Forex Broker Business Plan: Blueprint for Startups

By Hazem Alhalabi

By Hazem AlhalabiA versatile writer in a wide range of concepts, specifically in Web3, FinTech, crypto and more contemporary topics. I am dedicated to creating engaging content for various audiences, coming from my passion to learn and share my knowledge. I strive to learn every day and aim to demystify complex concepts into understandable content that everyone can benefit from.

Long hours of reading and writing are my bread and butter, and my curiosity is the catalyst to becoming the experienced writer I am. I excel at writing in English and Arabic languages, and I am endlessly looking to explore new realms and endeavours.

By Tamta Suladze

By Tamta SuladzeTamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

Opening a Forex brokerage startup, just like any new business, is challenging at the beginning. Most entrepreneurs face difficulties in getting around the planning process, allocating resources, and establishing the right foundations that will last for years.

Managers recommend investing sufficient time in the planning phase to save years of restructuring and minimise your risks. The same applies to creating a brokerage platform, given the dynamic and lucrative nature of financial markets. Therefore, you must carefully consider your Forex broker business plan.

This article will explain the most crucial aspects of launching a successful Forex brokerage and how to run a Forex business supported by a solid plan.

Writing a Forex broker business plan is crucial to setting your company’s standards, attracting investors and complying with regulations.

Dedicating sufficient time for the business planning process is recommended to avoid having to restructure your startup.

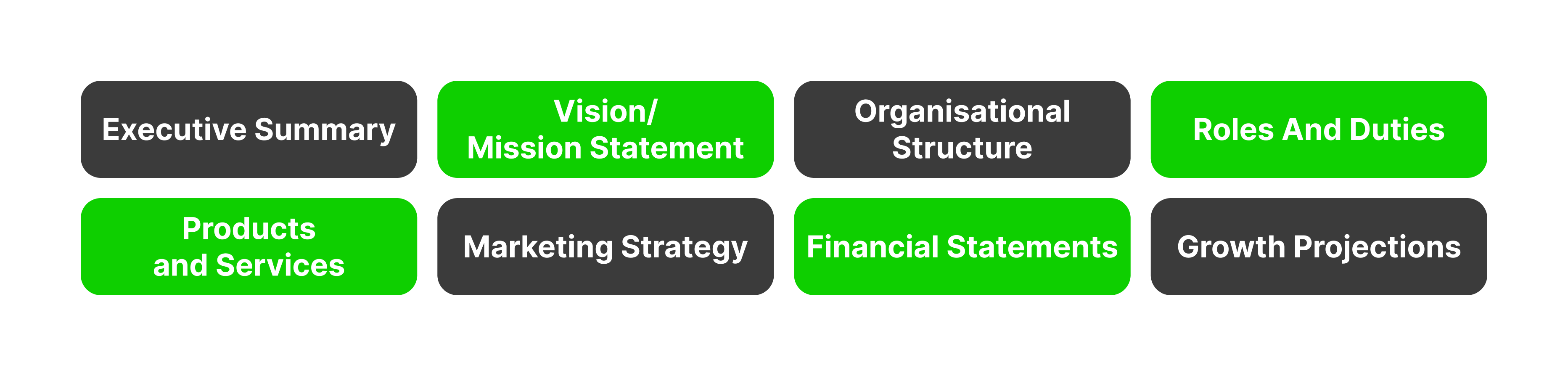

Your Forex brokerage plan includes an executive summary, mission and vision statement, product and services statements, budget, financial projections and growth estimations.

