What is a Liquidity Sweep - How to Capitalise These Lucrative Events

By Hazem Alhalabi

By Hazem AlhalabiA versatile writer in a wide range of concepts, specifically in Web3, FinTech, crypto and more contemporary topics. I am dedicated to creating engaging content for various audiences, coming from my passion to learn and share my knowledge. I strive to learn every day and aim to demystify complex concepts into understandable content that everyone can benefit from.

Long hours of reading and writing are my bread and butter, and my curiosity is the catalyst to becoming the experienced writer I am. I excel at writing in English and Arabic languages, and I am endlessly looking to explore new realms and endeavours.

By Tamta Suladze

By Tamta SuladzeTamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

Technologies have played a major role in trading activities, whether in the old days when traders and brokers communicate over the telephone or today with the outstanding speed of the internet. These tools help traders operate faster and make the right decisions.

This introduction lowered the barrier for new entrants, whether traders, service providers, facilitators and more. Therefore, trading has become more complex, and advanced systems are required to execute high volumes of orders, pools, assets, etc.

One tactic is to scan through as many liquidity providers as possible, called a liquidity sweep, to find the best trading conditions. Let’s discover how sweeping for liquidity works and why it is important.

Liquidity sweep is the process of placing an order that scans many liquidity pools and providers to find the best prices.

Sweeps use advanced technology to locate a matching order and execute an order at a low slippage rate and tight spreads.

Sweep events cause price fluctuations as order flow increases, sending signals for a pending large order.

Fake liquidity grab is a malicious tactic that uses order sweeping to send false signals by cancelling the order right before execution to manipulate the market.

