Top Natural Gas ETFs To Buy In 2024: A Comprehensive Guide

By Anna Churakova

By Anna ChurakovaBeing a person who is always eager to learn something new about the world and is fond of learning foreign languages, I had a lot of experience with text in various fields while working as a technical translator, technical writer for fintech products, and copywriter.

By Tamta Suladze

By Tamta SuladzeTamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

Natural gas serves as a universal energy source, with applications spanning electricity generation, heating, and as a feedstock for chemical production. As an investor, you can gain exposure to this dynamic commodity through top natural gas ETFs. These investment instruments offer a convenient way to participate in the natural gas market without the complexities of trading futures contracts.

Investors interested in natural gas exposure have plenty of ETF options.

UNL and UNG, the primary gas exchange-traded funds in the U.S. market, offer investors distinct exposure to natural gas prices driven by their unique strategies and objectives.

UNL, with an annual expense ratio of 0.90%, provides investors with a less volatile approach to natural gas investing. Its one-year performance of -51.3% reflects the challenges in the natural gas fund. While it doesn't offer an annual dividend yield, it boasts a reasonable three-month average daily volume of 19,366 and has managed assets totalling $16.3 million since its inception on November 18, 2009.

UNL combines near-month and following 11-month natural gas futures contracts traded on the NYMEX, with each month bearing equal weight. Additionally, this fund invests in swap contracts and forwards, making it an ideal choice for those seeking natural gas exposure without the inherent risks of trading futures contracts. UNL offers a less volatile alternative to UNG, providing stability for conservative investors.

UNG, with an annual expense ratio of 1.06%, operates as a commodity pool. It faced more significant challenges in 2023, exhibiting a one-year return of -71.6%. Like UNL, UNG doesn't provide an annual dividend yield, but it enjoys high liquidity, with a substantial three-month average daily volume of 22,057,920. UNG has accumulated substantial assets under management, totalling $1.11 billion, since its launch on April 18, 2007.

UNG is pooling investor contributions to trade commodity futures contracts. This fund aims to replicate the daily percentage change in the price of natural gas delivered at Henry Hub in Louisiana. UNG predominantly invests in front-month futures contracts, making it more suitable for traders with short-term strategies. This ETF can also serve as an inflation hedge.

