Market Depth Definition

Milena Moon is the head of media projects in the marketing department of the B2Broker Group. Milena's career began in 2018 as a freelance social media journalist. Since then, she has sought out and written about the latest crypto trends, from news in the sector to educational articles that help newcomers immerse themselves in the crypto industry in the easiest way possible. Milena also has experience and education in the TV industry, which help other B2Broker projects thrive.

Electronic trading is a complex system of interconnected elements of market data visualization, complex analytical tools, and no less complex software stuffing, which is the foundation of the whole ecosystem of financial assets trading. The most essential element reflecting the general market instability is the market depth, which is also a visual expression of information from the order book.

This will be your guide to the world of electronic trading and will tell you what is the market depth, what factors influence this indicator and what is the importance of its use in electronic trading.

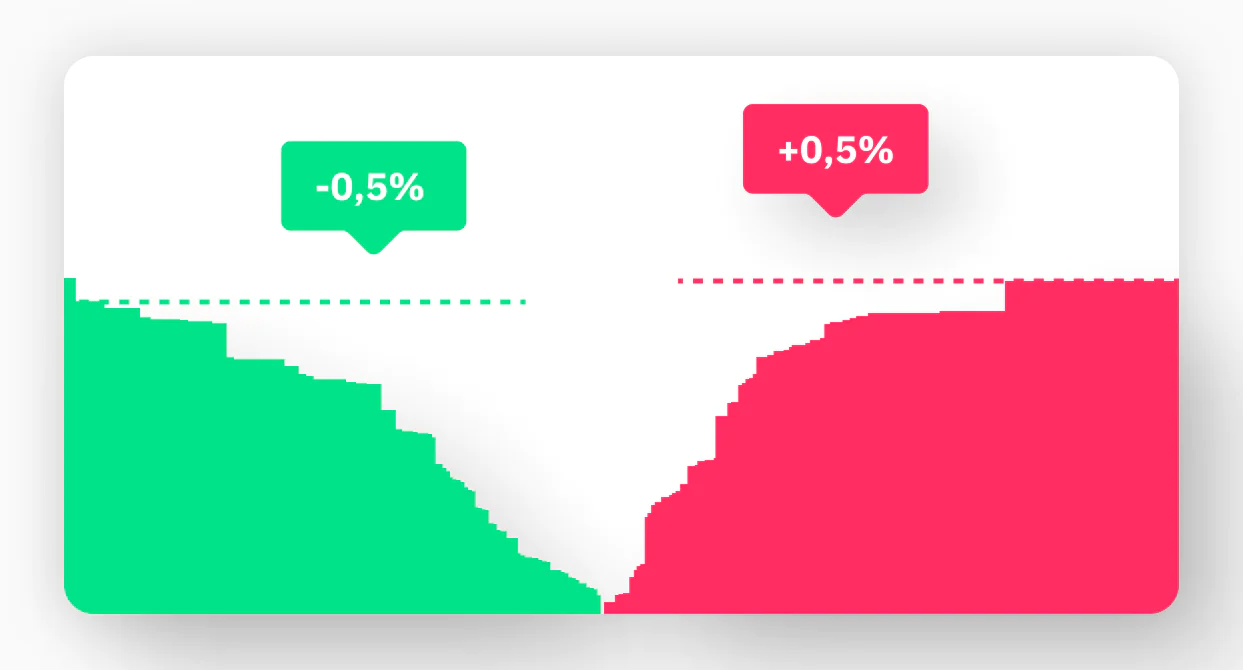

Market depth refers to an absolute indicator showing, in general terms, the state of the market and its potential movement. Market depth data, which is displayed on the depth chart, helps to determine the balance between supply and demand for a particular trading asset, which is the initial information for the graphical visualization of the law, which states that as the market price level of the asset increases, the demand for it falls in direct proportion, while supply increases in reverse proportion and vice versa. This takes into account various secondary indicators significantly influencing the growth and decline in asset quotations as a result of the active operation of the mechanism of execution of buy and sell orders.