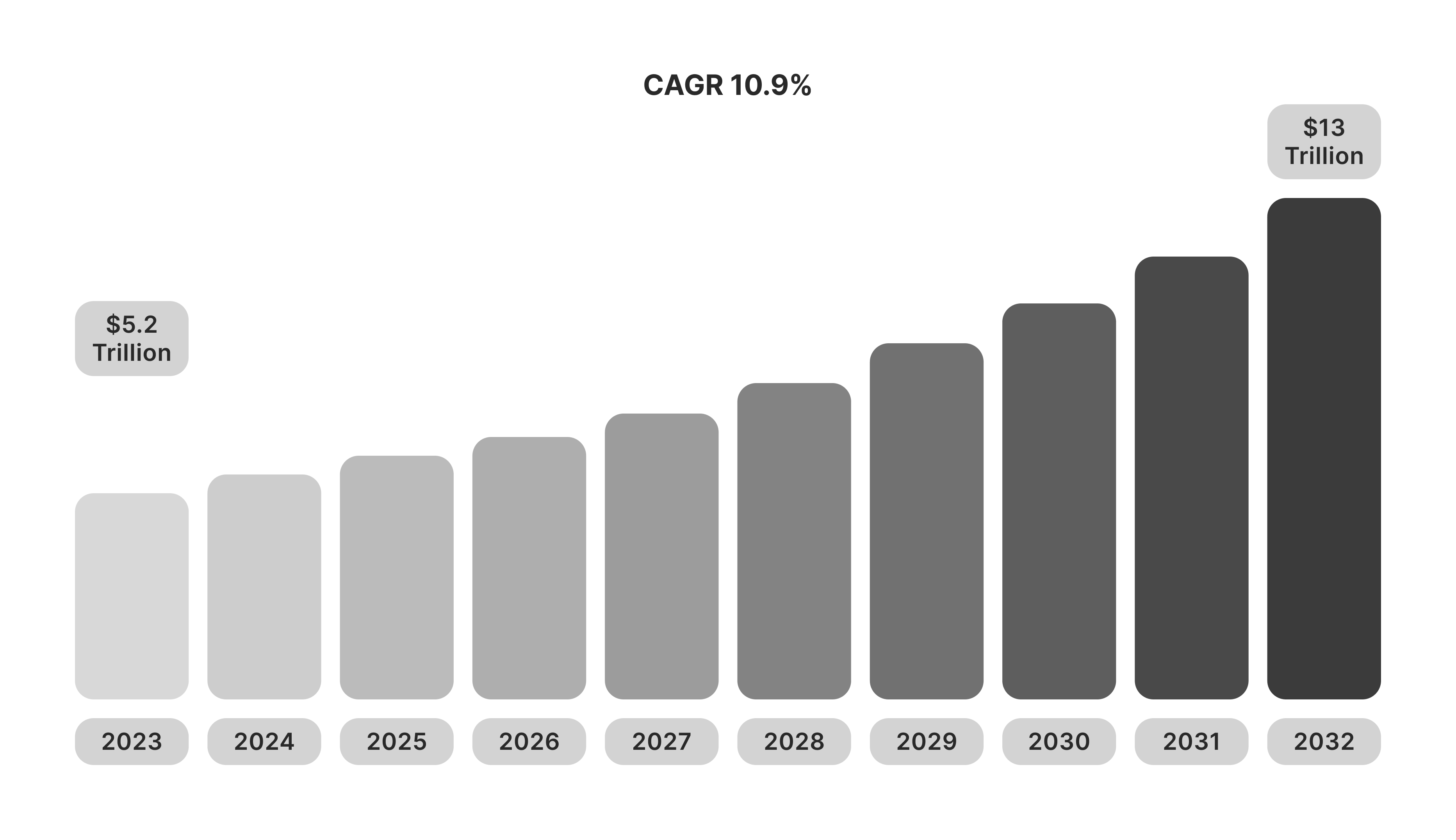

Let’s start with some facts about the online brokerage industry. The Forex brokerage industry is growing at a phenomenal rate. In 2023, the market size was estimated at $5.2 trillion, which is expected to exceed $13 trillion by 2032, marking 10.9% between 2024 and 2032.

These growing trends are attributed to low entry barriers to trading markets and the increasing number of users looking for secondary income generation tools.

These facts make the Forex brokerage market a highly competitive and profitable space. However, you need a proper Forex broker business plan to ensure long-term success.

