What is a Margin Account? How Risky is it?

By Constantine Belov

By Constantine BelovAs a hard-working, goal-oriented, and well-rounded person, I always strive to do quality work for every job I do. Faced with challenging tasks in life, I have developed the habit of thinking rationally and creatively to solve problems, which not only helps me develop as a person, but also as a professional.

Speaking about my professional activities, I can say that I have always been attracted to the study of foreign languages, which later led me to the study of translation and linguistics. Having great experience as a translator in Russian, English and Spanish, as well as good knowledge in marketing and economy, I successfully mastered the art of copywriting, which became a solid foundation for writing articles in the spheres of Fintech, Financial markets and crypto.

By Tamta Suladze

By Tamta SuladzeTamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

A margin account is more than a financial tool; it is a portal for investors to revolutionise their trading strategies and enhance capital growth. By allowing individuals to borrow against their current instruments, margin accounts radically increase buying power, opening doors to opportunities that cash accounts cannot provide.

This article will tell you what a margin account is, what advantages it offers, and what the prerequisites are for opening one. You will also learn about the rules and legal aspects to consider when using it.

Margin accounts allow investors to amplify their purchasing power and take advantage of market advances that may not be possible with a cash account.

While margin accounts can enhance returns, they also increase the potential for significant losses, especially during market downturns.

Strict rules and prerequisites, including initial margin and maintenance margin, are in place to protect investors and brokers from excessive risk.

