Risk Management Tools for Successful Trading

Being a person who is always eager to learn something new about the world and is fond of learning foreign languages, I had a lot of experience with text in various fields while working as a technical translator, technical writer for fintech products, and copywriter.

Tamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

Trading in any market and utilising any trading platform brings with it the possibility of risks that could be detrimental. It is essential to assess and handle trading risks, taking into account elements like inflation, natural disasters, and political instability.

Savvy investors employ risk management tools to safeguard their assets and enhance their opportunities for long-term financial gain. Using the proper trading risk management software and following the necessary steps is vital for effectively managing risk in market fluctuations.

This article will explore risk-handling tools and techniques that seasoned traders use to secure their portfolios and multiply gains.

Employing proper risk management techniques helps manage exposure to finance threats.

Trading risks can be active, measured by alpha, and passive, measured by beta.

Successful traders limit their dealing capital to an amount they can afford to lose in case of a trading mistake.

In the volatile finance trading world, a trader's success often depends on their risk-managing approach. By utilising effective risk tools and techniques, traders can ensure a sustainable career and manage exposure to capital threats.

Effective risk management in trading prevents market unpredictability, protects traders from disastrous losses, and instils discipline to cut losses at predetermined points. This systematic approach helps traders maintain confidence and remain solvent amidst unfavourable market movements.

Risk management involves measuring potential losses against profit potential on each new position in financial markets. A disciplined approach to risk and reward is essential to avoid losing positions for too long.

Without a proper plan, traders risk losing their positions and profits due to unexpected market news or having to earn profits for a long time. A risk management plan that includes several tools protects capital and earnings, reducing stress and anxiety. Implementing these tools helps traders achieve their trading goals without the stress of losing everything at any time.

Trading risk management tools are essential for defining exit strategies for both failing and successful trades. Risk exposure management involves estimating the potential impact of various risks on an investment or portfolio.

Trading risk can be evaluated using active and passive risk management methodologies. Active risks are subjective exposures arising from a trading strategy, while passive risks are objective exposures arising from market events.

Active risks represent subjective risk exposure from trading strategies, measured by alpha, which measures asset performance against a benchmark. A positive alpha indicates a higher return percentage, while a negative alpha indicates a lower return.

Passive risks are objective risk exposures arising from market events beyond our control. Beta, a passive risk ratio, measures asset volatility against a benchmark. A beta above 1 indicates higher volatility, indicating the portfolio amplifies market movements. Conversely, a beta below 1 suggests lower volatility, indicating stability and resilience in turbulent market conditions.

Strong risk-management strategies in trading can prevent euphoria and fear, which often lead to poor decision-making. It allows for objective market analysis and a willingness to follow the market flow, knowing you have taken reasonable steps to limit the risk of large losses.

One of the key risk management rules adopted by successful traders is to limit your trading capital to an amount that you can afford to lose if things go wrong. This method improves decision-making and allows to trade without feeling too much pressure.

Besides this method, proficient traders also use such techniques as backtesting, defining maximum drawdown, placing stop-loss orders and daily loss limits. They also employ position sizing, hedging, and portfolio diversification. Let's delve into each of these risk-managing techniques in more detail.

