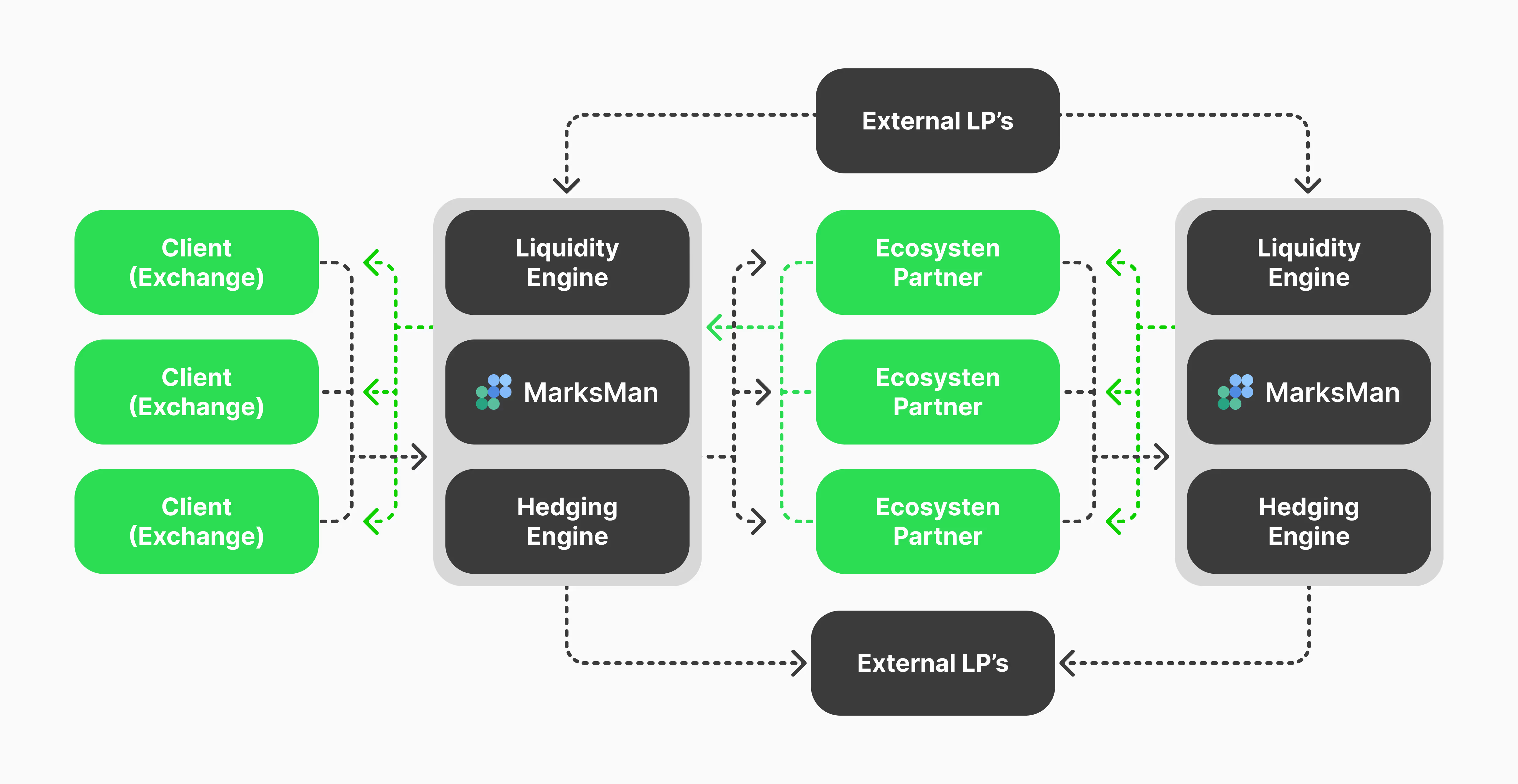

oneZero specialises in creating advanced multi-asset trading technology for many clients, including retail brokers, institutional brokers, banks, and liquidity providers. The company offers a comprehensive solution for accessing liquidity bridge Forex technology. Their platform comprises three key elements — Hub, EcoSystem, and Data Source — that work together seamlessly to deliver a holistic solution for trading technology, distribution, and analytics.

Forex bridge is an essential component in the architecture of any FX trading platform, which connects liquidity channels and brokerage companies. Therefore, when choosing an FX bridge server, it is worth paying particular attention to its characteristics and operation features, which will ultimately affect the overall performance of the brokerage system.