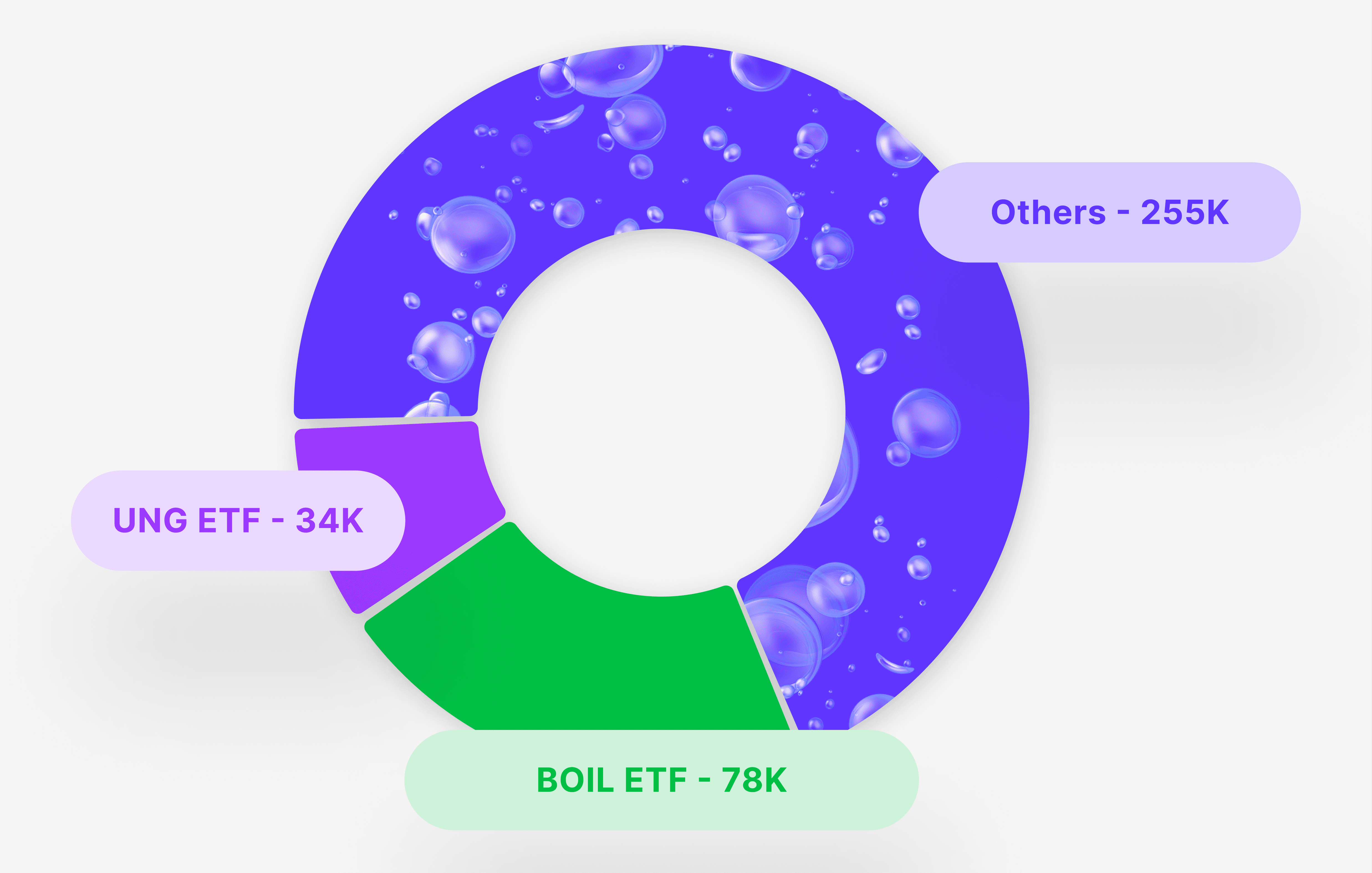

In addition to the primary gas exchange-traded funds like UNL and UNG, the aftermarket offers a range of alternatives tailored to various investment preferences and strategies. These ETFs open up additional opportunities for investors seeking diverse exposure to the natural gas stock market.

One notable option is the ProShares Ultra Bloomberg Natural Gas Exchange Traded Fund (BOIL), designed to provide double the daily performance of the Bloomberg Natural Gas Subindex. BOIL is an attractive choice for investors with a bullish outlook on natural gas, as it offers amplified returns based on daily price movements.

It's essential to remember that leveraged ETFs like BOIL are primarily intended for short-term trading due to the compounding effect of daily returns.

Another option to consider is the VelocityShares 3x Long Natural Gas ETF (UGAZ), which provides leveraged exposure to the S&P GSCI Natural Gas Index. UGAZ aims to achieve three times the daily performance of the index, making it a preferred choice for short-term traders looking to capitalise on daily price fluctuations. It's worth noting that the leverage offered by UGAZ magnifies both potential gains and losses, making it a high-risk, high-reward option in the gas Exchange Traded Fund landscape.

Fast Fact

In 1821, the first intended mission to obtain natural gas in America was a dig in Fredonia, New York, by William Hart. Hart is known as the "father of natural gas" as he pioneered the first American natural gas company known as the Fredonia Gas Light Company.

Investing in natural gas exchange-traded funds is straightforward, accessible through brokerage accounts offering ETF trading. Follow these basic steps to invest in these funds:

Select a Brokerage - Choose a reputable brokerage platform offering access to ETF trading, ensuring it supports the specific gas ETF you desire, such as UNL or UNG.

Open an Account - Sign up for an account with your selected brokerage, complete the necessary forms, and verify your identity.

Fund Your Account - Deposit your desired investment amount through various methods, including bank transfers, wire transfers, or checks.

Place Your Order - Use your brokerage account to place an order for your chosen natural gas ETF, specifying the number of shares you want to purchase and the price at which you're willing to buy.

Monitor Your Investment - Stay vigilant about your investment, track market conditions, and consider setting stop-loss orders for risk management.

Keep up-to-date - Staying informed is critical, as economic and geopolitical factors can significantly impact natural gas prices, ensuring you make well-informed investment decisions in this dynamic market.

Investing in gas exchange-traded funds can be attractive for those seeking exposure to this natural resources market. However, like any investment, evaluating whether gas ETFs align with your financial goals and risk tolerance is essential. Gas exchange-traded funds offer diversification, liquidity, and flexibility, allowing investors to capitalise on the energy sector's potential. However, it's essential to consider the inherent volatility of the gas market and the specific investment goals you aim to achieve.

A well-informed investment strategy, coupled with thorough research and risk management, can make gas exchange-traded funds a valuable addition to your investment portfolio. Before deciding, assess your financial objectives and the role of gas ETFs in your overall investment strategy to determine if they are a good fit for your investment goals.

Approaching top natural gas ETFs can be tailored to various investment strategies. Here are a few to consider:

Selecting the right platform to buy ETFs is a crucial step in your investment journey. Several reputable brokerage firms offer a wide range of exchange-traded funds, giving investors choices to align with their strategies. Some of our top picks for where to buy ETFs include well-established brokerage platforms:

AJ Bell - Offers the most comprehensive range of ETFs across equities, bonds, commodities and property. Providers include Invesco, Vanguard, iShares, BlackRock, Xtrackers, Global X and WisdomTree.

Free trade - Offers a good range of ETFs in equities, bonds and commodities. The Basic plan offers over 260 ETFs from Invesco, Vanguard and iShares.

eToro - Trading Platform - Offers a good range of ETFs in equities, bonds, commodities and property. Providers include Invesco, Vanguard, iShares, Xtrackers, Global X and WisdomTree.

When choosing your platform, consider factors such as access to specific ETFs, trading fees, account types, and research resources. These platforms aim to make investing in ETFs convenient, whether you're a seasoned investor or just starting on your investment path, and they can help you build a diversified portfolio that aligns with your financial goals.

Investing in top natural gas ETFs presents strategic opportunities for portfolio diversification in 2024. While this market faced challenges in 2023, well-informed investors can find prospects. United States 12 Month Natural Gas Fund LP (UNL) and United States Natural Gas Fund LP (UNG) offer unique characteristics, catering to diverse needs. Assess your investment goals, risk tolerance, and time horizon to select the most suitable natural gas ETF.