What is a Joint Brokerage Account, and How Do You Manage It?

With a Bachelor's Degree in International Journalism, my career has taken me through diverse industries. I began in the banking sector, gaining valuable insights into finance over five years. This foundation led me to fintech, where I began to merge my financial understanding with my passion for writing. As a copywriter, I use my diverse experience to create content that's easy to understand and engaging, helping readers feel confident and informed about financial matters.

Tamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

Lately, joint brokerage accounts have become increasingly popular among individuals seeking to leverage their resources and investment expertise. Whether it's a joint account with a friend, a family member, or a business partner, the collaborative nature of these accounts offers unique opportunities and challenges.

In this article, we go through the details of managing a joint brokerage account effectively, covering everything from understanding the basics to overcoming tax implications and optimising investment strategies.

Joint brokerage accounts offer increased investment power and simplified tax reporting.

Clear communication and shared decision-making are essential for successful account management.

Understanding tax implications and legal considerations is crucial for mitigating risks and optimising returns.

A joint brokerage account is a shared investment account held by two or more individuals. It allows multiple account owners to contribute funds, make investment decisions collectively, and access account information seamlessly.

Commonly opened by married couples, siblings, or business partners, joint brokerage accounts offer various benefits, including simplified tax reporting and the potential for higher returns through diversification.

Brokerage accounts come in various forms, including cash accounts, margin accounts, joint accounts, and others like retirement accounts. Joint accounts, which allow multiple individuals to manage investments together, have surged in popularity recently; let's explore the different types of joint accounts available.

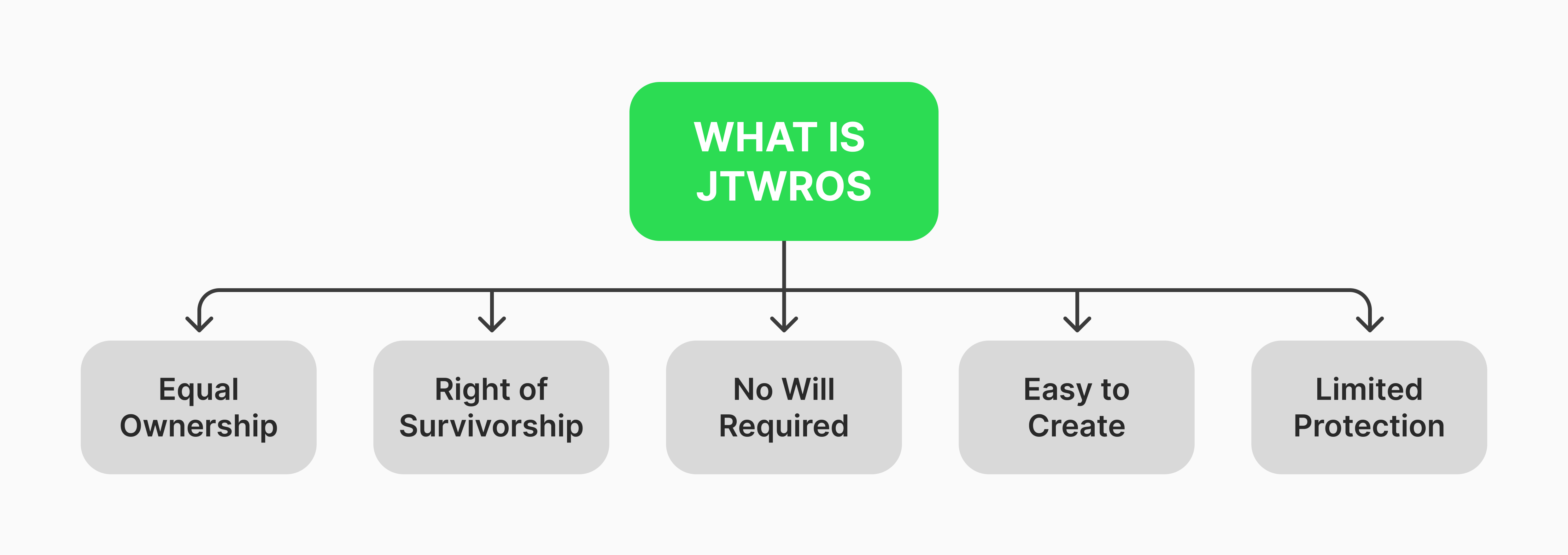

In this type of account, all account holders have equal ownership rights. If one account holder passes away, their share of the account automatically transfers to the surviving account holder(s) without going through probate. This version is common for spouses or partners who want to ensure that the surviving spouse/partner has immediate access to the assets in the account upon one's death.