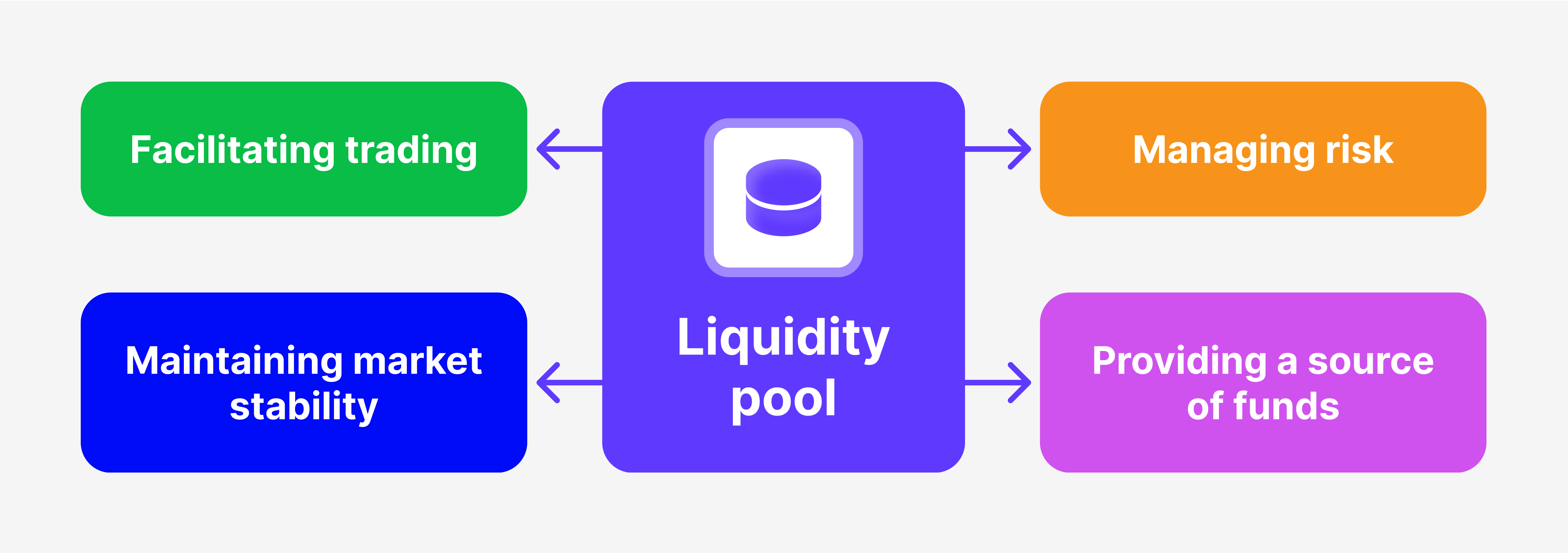

Understanding liquidity is a prerequisite to understanding liquidity sweep and its mechanism.

Liquidity is a key driver for the market’s dynamics, stability and efficiency. It refers to the ease with which traders can exchange between securities or from liquid to illiquid assets.

In other words, liquidity means the availability of tradable assets, which drives the demand and supply factor. Also, it refers to the availability of other market participants willing to trade with you, taking the other side of the transaction.

Liquidity is widely used to describe the efficiency of assets and markets, and Liquidity is widely used to describe a corporation’s economic status. Therefore, maintaining a healthy liquidity level is crucial for further development and growth.

High liquidity means that a product is sufficiently available and at an affordable price. Placing a buy order for liquid security gets executed quickly and at a closer price to the real value.

On the other hand, lack of liquidity results in execution delays as the order book is pending to find a matching order. Eventually, this leads to slippage and a larger spread.

The sweep is the process of scanning through a broad spectrum of liquidity pools to provide the best trading costs. When a trader buys/sells an asset, the trading platform “sweeps” through multiple liquidity providers and order books to find the best trading conditions, most importantly, price.

This method is beneficial to secure the best price, minimum slippage rate and low spread range, leading to fewer commission fees.

