Why & How to Start a Family Office in 2024?

By Constantine Belov

By Constantine BelovAs a hard-working, goal-oriented, and well-rounded person, I always strive to do quality work for every job I do. Faced with challenging tasks in life, I have developed the habit of thinking rationally and creatively to solve problems, which not only helps me develop as a person, but also as a professional.

Speaking about my professional activities, I can say that I have always been attracted to the study of foreign languages, which later led me to the study of translation and linguistics. Having great experience as a translator in Russian, English and Spanish, as well as good knowledge in marketing and economy, I successfully mastered the art of copywriting, which became a solid foundation for writing articles in the spheres of Fintech, Financial markets and crypto.

By Tamta Suladze

By Tamta SuladzeTamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

Budget planning and expense control are more important than ever, both as individuals and as affluent families with high levels of wealth, quality of life and a desire to preserve wealth, manage complex financial needs and ensure a smooth transition of assets from one generation to the next.

As the financial landscape changes and new opportunities and challenges emerge, a well-structured family office can offer customised solutions that align with a family's unique goals and values.

This article will help you understand the intricacies of the functioning and organisation of the family office and will tell you what functions it performs, what types are divided into and how to start your own family office in 2024.

A family office, a unique and specialised advisory firm, manages the wealth of ultra-high-net-worth (UHNW) individuals or families. Its distinctiveness lies in its comprehensive approach, overseeing not only financial and investment matters but also personal affairs. This tailored suite of services caters to the unique requirements of affluent families, setting it apart from conventional financial advisory services.

Family offices adopt a holistic perspective on wealth management, seamlessly integrating multiple facets such as financial planning, investment oversight, estate planning, tax optimisation, and lifestyle management. This integrated approach ensures that all aspects of a family's financial life are coordinated and aligned with their long-term goals and values.

Family offices empower wealthy families to navigate complex financial landscapes effectively by offering personalised solutions and dedicated resources. Their focus on individualised service allows for a deeper understanding of each family's aspirations, enabling them to create strategies that preserve wealth and enhance the family's legacy over generations.

Fast Fact

In 1901, U.S. Steel, America's first billion-dollar corporation, was formed by merging several steel companies. John D. Rockefeller profited from the transaction because he owned a large iron mine property in Minnesota's Mesabi Range. This investment marked the beginning of the modern family office.

Family offices managing the financial and personal affairs of wealthy families come in various forms, each tailored to the particular needs and preferences of the families they serve. The primary types of family offices are Single-Family Offices (SFOs) and Multi-Family Offices (MFOs), but variations within these categories also exist. They are as follows:

The Single-Family Office (SFO) is a specialised entity serving a single family's financial and personal affairs. This exclusive service provides highly tailored and individualised assistance, addressing the specific and often intricate needs of the family it serves.

One of the key benefits of an SFO is its level of control and privacy. By working with an SFO, a family can maintain complete control over investment strategies, financial planning, and other services. This ensures that the family's values and preferences are fully integrated into all decision-making processes. The family can enjoy the highest level of privacy and confidentiality, as the office is exclusively committed to serving their interests.

In addition to financial management, SFOs frequently provide comprehensive support in various areas such as estate planning, tax optimisation, philanthropy, and even personal services like travel arrangements and property management. This holistic approach allows the SFO to oversee and optimise all aspects of a family's wealth and lifestyle, offering a seamless and integrated management solution.