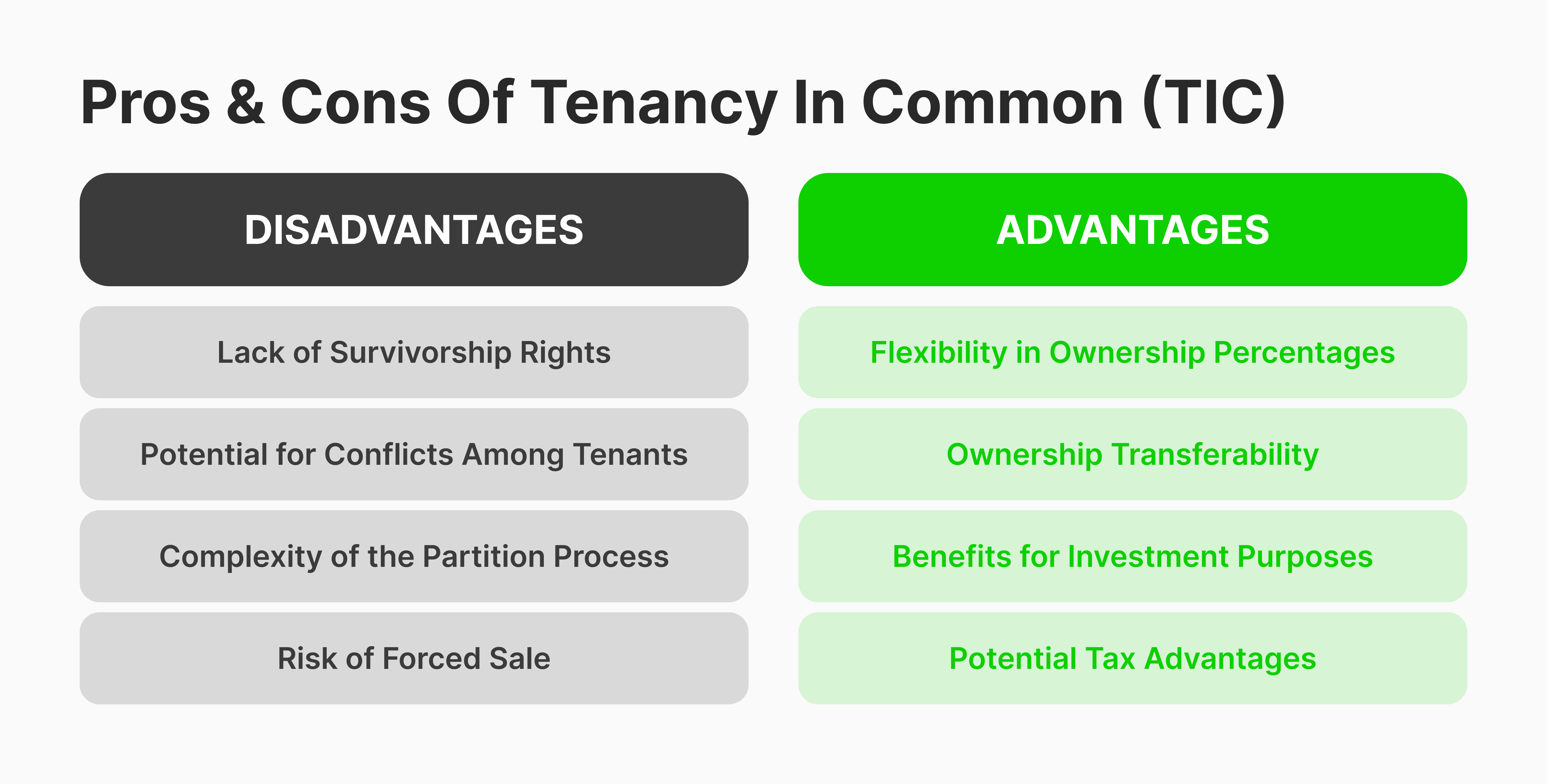

Unlike JTWROS, joint tenants in common can have unequal ownership interests in the account. Each owner can designate a specific percentage of ownership, which may or may not be equal. In the event of one owner's death, their ownership share does not automatically transfer to the surviving owner(s)