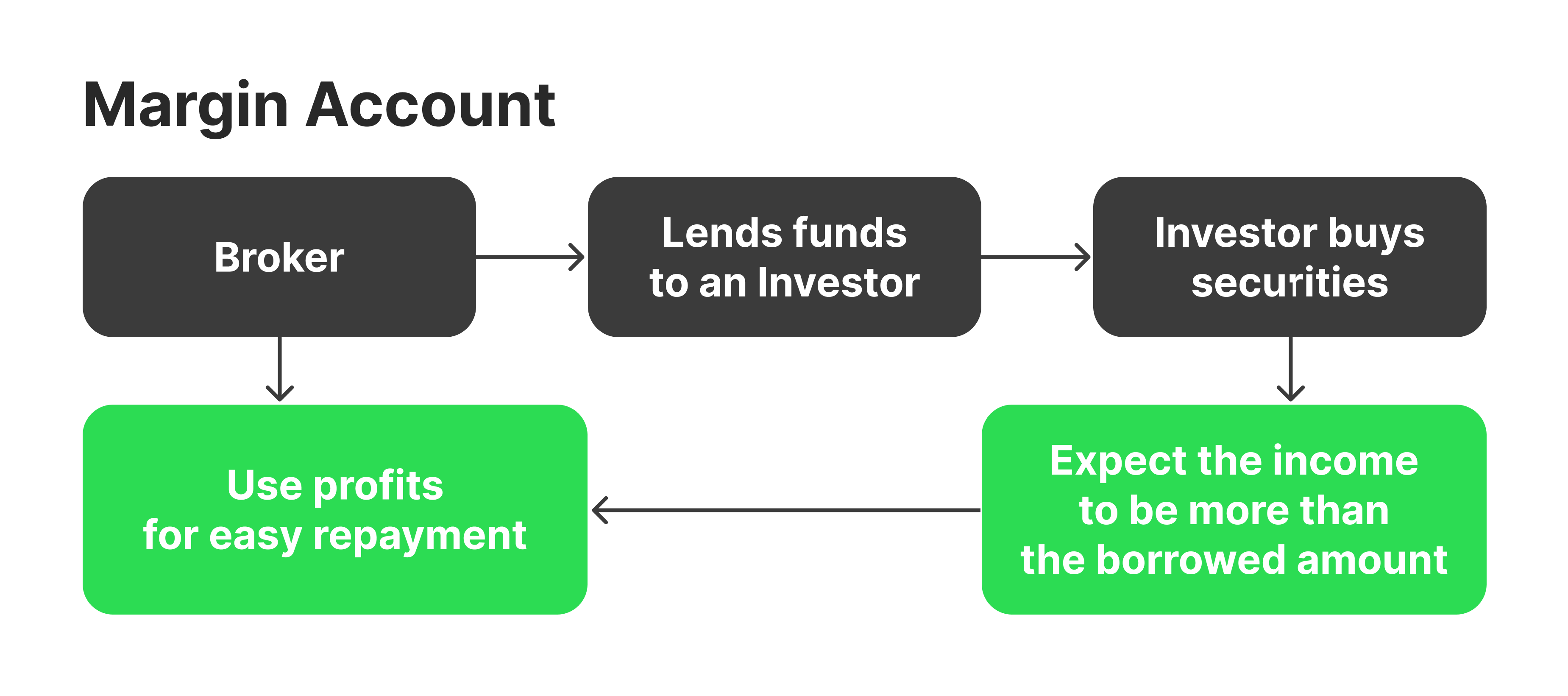

A margin account is a brokerage account that allows investors to borrow funds from their instrument's broker to spend on shares. By using the instruments in the account as collateral, traders can leverage their purchasing power beyond their cash balance.

This facility appeals to active investors who maximise returns by exploiting market opportunities. However, the ability to trade on borrowed money comes with heightened risks, making margin accounts suitable primarily for expert traders with a clear market appreciation.

When opening a margin account, investors must meet specific standards set by their broker and regulatory authorities, such as maintaining a minimum deposit known as the initial margin.

Once the account is active, a percentage of the asset's worth, the minimum deposit, must always remain to avoid a margin call, where the broker demands additional funds or liquidates assets to cover losses.

For most investors, a margin account represents a double-edged sword. While it offers the potential for higher returns, the risks associated with leveraging investments underscore the importance of careful planning, thorough market analysis, and risk management.

Fast Fact

Failing to meet a margin call can result in your broker selling your instruments without notice, possibly leading to vast losses.

A margin account offers significant advantages for investors looking to enhance their trading capabilities and maximise potential returns. The primary benefit is increased purchasing power through leverage, allowing traders to buy more instruments than they could with cash alone. This amplified exposure to the market can lead to greater profits in favourable conditions, making it a powerful tool for active investors and speculators.

Another key advantage is the flexibility that margin accounts provide. Investors can use borrowed funds to seize time-sensitive opportunities, diversify their portfolios, or implement advanced trading practices like short selling. This flexibility can be especially valuable in volatile markets, where quick decisions and immediate access to additional capital are critical for success.

Margin accounts also offer liquidity advantages. Investors can access funds without having to sell their existing instruments, which can help maintain positions in long-term investments while pursuing short-term opportunities. This ability to borrow against assets in the account can act as a financial bridge, providing a convenient alternative to traditional loans.

Beyond that, a margin trading account enables investors to employ risk-management strategies like hedging. For example, traders can use leverage to balance positions or offset potential losses in a declining market. The ability to short-sell is another strategic benefit, allowing investors to profit from downward price movements.

Margin accounts operate under specific prerequisites designed to regulate the borrowing and usage of funds. These prerequisites ensure that both the investor and broker are protected from excessive risk. The key margin prerequisites include the initial margin, maintenance margin, and margin call thresholds, which are governed by regulatory bodies such as FINRA and the SEC in the United States, along with brokerage-specific policies.

The initial margin is the minimum amount an investor must deposit to open a position in a margin account. Typically set at 50% of the total purchase value, this pre-requisite is established by Regulation T of the Federal Reserve Board in the U.S.

For instance, if an investor wants to purchase $20,000 worth of instruments, they must contribute at least $10,000, while the remaining $10,000 can be borrowed from the broker.