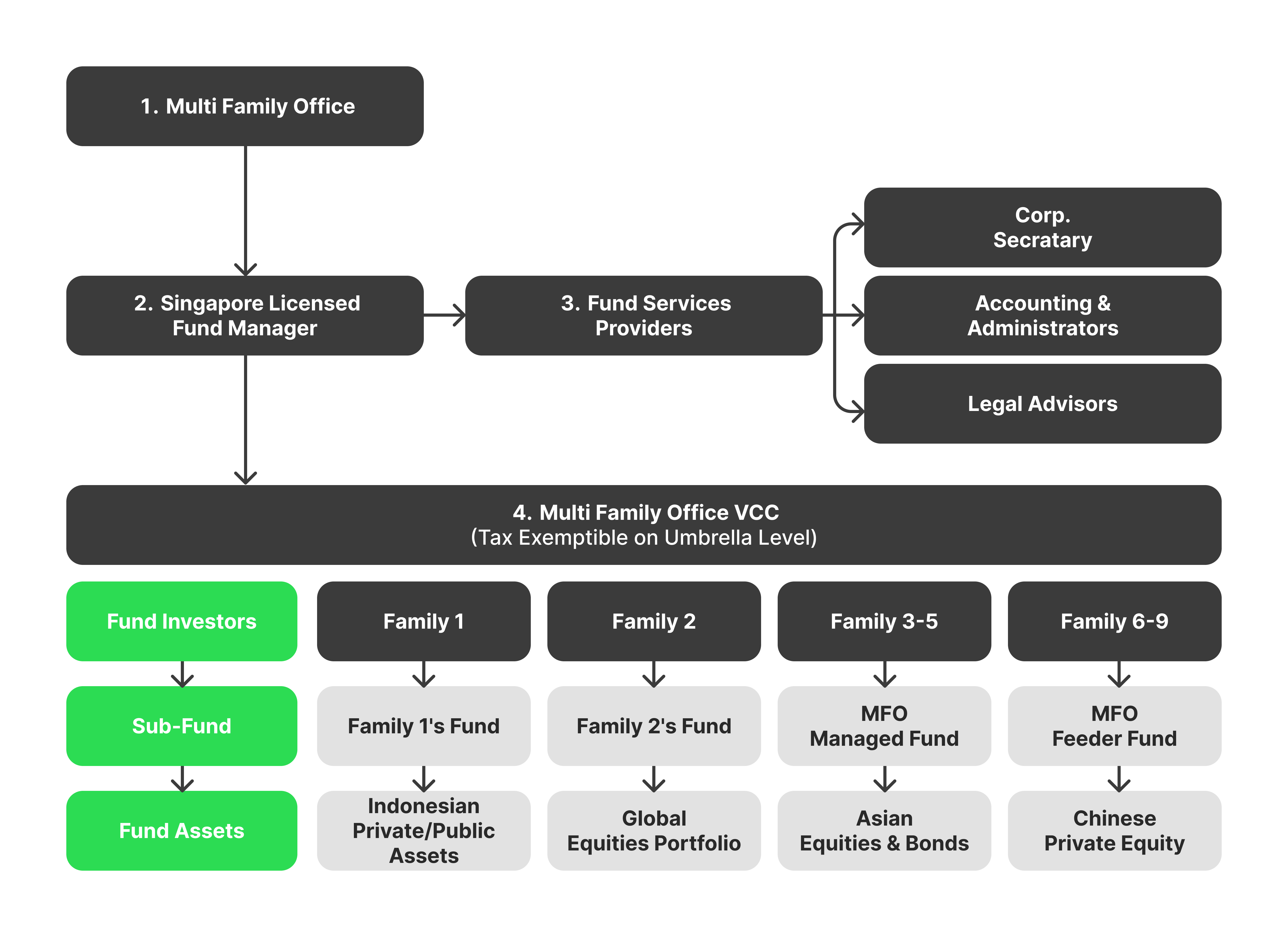

Multi-Family Offices (MFOs) offer comprehensive wealth management services by serving multiple families and pooling resources. This model enables families to access various financial services while sharing the costs with other clients, making it a cost-effective solution.

The broader client base of MFOs allows them to tap into diverse expertise and resources, including specialised investment strategies, tax planning, estate management, and exclusive investment opportunities that may not be accessible to single-family offices (SFOs).

By leveraging economies of scale, MFOs make high-quality wealth management services accessible to families who may not have the wealth required to establish their own SFO.