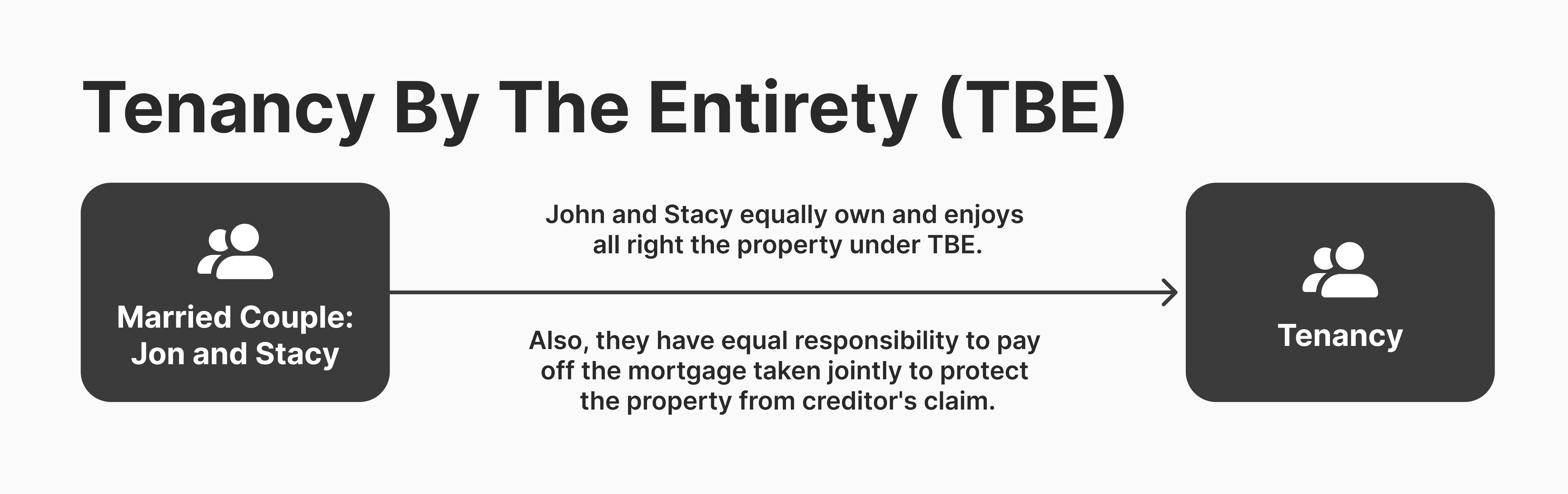

Tenancy by the Entirety (TBE) is a type of joint ownership structure that is available to married couples in some states in the United States. It is similar to joint tenants with rights of survivorship but with an added layer of protection specifically for married couples. In TBE, both spouses collectively own the entire property or asset. This means that neither spouse has a divisible interest in the property; rather, both spouses own the whole.

TBE requires the "Four Unities" to be present: unity of time (both spouses must acquire the property simultaneously), unity of title (both spouses must be listed on the title or deed), unity of interest (both spouses must have equal ownership interests), and unity of possession (both spouses have an equal right to possess and use the property).

Like JTWROS, TBE includes the right of survivorship. This means that if one spouse passes away, the surviving spouse automatically inherits full ownership of the property without the need for probate proceedings. The property bypasses the deceased spouse's estate and goes directly to the surviving spouse.

One of the unique features of TBE is that it typically offers protection from creditors of just one spouse. In many states, creditors of one spouse cannot seize property held as TBE to satisfy the debts of that spouse alone. This protection may vary depending on state law and specific circumstances. TBE is terminated upon divorce, the death of one spouse, mutual agreement between both spouses or if the property is legally conveyed to a third party.