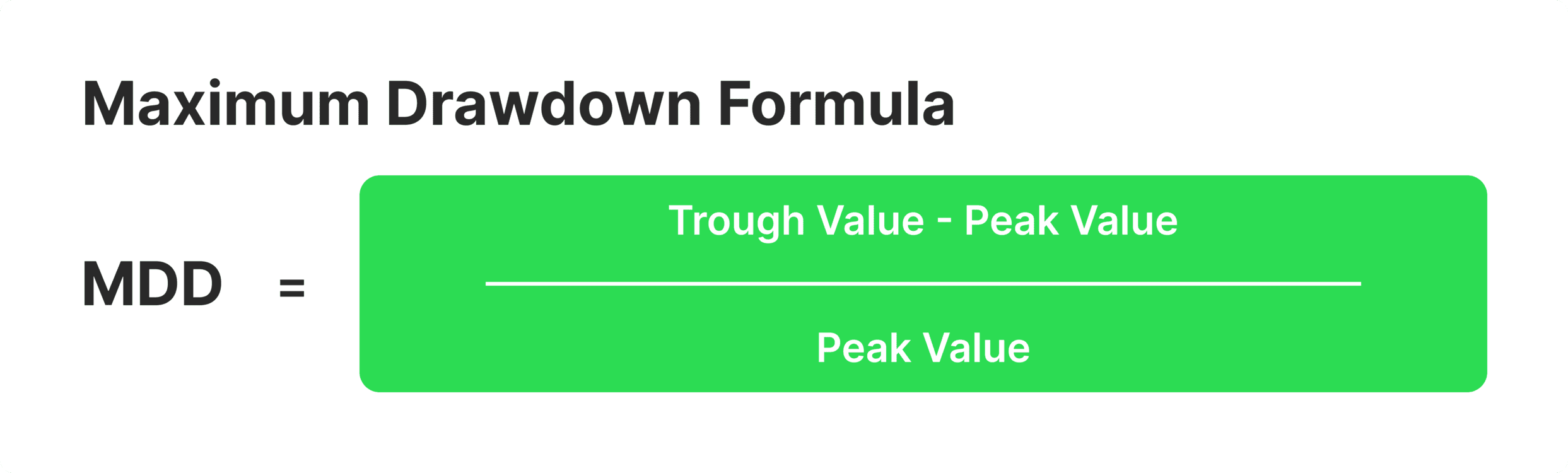

Maximum drawdown (MDD) is a measure of the largest movement from a high point to a low point before a new peak is achieved. It is used to assess the relative riskiness of stock screening procedures based on capital preservation. A low maximum drawdown indicates small losses, while a zero maximum drawdown indicates no losses. The maximum drawdown formula is as follows:

The worst possible maximum drawdown is -100%, meaning the investment is worthless. MDD should be used in the right perspective to derive maximum benefit from an investment's performance. Professional traders base their MDD on their financial situation and willingness to take risks.

All traders have a max drawdown, which is their account size. If you're concerned about losing more than your MDD, set it as the maximum amount of money in your trading account.

Backtesting is a method used by professional traders that helps analyse and evaluate the performance of a trading strategy using historical data.

It lets traders assess the effectiveness of their strategies without risking real money. By analysing the strategy's performance over time, traders can gain insights into its performance under different market conditions and make necessary adjustments.

Backtesting benefits traders by identifying potential flaws in their strategies, such as underperforming techniques, which may indicate a need for refinement. It also helps optimise trading techniques by spotting the most effective parameters, such as testing different values for indicators to see which ones yield the best results.

A stop-loss order (SLO) is a crucial tool in risk handling, helping traders and investors protect their capital by setting predefined exit points. They automatically close an open trading position if unexpected volatility occurs and the underlying asset's price reaches a set value, helping protect trade against emotional decisions during market fluctuations. SLOs are often combined with Take-profit orders. Take-profit orders execute when an asset reaches a profit goal, securing earnings before market reversal.

Using SLOs as part of risk handling helps control risk, reduces the chance of large unexpected losses, and helps assess risk and reward. It allows users to measure the profit or loss achieved on each trade against the original potential loss, making it easier to decide not to enter certain trades if the profit potential is too small compared to the initial risk.

However, setting the SLO too often can lead to excessive trading commissions and missed opportunities. To set the right stop-loss level, start with a percentage based on your risk tolerance, consider volatility-based orders, and combine stop-loss orders with other risk management techniques like position sizing and diversification. It's essential to backtest different stop-loss levels using historical data to see how they would perform in different market conditions.