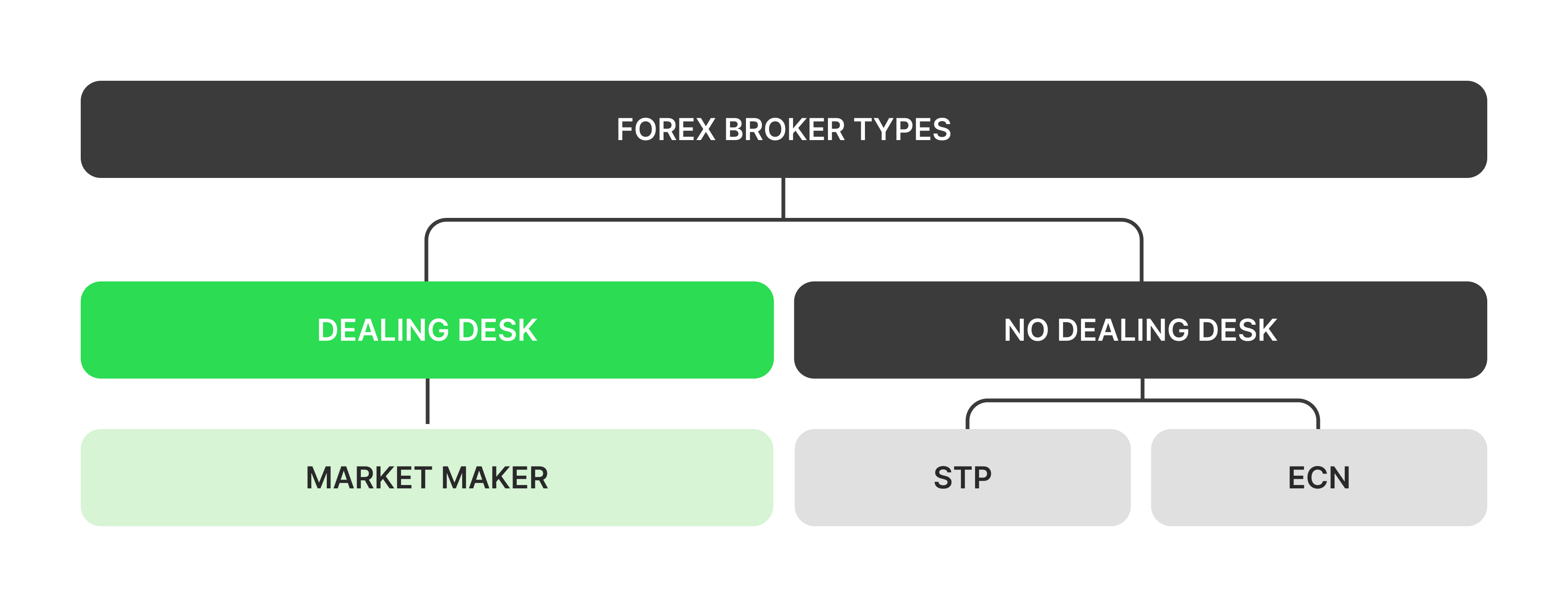

Making money in this space depends on the Forex broker business model. The most common way to generate returns is through commissions, which involve collecting fees from traders’ activities, order execution, deposits, withdrawals and other fund management services.

The market maker broker gains from the bid-ask price difference. Since the buying and selling prices differ, the broker consistently purchases assets from issuers and sells them in secondary markets at higher rates and gains from the spread.

Brokers can earn from the rollover fees when Forex traders leave their positions open overnight, while trading desks make money from taking the counterpart side of the trade with investors on the same platform.

Before diving deeper into preparing a Forex brokerage business plan, let’s discuss some aspects that you must consider when strategising on your Forex startup. Identifying your business model, jurisdiction, and USP is critical and can be a make-or-break deal.

The jurisdiction represents the legal authority that will govern your financial activities and guide your business. Jurisdictions vary between regions and countries, with each of them having distinct rules and regulations that you must familiarise yourself with before investing.

Whether you are working as a broker-dealer, market maker, discount broker or full-service broker, determining your model dictates your profitability strategy, legal requirements, and business plan.

Discount brokers are the most common type of brokerage. They execute trades requested by users, while full-service brokers offer consultancy services, fund management, and other investment opportunities.