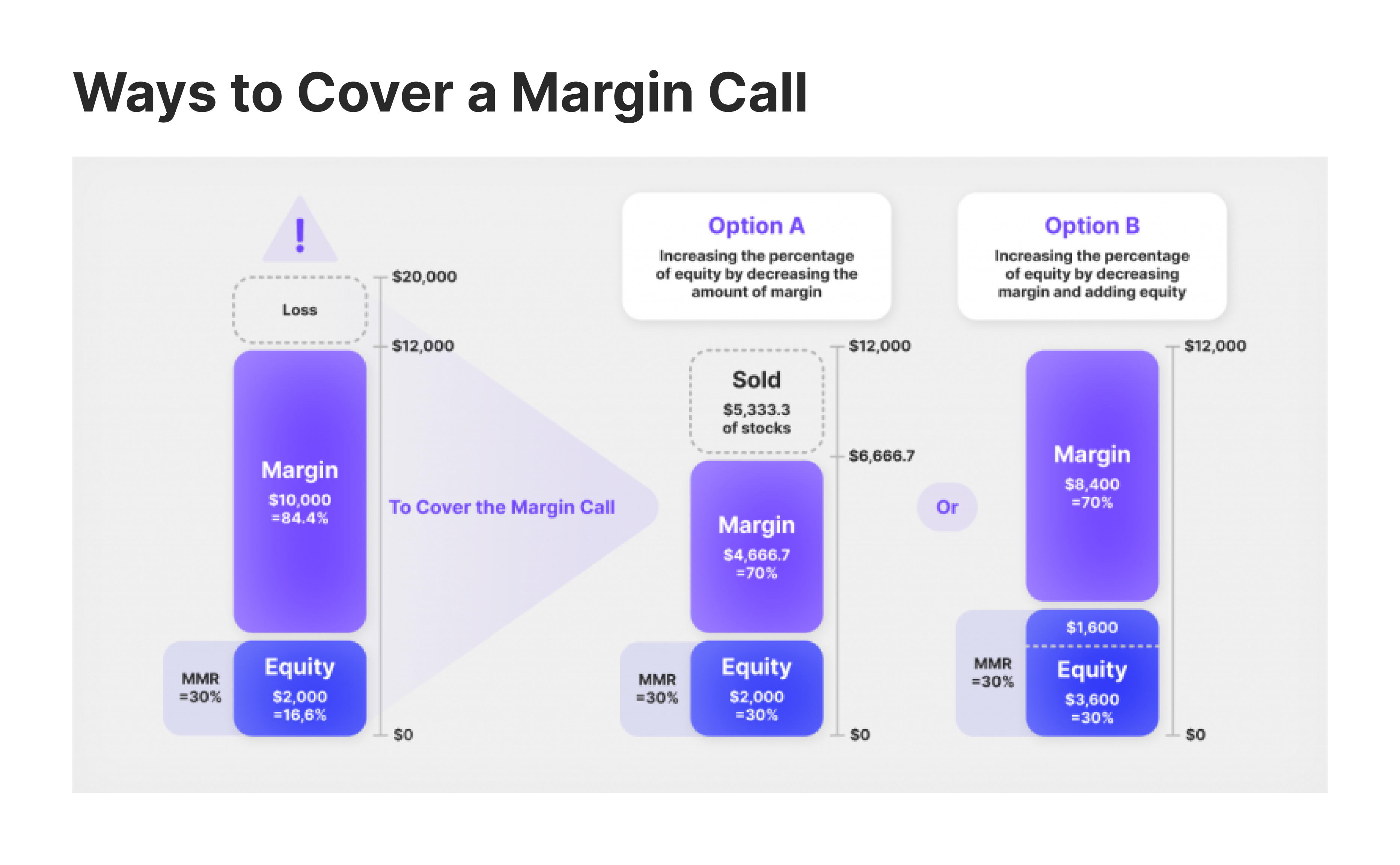

The maintenance margin is the proportion of equity that must be maintained in the account after establishing the position. FINRA requires a maintenance margin of at least 25% of the total market value of the instruments in the account.