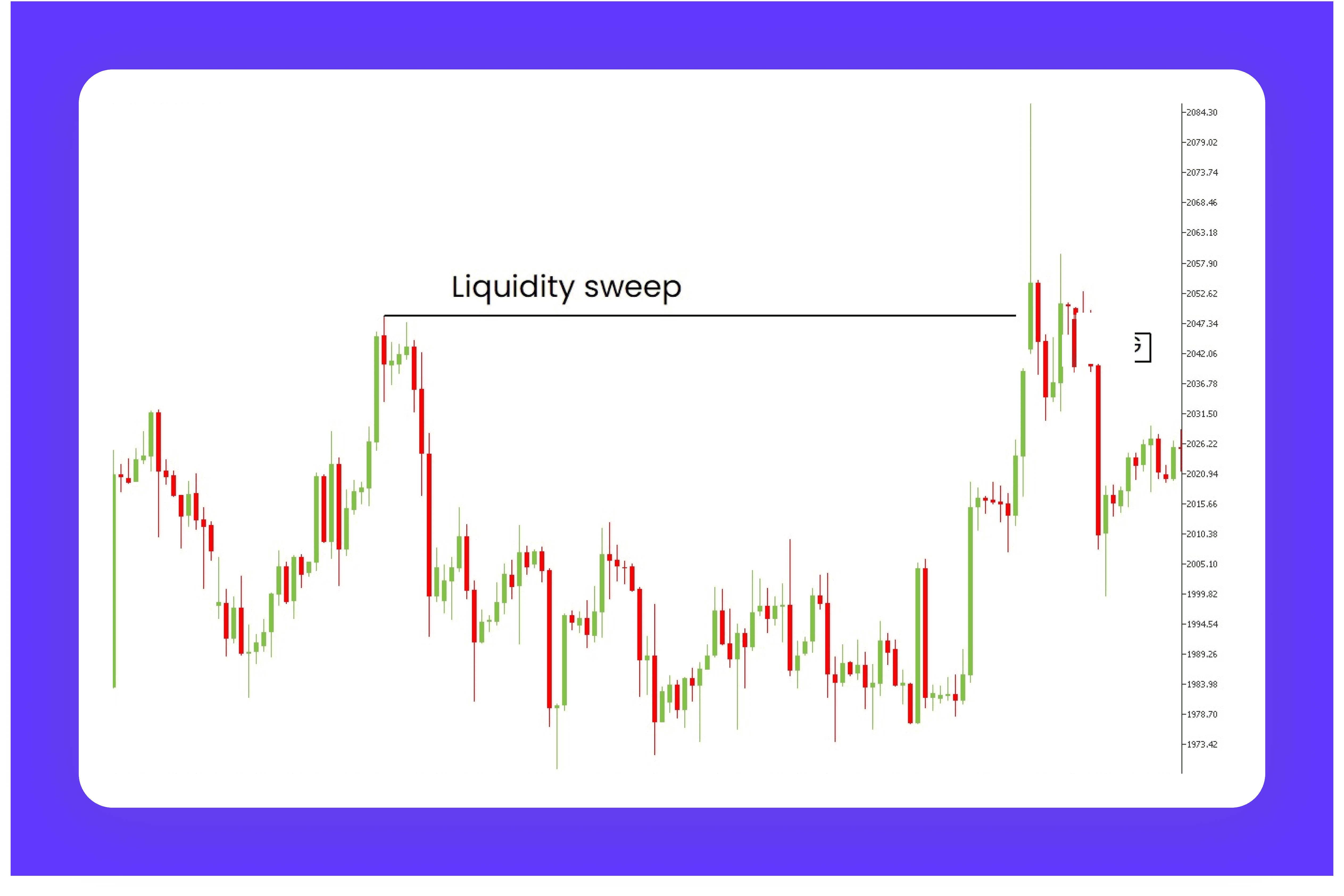

As sweeps massively scan order books of liquidity providers at different levels, they can send signals, triggering a significant interest in the subject security. Thus, prices may increase or decrease, causing an uptick in price action, and market demand fluctuates.

Sweeping is useful, especially in unstable markets or when the demand and supply levels are irregular. Large players carry out sweeps in various markets, such as Forex, stocks and cryptos. However, their advantage is evident in volatile and illiquid markets.

Before technology prevailed on every platform, most of the order execution was done manually or by direct interaction between brokers, financial institution representatives and other mediators over the telephone.

Sweeping for liquidity using the old tactics would not be feasible because this approach uses advanced algorithms to skim a huge number of order books, liquidity providers and markets trying to secure the best price.

Therefore, sweep routes the order to many liquidity pools and providers to find the best trading conditions. This process is usually done momentarily as the platforms strive to execute the order quickly.

Order sweeping involves analysing markets, exchanging real-time data and finding the right match for a given order.

Some traders or malicious actors manipulate the order book using a similar tactic to sweep but with the sole purpose of sending false signals.

Fake grabs happen when a significant order is requested using liquidity sweep, scanning through multiple liquidity pools and order books, and cancelling the order just before completion.

This event sends a fake sign about a requested order, which can majorly affect others’ signals and trading decisions and cause significant market shifts. Performers of this activity then trade according to the outcomes of this event and place orders accordingly.

It is important to stay aware of these instances by carefully analysing the market structure when major fluctuations happen and placing a stop-loss order to avoid excessively losing your funds.

Liquidity sweeps can be done in any market and for buying or selling any security. However, many traders use this tactic in highly liquid and volatile products. In the Forex market, trillions of dollars are traded daily, with hundreds of pairing combinations to trade different currencies.