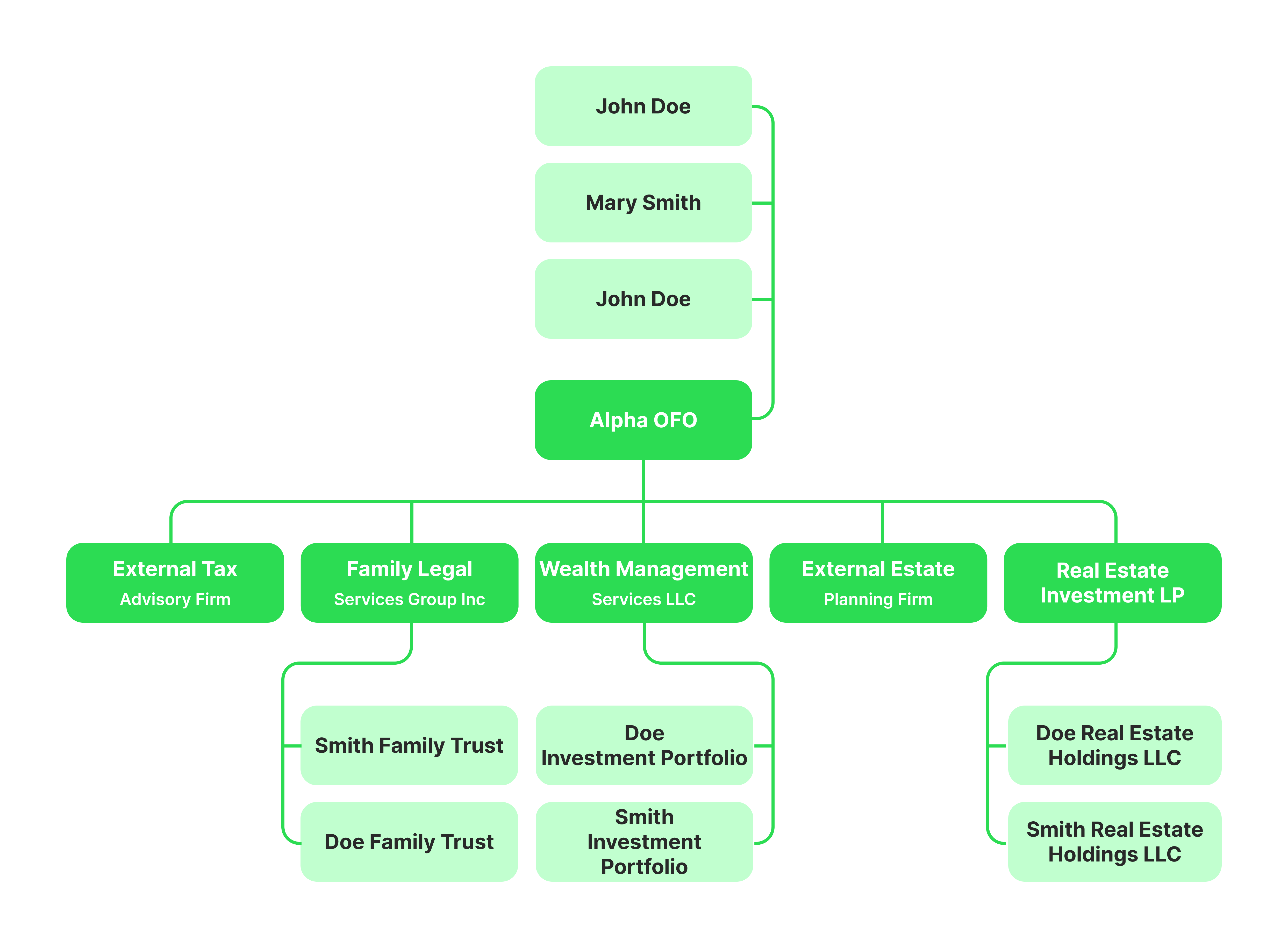

In this model, a family hires an external firm to provide office family services. This third-party provider manages all aspects of the family's wealth, from investments to personal affairs.

While outsourced, the services are still tailored to the family's needs. The external provider typically works closely with the family to ensure their goals and values are reflected in the management strategy.

An outsourced family office offers flexibility in terms of services and scalability, allowing families to adjust the level of service as their needs change.