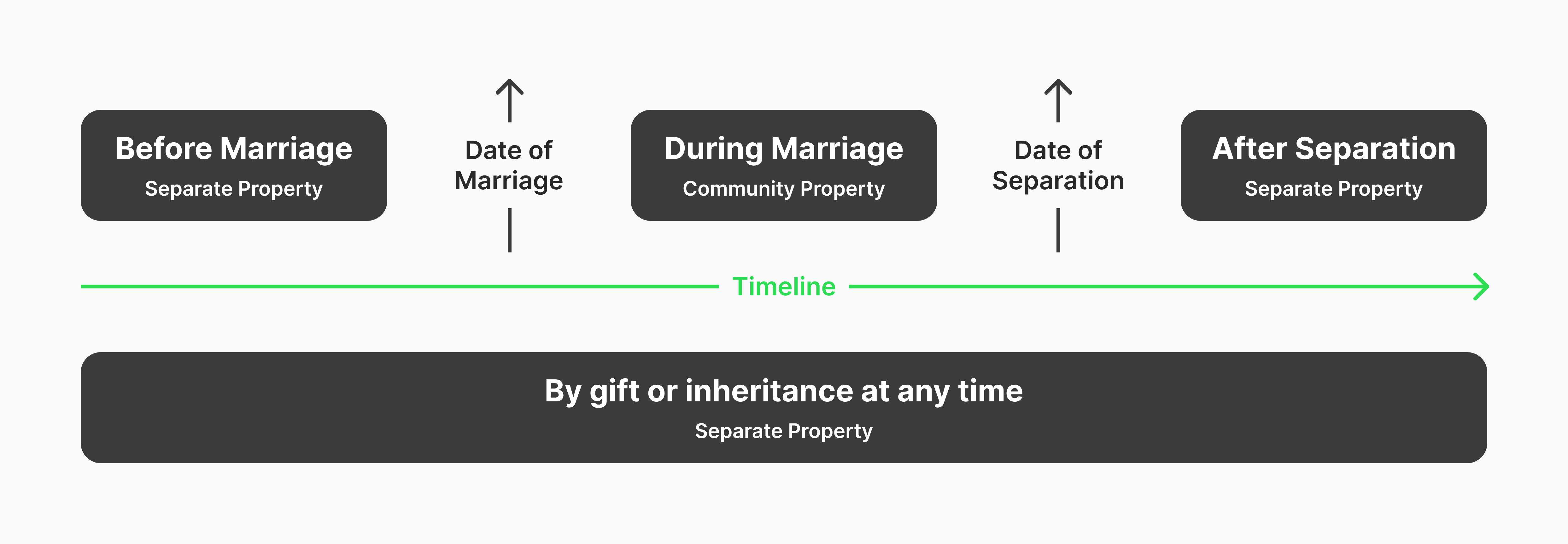

Community property accounts are available in some states in the United States and are typically used by married couples. Assets acquired during the marriage are considered community property and are owned equally by both spouses. In the event of divorce or death, assets in a community property account are divided equally between the spouses.