Therefore, liquidity sweep in forex ensures the order is executed at the best possible price, giving the trader a significant advantage and opportunity to land a profitable opportunity. Other benefits of using sweeps include the following:

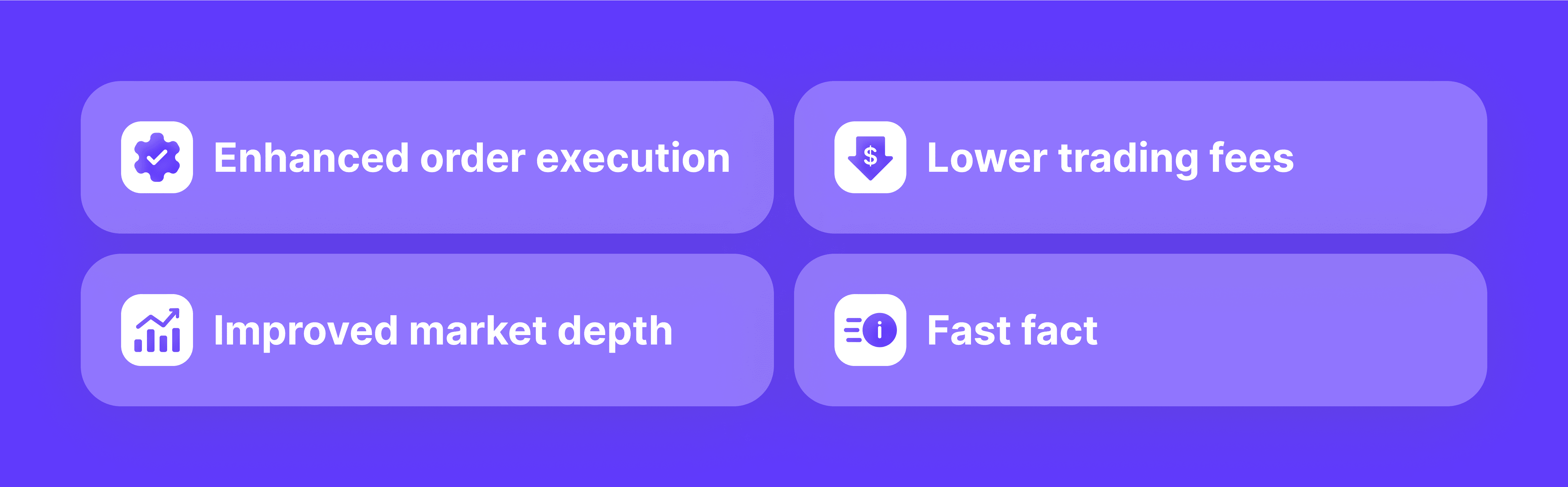

Sweeping various liquidity providers increases the chances of finding a better price and trading conditions than using a single order book or platform. Therefore, an order can be executed at a lower slippage rate, a tighter spread range, and closer to the real value.

Scanning through multiple providers allows the trader to settle with the lowest spread range. The spread is the difference between the asking and bidding prices, and brokers usually take this difference as a transaction fee.

Brokers buy a product at a lower price, and traders buy it at a higher price. This difference is realised as broker’s fees. Therefore, sweeping for liquidity and low spread range results in lower brokerage fees and more affordable transactions.

With liquidity sweeps, a trader explores a plethora of tradable assets and options such as CFDs, futures and options, and more offered by several liquidity providers rather than a single one.

This increases the market depth and improves its dynamics and efficiency.

Fast Fact

Market depth refers to the number of pending buy and sell orders in the order book, contributing to liquidity and order execution speed.

Executing a market order with sweeping allows investors to diversify their trading strategy and not rely on a single provider. Different liquidity providers may specialise in different assets and markets, and skimming through many of them ensures the trader finds the best trading opportunity.

Sweeping employs advanced technologies and logical order to find a matching order, analyse the market in real time and compare with your requested trade.