Some family offices are part of a family-owned business, strategically using the company's established structure to oversee family wealth. This integration facilitates seamless management of the business and the family's personal assets by consolidating resources and expertise.

Embedded family offices leverage the resources and infrastructure of the family business, enabling them to operate with heightened efficiency and reduced costs compared to independent single-family offices.

These family offices offer specialised services tailored to the needs of the family business. This may include providing support in areas such as corporate governance, succession planning, and business strategy, in addition to conventional wealth management services.

A hybrid family office blends elements of SFOs and MFOs or combines in-house services with outsourced solutions. This allows families to retain control over certain aspects of wealth management while leveraging external expertise for others.

The hybrid model offers a highly customised structure, enabling families to choose the most efficient and sustainable approach to managing their wealth.

Hybrid family offices are scalable, making it easier to adjust the level of service as the family's wealth and needs evolve.

A VFO operates primarily through digital platforms, using technology to deliver family office services. This model offers flexibility and reduces the need for physical office space and full-time staff.

VFOs often outsource key functions to external specialists, including investment management, legal services, and tax planning. This allows for a leaner operation while still accessing top-tier expertise.

VFOs can be more cost-effective than traditional family offices, making them an attractive option for families seeking comprehensive services without a physical office's high overhead.

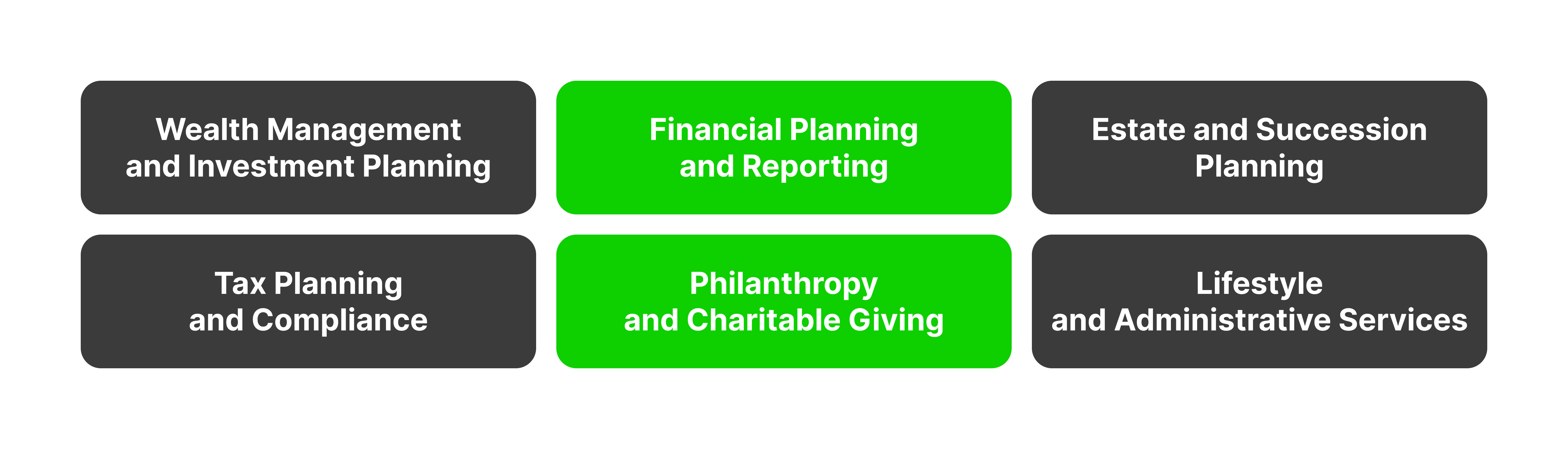

Family office firms are multi-structured organisations responsible for various issues related to the personal financial planning of an individual or group of individuals. Such companies are powerful planning and analytical tools because they perform a wide range of functions, including the following:

Regarding portfolio management, the focus is on developing and overseeing a varied investment portfolio specifically tailored to the family's unique risk tolerance and financial objectives. This involves carefully selecting a mix of different investment assets such as stocks, bonds, real estate, and other securities to spread risk and maximise returns.