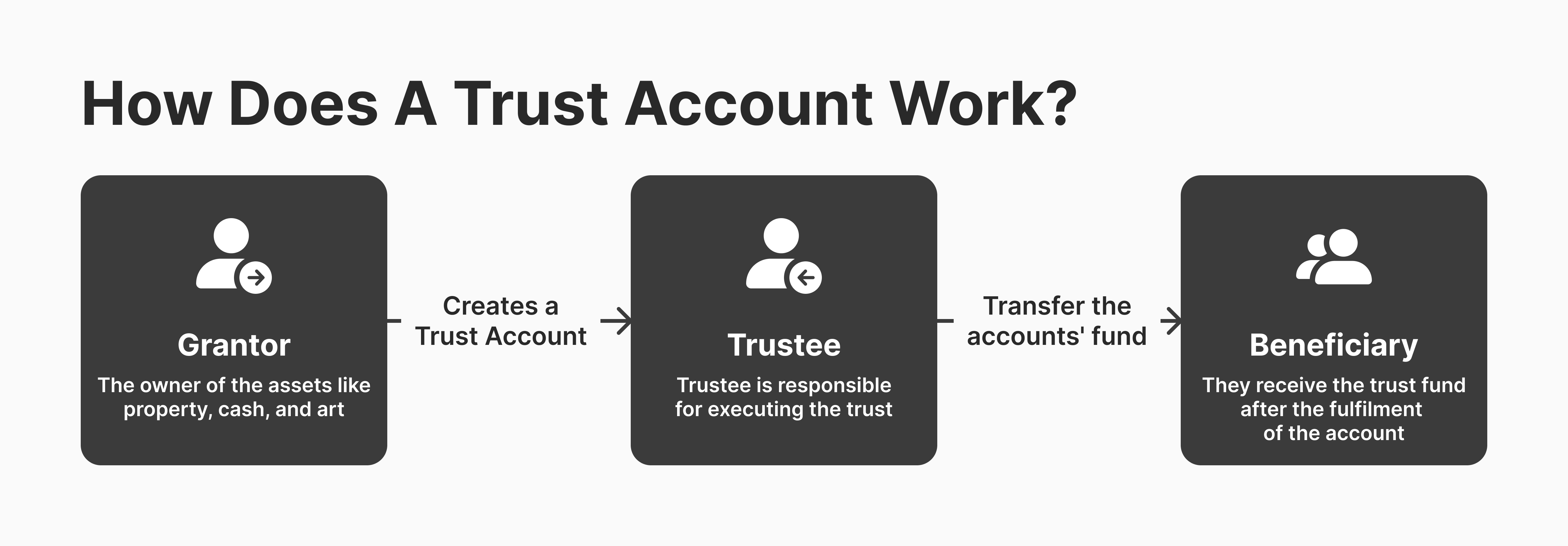

Trust accounts are established by a trustee on behalf of one or more beneficiaries. The trustee manages the assets in the account according to the terms of the trust agreement. Joint trust accounts may involve multiple trustees and beneficiaries, allowing for shared management and ownership.