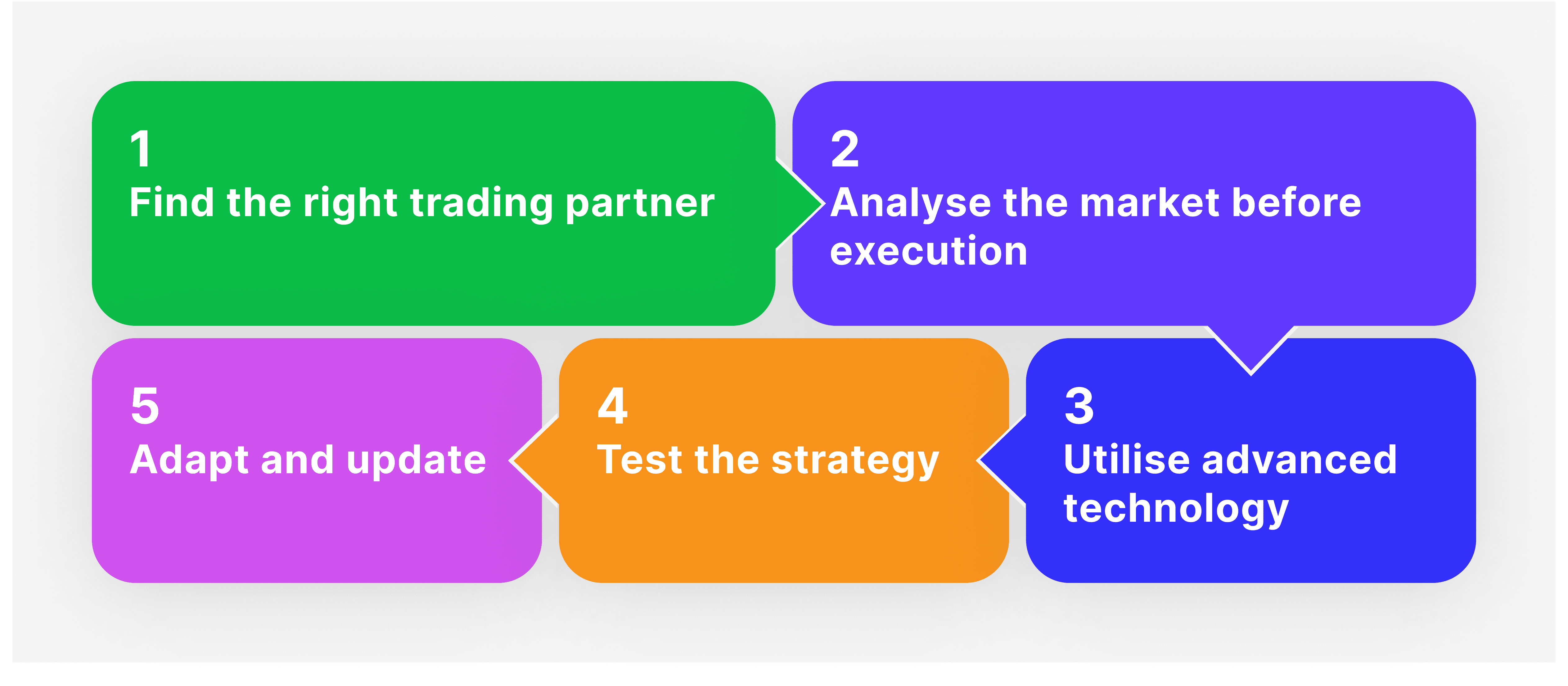

Forex liquidity sweep can be done according to the trading strategy. However, most styles include the following steps.

Forex liquidity sweeps are usually carried out by brokerage firms, prime brokers or liquidity providers. Therefore, research the market before you settle with your trading partner and ensure they provide all the means to sweep and execute your orders.

Look into the reviews of the chosen provider and find any feedback about the reliability of their order sweep practices.

Scanning the market and getting the best prices is what every trader looks for. Does it mean that you must use sweeps with every order?

Traders usually deploy sweeping as an integral part of their strategy, depending on their investment strategy, volume, expected execution speed and order size.

For example, it makes sense to use this approach while putting in large orders that have limited liquidity or unexpected volatility in the market.

Sweeps involve multiple operations before the order is finally executed. However, they also strive to minimise the slippage time. Finding the best Forex trading platform provides a degree of confidence in their approach, technology and trading platforms.