Asset allocation is a vital part of this process, involving the strategic distribution of assets across different investment categories to achieve the best possible balance between risk and return. This helps ensure that the portfolio is optimised for performance and risk management.

Creating detailed financial plans and budgets is essential to achieving long-term financial goals for the family. These plans should take into account all sources of income, as well as all expenses, to ensure that financial objectives are met.

Regularly providing comprehensive and transparent financial reports is crucial for helping family members make well-informed financial decisions.

Estate management involves the meticulous process of creating and overseeing trusts and estates to facilitate the smooth transfer of wealth to subsequent generations. This includes establishing legal structures and mechanisms to safeguard assets and ensure they are distributed according to the grantor's desires.

On the other hand, succession planning encompasses the comprehensive preparation and execution of strategies to seamlessly pass on business interests and financial obligations within the family unit. This involves identifying and grooming the next generation of leadership and establishing protocols for transferring ownership and decision-making authority.

The family investment office assists in creating and implementing custom strategies to minimise tax liabilities through careful analysis of available deductions, credits, and exemptions while ensuring full compliance with all applicable tax laws and regulations to maximise savings for individuals and businesses.

It also participates in managing the entire tax filing process, including thorough documentation and record-keeping, to accurately report income, deductions, and credits by tax laws. This includes maintaining organised records to facilitate seamless audits and ensure compliance with all regulatory requirements.

Family offices play an integral role in establishing and overseeing the operations of family charitable foundations or donor-advised funds aimed at achieving philanthropic objectives.

Besides establishing these entities, family offices also take on the responsibility of managing the grant process. This includes overseeing the distribution of charitable grants and ensuring that they align with the family's philanthropic mission and values.

Family offices offer various personal concierge services to support high-net-worth individuals and families. These services include meticulous travel planning, coordination of household management tasks, and expert management of luxurious assets.

Along with this, family offices also provide valuable legal and administrative support, offering specialised legal advice, expert document preparation, and administrative support to fulfil diverse family needs.