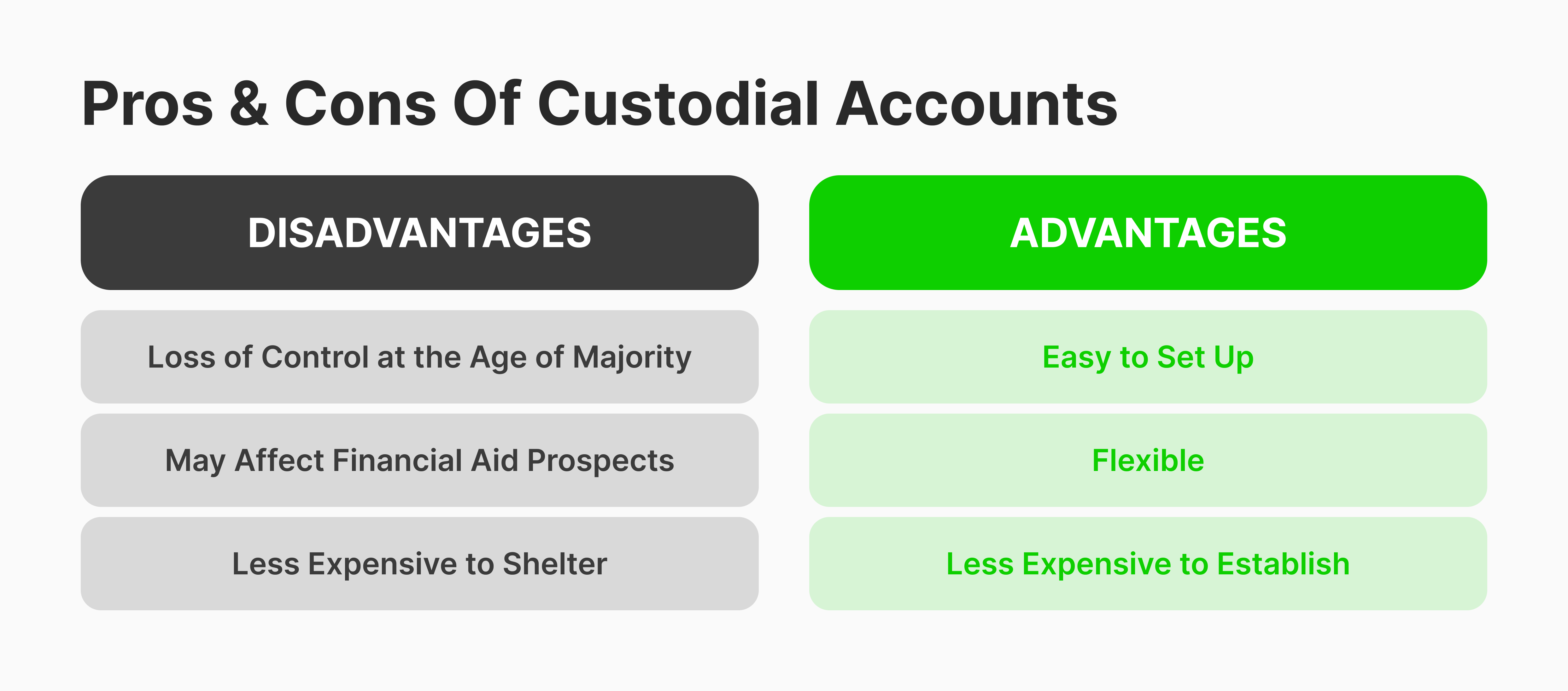

Custodial accounts are established for the benefit of a minor, with an adult acting as the custodian. Joint custodial accounts may involve multiple custodians, such as both parents, managing assets for the minor's benefit. Once the minor reaches the age of majority, they gain control of the account.

These accounts are opened by business partners for the purpose of investing jointly in securities or other assets related to their business activities. Business partnership accounts may have different structures and legal implications depending on the type of partnership (e.g., general partnership, limited partnership, etc.).

Understanding the nuances of each account type is crucial for making informed decisions and mitigating potential risks.

Fast Fact

A joint account with a parent could have tax implications. If the account earns interest, you, as well as your parent, will have to report the interest earned on your federal income tax return.

Individual and joint brokerage accounts are two common types of investment accounts, each with its own features and considerations. Here's a comparison:

An individual brokerage account is owned and managed by a single individual. The individual has sole control over investment decisions and access to the account. A joint brokerage account is owned and managed by two or more individuals. All account holders have equal rights to manage the account and make investment decisions.

In the case of individual accounts, only the account owner has access to the funds and assets in the account, while in joint accounts, all account holders have access to the funds and assets in the account. Any joint account holder can make deposits, withdrawals, and investment decisions.

In the individual brokerage account, taxes are calculated based on the individual's income, capital gains, and dividends generated from investments in the account. The individual is responsible for reporting and paying taxes on gains and income.

In the joint account, taxes are typically calculated based on the proportional ownership of each account holder. Each account holder is responsible for reporting and paying taxes on their share of the gains and income generated from investments in the account.

Taxation and legal implications play a significant role in joint brokerage account management. Whether it's understanding who pays taxes on the account or planning for estate distribution, careful consideration of these factors is paramount.

The individual account owner is solely responsible for any legal liabilities arising from the account, including debts, lawsuits, or claims. In a joint account, each account holder may be held jointly and severally liable for any legal liabilities arising from the account. Creditors may have access to the assets in the account to satisfy claims against any account holder.

Upon the death of the Individual account owner, the assets in the account typically transfer to the designated beneficiaries or heirs according to the owner's will or estate plan. In a joint tenancy with rights of survivorship or tenancy by the entirety, the assets in the account automatically transfer to the surviving account owner(s) upon the death of one account holder, bypassing probate.

The choice between an individual and a joint one depends on factors such as the relationship between account holders, tax considerations, estate planning goals, and individual preferences for control and flexibility. It's important to consider these factors carefully and consult with financial and legal professionals when making a decision.