The market depth indicator is the only accurate tool to help traders make more informed trading decisions. Thus, if there is an imbalance between the volume of buy and sell orders, it indicates the presence of activity, which shows in what direction the price can move in the very short term. For example, if you can see in good market depth that the number and amount of buy orders are significantly higher than the number of sell orders, this could indicate an upward price movement due to buyer pressure and vice versa. Traders and investors can also use market-depth data to find potential support and resistance levels. A large cluster of buy orders at a specific price can indicate a support level, while a multitude of sell orders at or near a certain favorable price can be seen as a resistance zone.

Fast Fact

Market depth is a universal indicator that reflects the state of market conditions and provides comprehensive items of information about important indicators of the trading process.

Overall market depth is a complex indicator that serves as the main reference point for market players in the framework of trading activity on any market. At the same time, there are a number of factors that determine the state of market depth indicator, which, in its turn, gives the market participants comprehensive information about the forecast movement of quotations in the nearest future. Let’s consider each of the factors, which influence the market depth level.

An order to buy or sell a financial asset is an electronic record in the depth of market panel containing information on the price and volume at which the transaction will be executed. The aggregate number of orders, including both market and entry orders, forms the so-called order wall, which is clearly visible on the depth chart of the market. Consequently, the higher the demand for a certain trade asset, the higher the trade volume within a certain time frame and the higher its depth on the plane of purchasing power. The same applies to the supply, with the growth of which the depth on the sellers’ strength plane increases as well.

Market depth is a dynamic indicator that changes in real time, and the rate of change in the visualization of market sentiment is directly proportional to the level of volatility. The difference between the number of buy and sell orders is expressed as an absolute indicator of buyer or seller pressure and indicates the trend of the asset price in the short term, depending on various factors. This difference is due to the number of orders, the greater part of which have the orders of large volume from big market players, which indicates the speculative nature of the trade in some cases and serves as a signal for the soonest change in quotations.

In order to use market depth correctly, it’s required to understand the pricing patterns of an asset. One of the important indicators influencing this process is the volume of entry orders. Generally speaking, this volume showcases the total amount of buy/sell orders placed at a price different from the market price and displayed in the order book. Often trading volume data is informative and is used in practice for building a general picture of market movement taking into account individual characteristics of a particular security.

Key takeaways market depth is used in technical and fundamental analysis to predict the movement of asset prices. In trading any class of financial instruments one can frequently observe short term price volatility caused, as a rule, by the presence of large players, which are also called “whales” according to the trading lexicon. Having impressive capital, these traders are able to have a significant impact on price behavior by buying or selling extremely large volumes of the instrument, thereby promoting price appreciation or decline.

As mentioned above, the market depth indicator is an absolute expression of the balance of pending orders to buy and sell a specific asset at a specific price at a specific moment in time. This tool is the most important indicator of market activity, the level of overbought or oversold assets, as well as an indicator of such important elements as spread and liquidity.

In essence, the spread and liquidity are fundamental indicators of the quality of the trading process, determining the conditions of its implementation. The spread reflects the distinction between the best buy offer and the best sell offer and directly depends on the level of liquidity, which in turn is a conventional value of the speed (or ease) with which an asset can be bought/sold in the market. Having a direct correlation, these indicators are the main means of determining the level of cash invested in the asset.

Being the only tool that provides a complete and comprehensive view of market sentiments for any particular trading asset, market depth acts as an indispensable assistant in forecasting market movements, allowing you to quickly and deeply analyze the probability of changing asset’s price trends, analyze and identify pricing patterns, taking into account any factors affecting the liquidity of the stock, to adjust trading strategies to optimize trading activity and much more.

With a clear understanding of market conditions, investors are able to capitalize on any price movement. Thanks to comprehensive information about trading volume, market depth helps to find the optimal point to enter or exit open positions, which is especially indispensable for speculative investors, whose strategy involves high-frequency trading, where the equivalent profit is directly dependent on the correct calculation of entry and exit times. Moreover, the market depth chart can serve as a basis for constructing different models of market behavior, determining resistance and support levels using artificial intelligence and machine learning technologies, which will most likely happen in the near future.

Regardless of the type of market, be it stock market, crypto market or Forex, the concept behind the analysis of market depth helps to be guided by the same principles of building models (strategies) for trading activities, which helps enhance the efficiency of investments and achieve a higher level of professionalism in the field of electronic trading.

Share your queries in the form for personalized assistance.