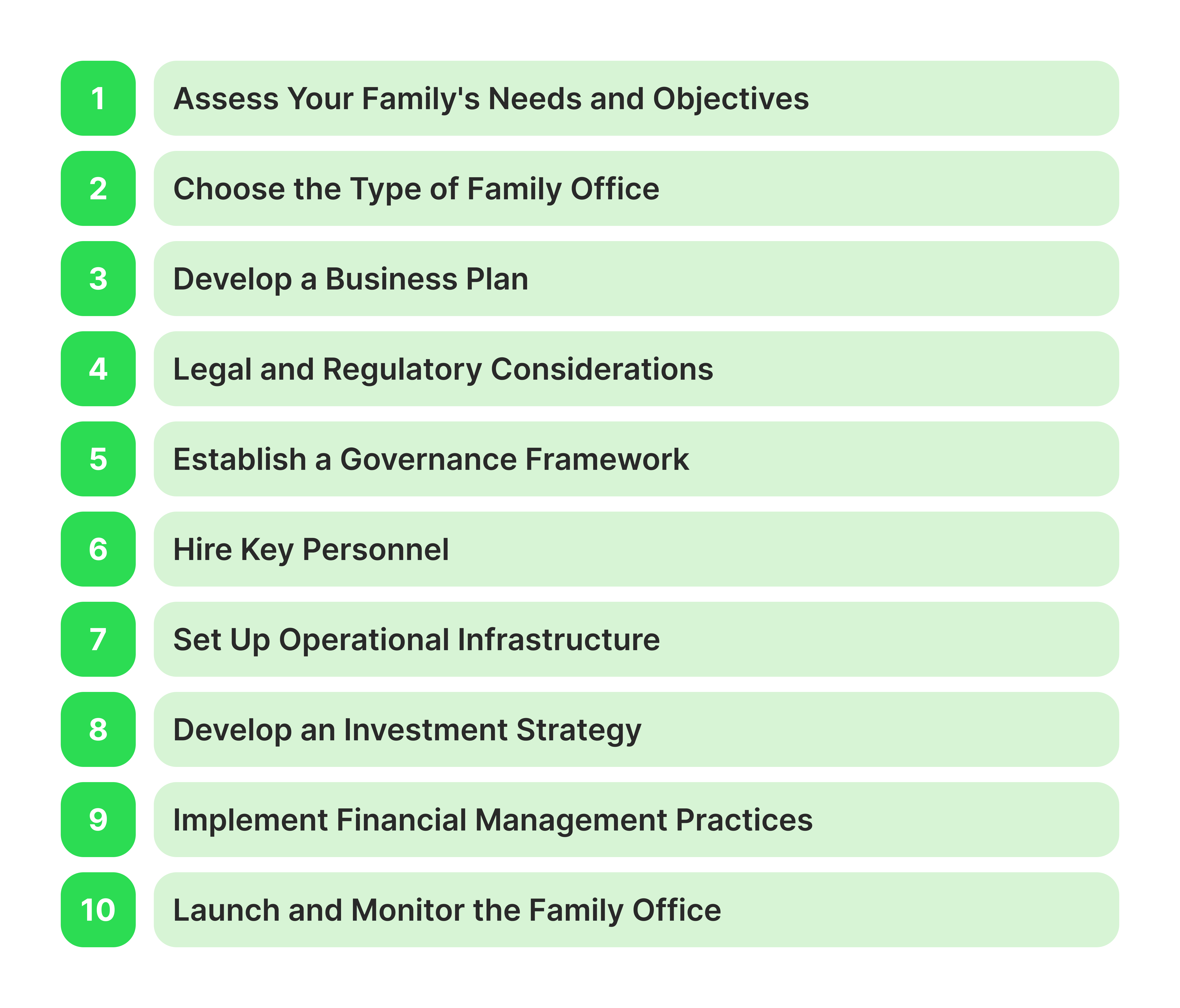

Establishing a family office requires meticulous planning and strategic choices to align with an individual’s or family's needs and aspirations. This detailed guide outlines a systematic approach to launching a family office structure in 2024.

The first step when establishing a family office is clearly defining the primary objectives. This involves identifying key goals such as wealth preservation, investment management, succession planning, philanthropy, or lifestyle services.

Furthermore, it is essential to thoroughly evaluate the family's overall wealth to ascertain whether establishing a Family Office is a prudent decision. Typically, Family Offices are better suited for ultra-high-net-worth families with considerable assets.

As was already written above, there is a wide range of varieties of family offices and models of their functioning, each of which has its own strengths and weaknesses, as well as peculiarities of work, which are expressed in certain characteristics that affect the overall style of financial management of an individual or family.

At this step, it is necessary to make a comparative analysis and choose the appropriate model, taking into account individual needs and preferences.

When developing the business plan for the family office, it is essential to define its mission, vision, and values meticulously. These elements will serve as the guiding principles for its operations and overall strategic direction. In addition, the organisational structure should be thoughtfully decided upon, including key roles, reporting lines, and decision-making processes.

Furthermore, it's crucial to list the comprehensive range of services the family office will provide, such as investment management, tax planning, legal services, lifestyle management, and succession planning. Each service should be outlined thoroughly to ensure clarity and coherence in the business plan.

When establishing a family office, it's crucial to carefully select a legal structure such as a trust, corporation, or limited liability company. This choice should be based on thorough consideration of tax efficiency, liability protection, and operational requirements.

Additionally, diligent attention must be given to ensure the family office fully complies with local and international regulations. This includes adherence to financial reporting standards, Anti-Money Laundering (AML) regulations, and Know Your Customer (KYC) requirements.

Furthermore, selecting the jurisdiction for the family office is a critical decision that should factor in elements such as tax laws, the regulatory environment, and proximity to family members. These considerations can significantly influence the family office's overall operational and financial efficiency.

A robust family governance structure is essential to manage the family office effectively. This can be achieved by forming a family council, conducting regular meetings, and implementing clear communication channels.

An inclusive decision-making process should be defined for the family office, encompassing areas such as investment strategies, the recruitment of key personnel, and significant expenditures.

Additionally, a comprehensive succession plan is vital to guarantee a smooth transition of leadership and management of the family office across successive generations.