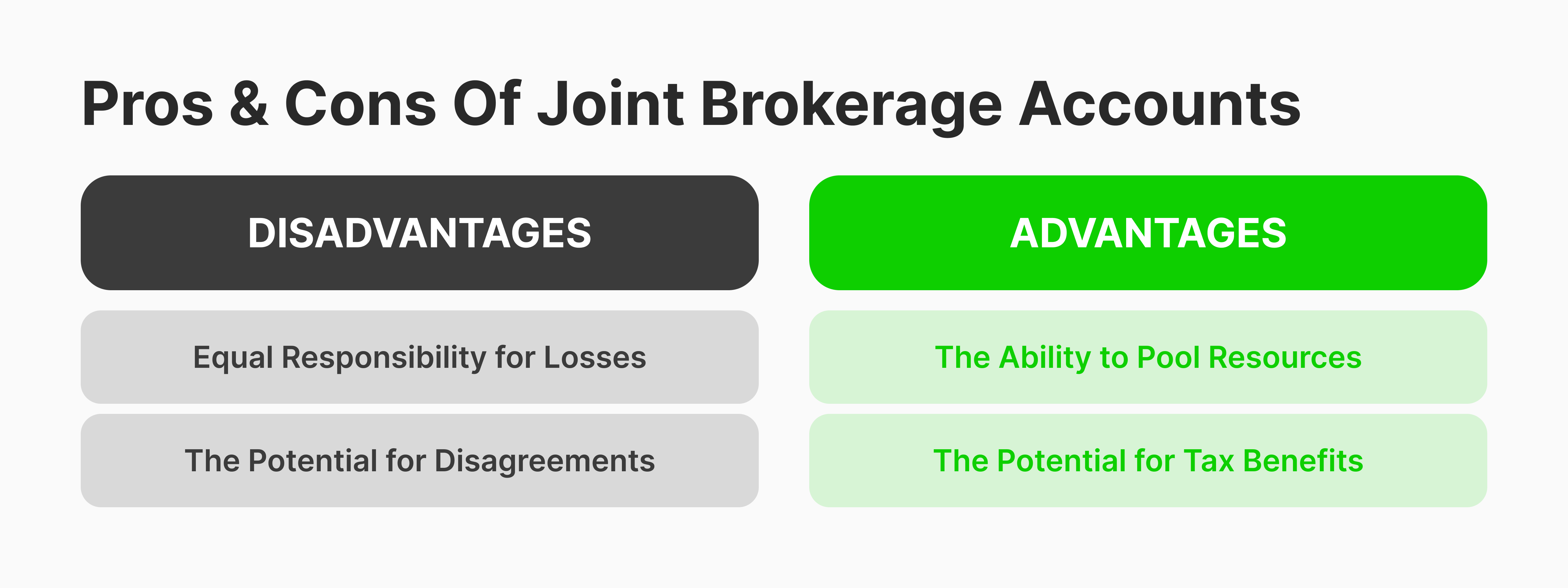

Joint investment accounts offer numerous advantages, including increased investment power, simplified tax reporting, and shared responsibility. However, they also present potential challenges, such as conflicts over investment decisions, legal issues, and personal financial risks. Understanding these pros and cons is essential for making informed decisions about opening and managing a joint brokerage account.

Setting up a joint account involves a few straightforward steps. Here's a general guide on how to do it:

Managing a joint brokerage account requires clear communication, mutual financial goals, and meticulous record-keeping. Here are some essential tips for ensuring smooth operations:

Establish clear communication channels and decision-making processes.

Set investment goals and risk tolerance levels together.

Keep accurate records of all transactions and conduct regular account reviews.

Plan for unexpected events, such as death or divorce, by consulting with legal experts.

Choose a reputable brokerage firm and monitor account statements meticulously.

Managing a joint brokerage account effectively requires diligence, communication, and strategic planning. By understanding the intricacies of joint account ownership, navigating tax implications, and implementing sound investment strategies, account holders can maximise returns while fostering harmony and collaboration.

Whether it's joint investments with a friend, a family member, or a business partner, a well-managed account can be a powerful tool for achieving financial goals and building wealth over the long term.

Joint brokerage accounts are legally binding, and each account holder is responsible for fees, taxes, and penalties.

Cash and Margin Accounts, Joint Accounts, Retirement or Education Savings Accounts

A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs.

Share your queries in the form for personalized assistance.