A trading platform offering algorithmic trading and automation tools is likelier to carry out liquidity sweeps. Therefore, conduct thorough research on the technology and platforms used for order execution.

If it is your first time using order sweeps, it is important to assess this strategy using a small buy order to test the speed, fees and overall quality.

Once you are satisfied with the results and the order execution, you can embed it into your trading style and scale it over various instruments and asset classes.

After implementing a successful sweep, monitor the effectiveness of this strategy on your investment portfolio.

Markets are highly dynamic, and what works today may not be as efficient after several months. Therefore, keep updating and modifying your approach accordingly. Moreover, your trading goals may change over time, which encourages adapting your strategy.

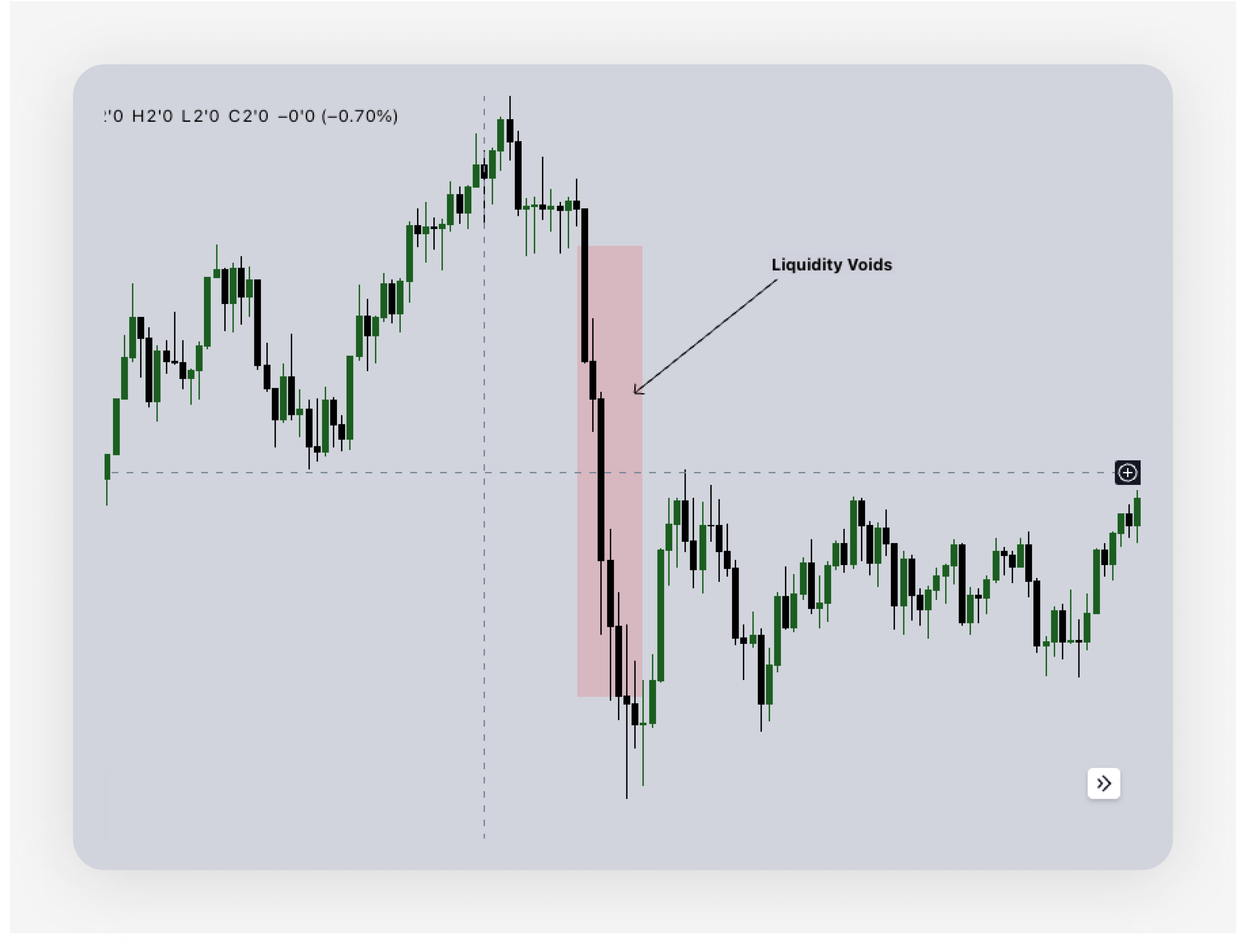

Liquidity sweeps and voids are somehow relevant as both concepts represent market fluctuations and the dynamics of demand and supply laws.

Liquidy void refers to the repetitive price fluctuations as a response to the changing purchase patterns over time. For example, if the Bitcoin market price were $20,000, which is considered relatively affordable, many people and investors would start purchasing and storing BTC in their wallets.

The increased demand will trigger a price rally, and the Bitcoin price will eventually increase. If the price is hiked to $60,000, the demand becomes less because the coin becomes less affordable for the average person and most retail traders, causing the price to drop.

This repetitive pattern of purchase inefficiency and increasing demand is called void, which shows on the chart as a fluctuating line that balances itself in the long run.

The mechanism of liquidity void is usually affected by liquidity sweeps, which send various signals to various order books and pools, driving the demand pattern.

Traders can monitor liquidity sweeps when they happen, but there are a few risks associated with them if they turn out to be fake grabs. Therefore, if you notice a sudden price fluctuation caused by sweeps, here are some tactics to safeguard your position.

Use stop-loss and take profit: To avoid losing excessively if the market moves against your favour, use stop-loss and set the maximum losses that you can take.

Determine key levels: Find out support and resistance points when a liquidity sweep occurs. This helps you determine if a sudden market move is a natural dynamic or an overbuying activity caused by a sweeping signal.

Monitor order volume: Order flow and volume are important determinants of such events as they tend to increase in association with liquidity sweeps.