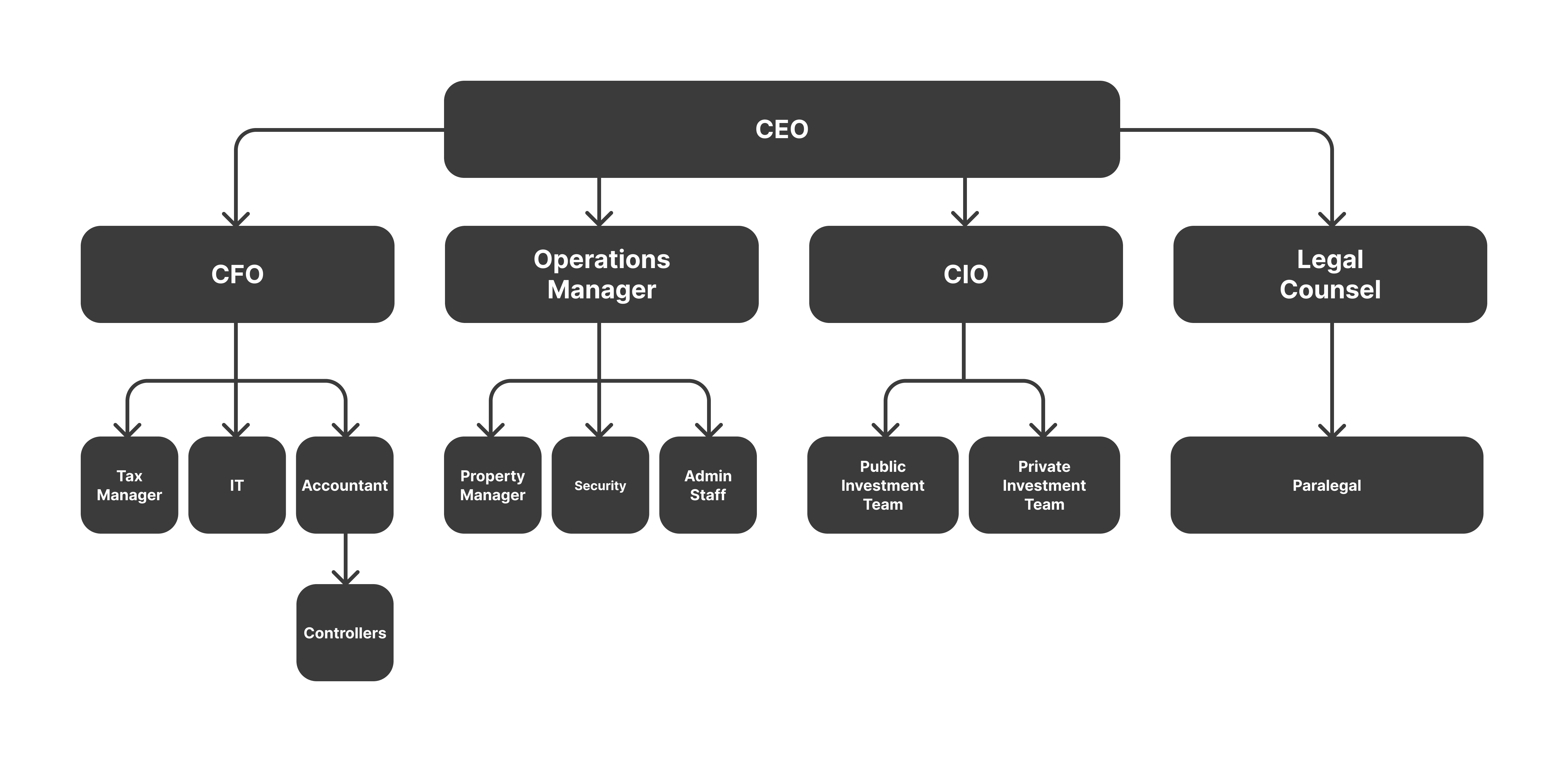

Establish a recruitment process to onboard highly experienced professionals to oversee the family office operations. This team should ideally include a Chief Executive Officer (CEO) to provide strategic leadership, a Chief Financial Officer (CFO) to manage financial matters, investment advisors to handle portfolio management, legal counsel to navigate complex regulatory environments, and tax specialists to optimise financial planning.