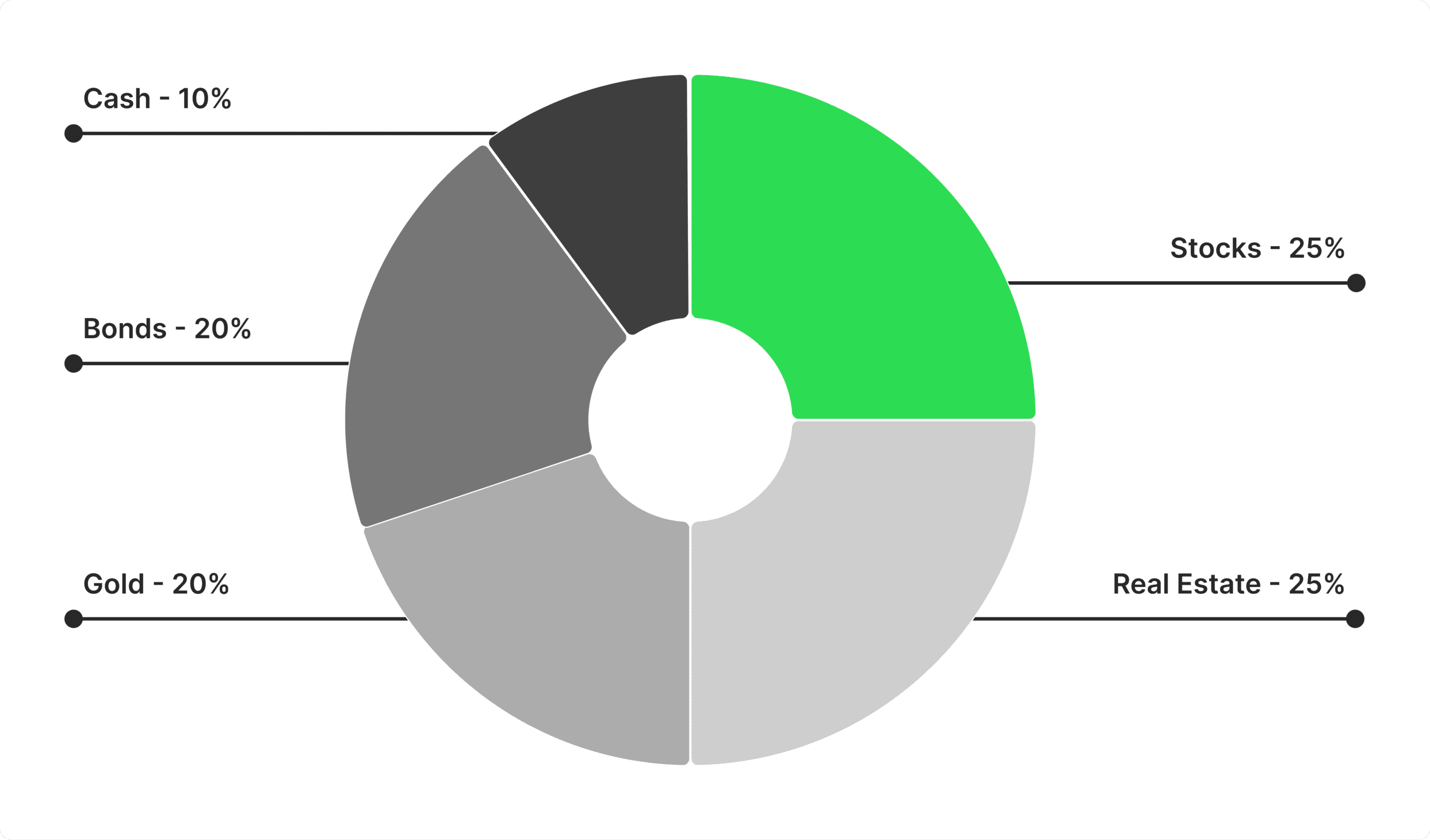

This is a strategy used by experienced traders and investors to minimise the impact of adverse events on a specific investment or sector. It involves distributing their investments across various asset classes or markets to minimise exposure to a single security.

Portfolio diversification involves choosing less-correlated assets that move simultaneously and correlate highly with the same factors. Positive or negative correlations can affect the price movement of assets. Positively correlated assets, like USD/JPY and USD/CHF, increase when markets move in our favour, leading to substantial profits but high-risk exposure.

Negatively correlated assets, like USD/JPY and EUR/USD, move in opposite directions, resulting in minimal profits and negated by trading fees. No or low correlation assets, like USD/JPY, have no price relation, causing significant risk and a single factor creating a major risk for the portfolio.