However, brokers often impose higher thresholds, such as 30% or even 40%, depending on the traded instruments and the investor's risk profile. Falling below this margin level can trigger a margin call.

A margin call shows up when the balance in the account drops beneath the maintenance margin limit. In this case, the broker requires the investor to deposit additional funds or sell instruments to restore the account's equity. If the investor fails to meet the margin call promptly, the broker may liquidate assets in the account to cover the deficit, often without prior notice.

Beyond regulatory minimums, brokers often impose their own house margin prerequisites, which are stricter to reduce risk exposure. These prerequisites vary by brokerage and may depend on factors such as the instruments' volatility or the investor's trading history.

Certain types of trading, such as short selling or trading in highly volatile or leveraged instruments, may come with higher margin prerequisites. For example, trading derivatives like options might require specific margin levels beyond those for standard equity investments.

Margin accounts are heavily regulated to protect investors and the financial system from excessive risk. These regulations establish clear rules for margin trading, ensuring that investors fully grasp their obligations and brokers maintain fair practices. The key ones are summarised below:

Regulation T, established by the Federal Reserve Board in the United States, governs the initial margin prerequisites for trading instruments. It mandates that investors deposit at least 50% of the purchase price of equity using a margin trading account. This regulation applies to both the purchase of instruments and short-selling. Brokers may impose stricter prerequisites but cannot exceed the regulatory minimum.

FINRA sets the maintenance deposit pre-requisite at 25% of the total market value of shares in a margin account. This means investors must maintain at least 25% equity to avoid a margin call. Brokers, however, often impose higher maintenance margins, especially for volatile instruments or high-risk trading strategies.

In addition to federal and FINRA rules, brokers may implement house margin prerequisites, which are stricter than regulatory minimums. These policies vary by brokerage and may be based on the investor's risk profile, trading patterns, or the types of instruments held in the account. Investors must carefully review the brokerage agreement to comply with these specific rules.

Brokers are legally required to provide investors with full disclosure of the risks associated with margin trading. This includes information about potential losses, the broker's right to liquidate assets without notice, and the impact of margin calls. Investors must sign a margin agreement acknowledging these risks and confirming their knowledge before opening a margin account.

Brokers have the legal authority to issue margin calls when an account's equity falls below the regular margin pre-requisite. If the investor fails to meet the margin call, the broker can liquidate assets in the account to restore equity levels. Importantly, brokers are not required to notify investors before selling instruments, emphasising the need for diligent account management.

Regulations prohibit brokers and investors from manipulating or fraud using margin accounts. For example, excessive leveraging to artificially inflate market prices or conceal financial instability can result in severe penalties.

Investors who believe they were misled or unfairly treated by their broker regarding margin account practices can seek legal recourse through arbitration or by filing complaints with regulatory bodies like FINRA or the SEC.

Regulations on margin trading vary by country. For example, European markets adhere to stricter leverage limits under ESMA (European Instruments and Markets Authority) rules, while other jurisdictions may have more lenient prerequisites. Investors trading internationally must be aware of the specific regulations in each market.

A margin account is not just a mechanism for borrowing; it’s a financial scheme that blends chance with responsibility. Its ability to enhance purchasing power and offer flexibility makes it a valuable asset for traders prepared to leverage its potential wisely.

Success in margin trading lies in balancing ambition with prudence. By adhering to regulatory prerequisites, employing sound risk management strategies, and staying updated about market events, traders can exploit the full promise of margin accounts.

A trading account that lets shareholders lease funds from their dealers to buy instruments, increasing purchasing power by using assets as collateral.

A cash account uses only deposited funds, while a margin account allows borrowing and offers leverage but with higher penalties.

Your broker can sell your instruments without notice to cover the shortfall, potentially causing significant losses.

Experienced investors and active traders who understand the risks and can manage leveraged investments responsibly.