Simultaneously, hire a dedicated team of administrative and support staff to manage day-to-day operations efficiently. This team should include skilled accounting professionals to handle financial transactions, IT specialists to ensure robust technological infrastructure and concierge services to provide personalised assistance and support.

Beyond that, ensure that the entire team embodies the family's values and is committed to achieving the long-term objectives of the family office. Building a trust, transparency, and collaboration culture will foster a cohesive and high-performing team.

Ensure the implementation of reliable and secure IT systems for financial management, reporting, and communication to safeguard sensitive data and optimise operational efficiency.

Also, leasing or purchasing office space options should be evaluated, considering factors such as the requirement for confidentiality, accessibility, and a comfortable work environment for employees.

Develop partnerships with external service providers to meet specialised needs, including obtaining legal advice, strategic tax planning, and managing estate-related matters.

Evaluate the family's comfort level with risk by considering their past investment experiences, financial constraints, and future expectations. Customise an investment approach that matches the family's financial priorities and the time they have for investing.

Identify the most suitable distribution of investments across various asset categories, such as stocks, bonds, real estate, private equity, and alternative investments. Create a strategic combination of these asset classes to optimise the family's investment portfolio.

Implement stringent and thorough evaluation procedures for selecting and monitoring investments to protect the family's wealth. This entails conducting in-depth research, due diligence, and continuous assessment of the chosen investments to mitigate risks and capitalise on opportunities.

Develop a solid budget for the family office, considering various operating costs such as office rent, utilities, insurance, maintenance, and salaries for staff members. Consider anticipated investments in diverse asset classes such as stocks and bonds, real estate, and alternative investments.

Monitor cash flow diligently to maintain sufficient liquidity to cover ongoing expenses and capitalise on potential investment opportunities.

Implement a robust system for regular financial reporting to provide transparency and accountability to family members. This may include detailed reports on income, expenses, investment achievements, and overall financial health of the family office.

Conducting a soft launch as a preliminary step is recommended to ensure a successful implementation of the family office's operations. This will allow for testing of the operations and making necessary adjustments before a full-scale implementation.

Regularly reviewing and analysing the family office's performance is essential. This includes assessing investment returns, evaluating service quality, and ensuring alignment with the family's goals and objectives.

Further, it is paramount to maintain agility and be prepared to adapt to changes in the family's needs, market conditions, and the regulatory environment. Adapting to these changes will ensure that the family office remains effective and efficient in meeting the evolving requirements and challenges.

Family offices are a strategic investment for affluent families seeking professional wealth management. Family offices offer various tailored services to help families accomplish their financial aspirations, uphold their wealth through the generations, and maintain their legacy.

Starting a family office in 2024 is a complex but rewarding endeavour that requires careful planning, clear governance, and the right team. Following the steps described can help you create a family office that preserves and grows wealth and supports the family's long-term objectives and values.

A family office is a private organisation established to manage a wealthy family's financial and personal affairs. It provides various services, including investment management, tax planning, estate planning, philanthropy, and lifestyle management.

Starting a family office in 2024 allows families to have personalised control over their wealth management, align financial strategies with family values, and ensure long-term wealth preservation across generations. It also helps address modern financial markets' complexities and changing regulatory environments.

Evaluate the complexity and size of a family’s assets, the need for centralised management, and the desire for customised financial and lifestyle services. Typically, families with significant wealth and diverse financial interests benefit most from a family office.

Costs vary based on the complexity of services, number of employees, legal setup, and operational requirements. Starting a single-family office typically requires significant initial capital and ongoing expenses, while a multi-family office can spread costs across multiple families.

Challenges include high setup and operational costs, managing complex family dynamics, ensuring regulatory compliance, and keeping up with evolving financial markets and tax laws.

Yes, family offices often provide lifestyle management services, including concierge services, travel planning, property management, and personal security.