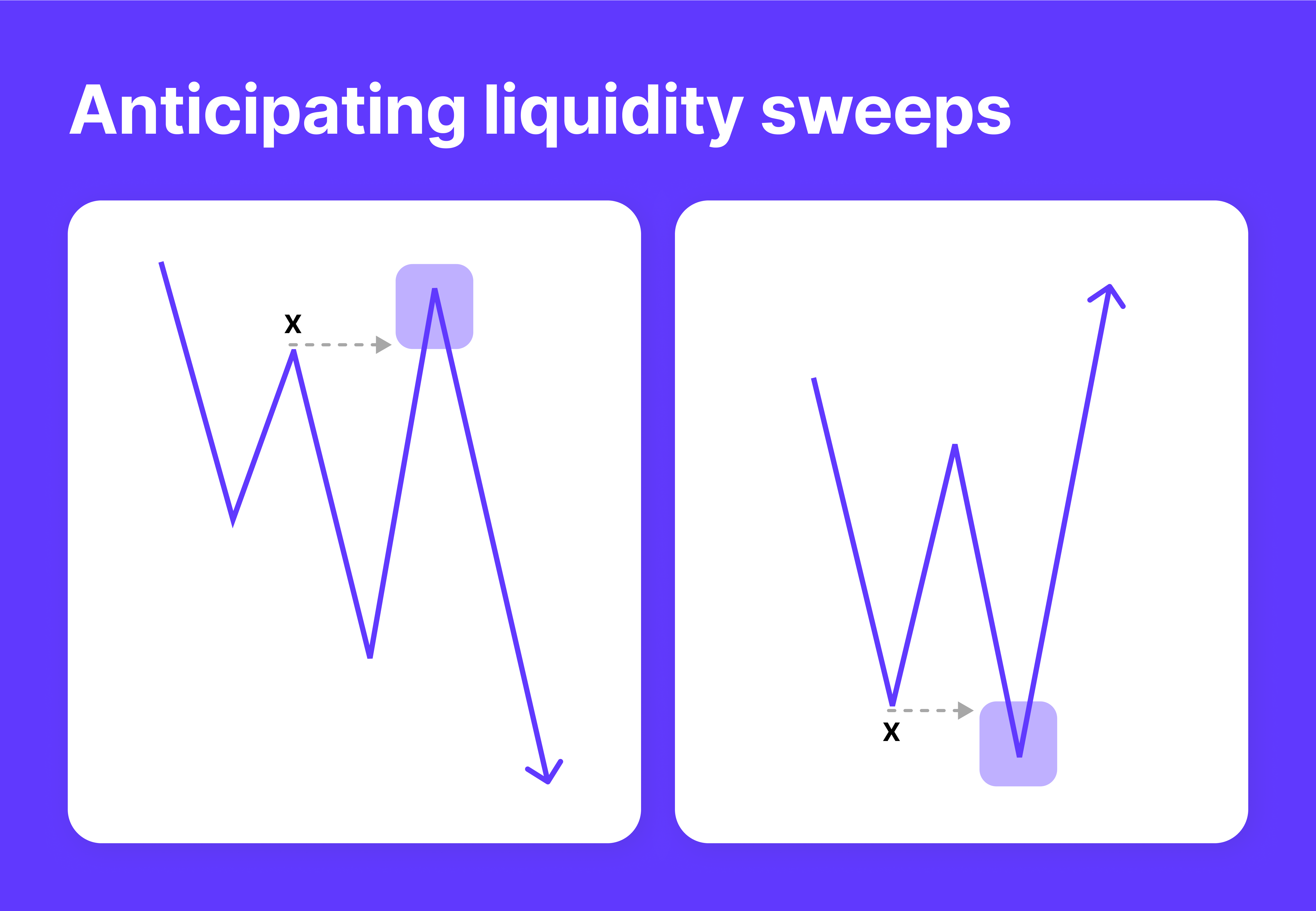

Liquidity voids happen in conjunction with natural market dynamics and the flow of demand and supply factors. Thus, traders usually use these moments to trade on both sides of the trend.

When a buy-side void is observed, and the demand is low because prices are high, traders can wait for a price reversal before they place a buy order and capitalise on a potentially bullish market.

On the other hand, when there is a sell-side void and prices are peaking, the trader can wait for a retraction to happen and place a short order, capitalising on an anticipated bearish market.

Nevertheless, it is important to note that markets do not necessarily retract quickly and return to previous price levels. Corrections may take longer depending on market conditions and events, and reversal can happen in multiple stages. Therefore, it is better to enter a trade with stop-loss or take-profits to avoid unexpected price action.

Liquidity sweeps are market events where the trader places an order that scans “sweeps” multiple liquidity providers, pools, and order books to find the best matching order and provide suitable trading conditions.

This approach eliminates the full reliance on a single provider and enables the investors to explore deeper market offerings and potentially settle the order at a lower price.

Executing a sweep entails sophisticated technology and a trading platform. Therefore, ensure your trading partner provides all the tools to sweep and execute an order quickly and at the lowest costs possible.

Liquidity sweeps refer to placing an order which scans through multiple market orders to find the best matching order and lowest prices possible.

Sweeps usually cause price fluctuations depending on the executed order. Therefore, traders may anticipate an increased action in either direction, placing a buy order if a bullish movement starts or selling if a bearish movement occurs.

Sweeps are usually associated with an increase in order flow, causing prices to drop quickly in comparison to previous events. On the price chart, sweeps are marked by sharp price falls following a period of balancing and corrections.

When sweeps happen, prices fluctuate due to instability in the order flow. Therefore, it is crucial to determine support and resistance levels and identify breakthroughs to place an order on one side of the trend.