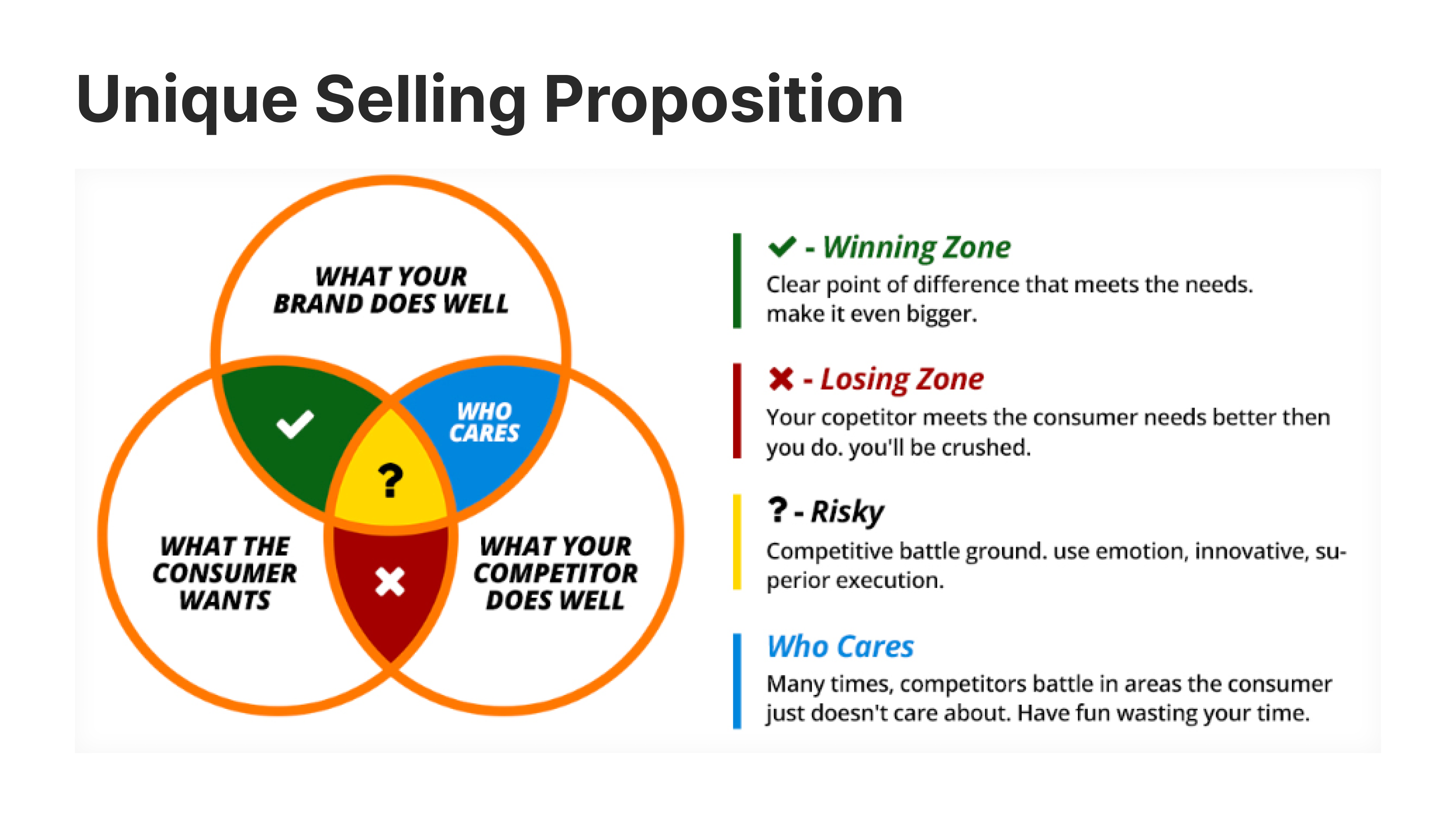

The market is oversaturated, and many brokers and operators compete for a massive pool of customers and revenue. Therefore, you need to select a unique value proposition that distinguishes you from the rest.

Your USP could be low processing fees, offering copy trading, providing cross-device experience or any other quality that makes you different.

Now let’s discuss the most critical part of your business, which most investors and regulators are concerned with: Your Forex business plan.

The plan consists of multiple sections, each dedicated to a distinct part of your business. These are executive summary, vision and mission statements, organisational structure, role and responsibilities, offered products and services, sales and marketing strategies, financial statements, and growth projection. Let’s explain them separately.

Fast Fact

Calculating your break-even point is crucial to estimate the level at which your business will make neither losses nor profits. It is a good starting point for profit estimation, which can be calculated as the following:

Break-even = Fixed costs / (sales price per unit – variable costs per unit)

With easily accessible online services, you can find different ready-to-use plans to fill and use. However, choose a suitable Forex business plan sample that suits your objective because industries have various pain points and emphases.

Moreover, manually writing your Forex trading business plan lets you articulate your perspective accurately, but it might take longer.

Therefore, you can either use an online business plan template as a guideline to follow the same structure or search for a business plan for Forex company to ensure it aligns with your aim.

You might have the most solid Forex brokerage firm business plan and well-thought-of strategies, but your success is not guaranteed because the competition is very high.

The best way to distinguish your brokerage is by continuously improving, accommodating changing client needs, and adapting to market conditions.

For example, the rising trends in trade automation led to increased copy trading. In such scenarios, brokers who integrated copy trading solutions managed to capitalise on the increasing demands and accumulate wealth.

The same applies to prop trading, AI Forex trading and every revolutionary trading technology. Therefore, you must keep up with the latest market developments and integrate the most advanced solutions that your target users require.

Crafting a Forex broker business plan is the first step to launching your trading platform. The plan acts as a guideline for everyone involved in the establishing process, regulatory authorities and even if you are looking to raise capital.

This challenging aspect requires a thorough understanding of your business type and sufficient time investment to develop the most sophisticated FX brokerage plan. Start by identifying your business model, regulatory jurisdiction and USP, and use our checklist to find the plan’s key elements.