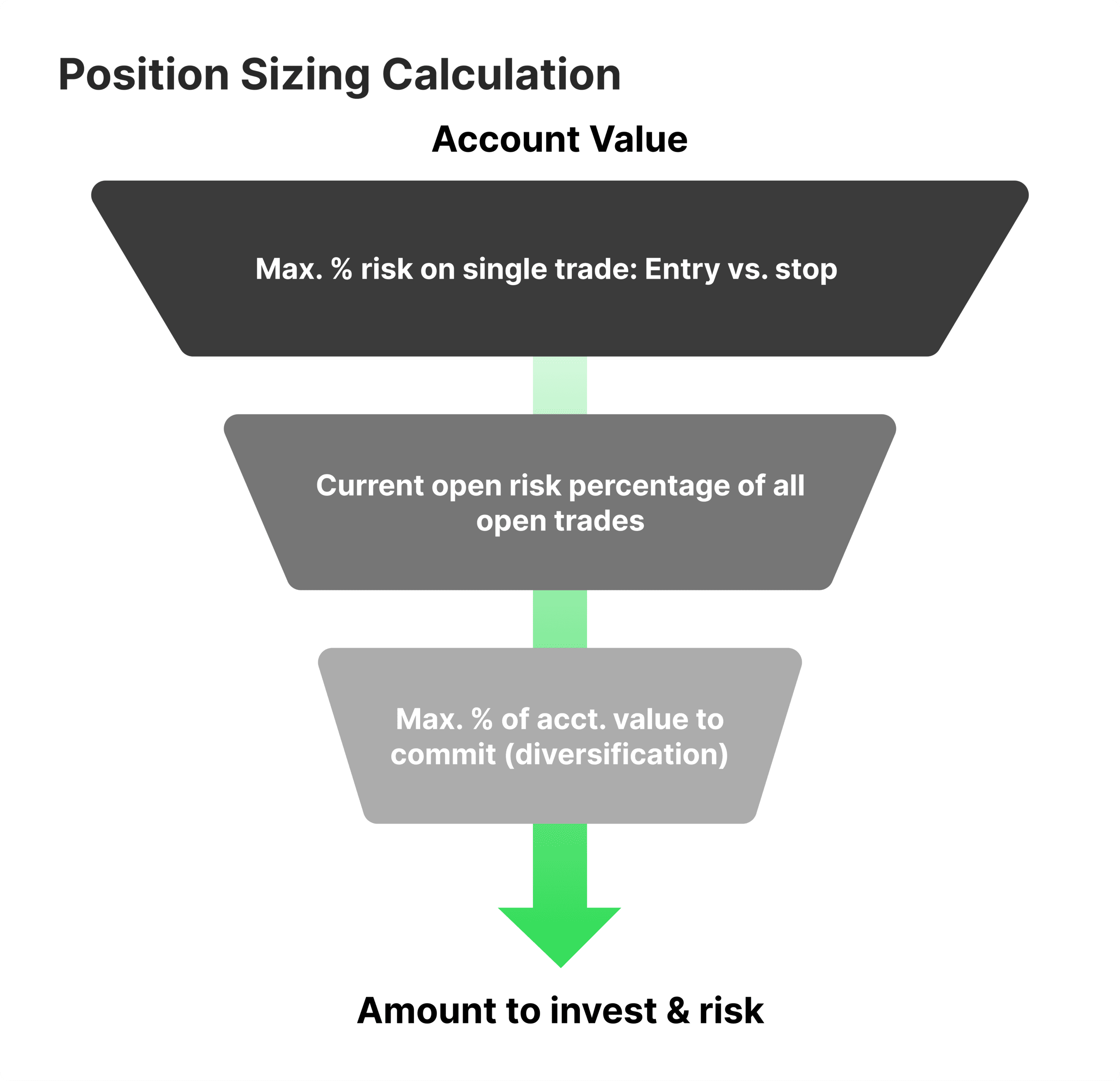

Position sizing is a fundamental strategy that limits the impact of a single trade or investment on the overall portfolio, controlling risk by defining the amount of capital at risk in any given position. It's the opposite of going "all in," allowing each trade to limit exposure to a certain percentage of total capital.

In other words, position sizing limits trader positions to 1-2% of their account to prevent significant impact from single trades. For example, setting the maximum exposure of one trade to 2% would limit exposure to 100x2%, allowing for 50 trades before losing all money.

Fixed percentage position sizing is a trading strategy where the position size is calculated on each new trade, ensuring the initial stop-loss level equals a fixed percentage of the funds in the account. This method is crucial for maintaining a trading edge and avoiding erratic position sizing.

It allows for the gradual increase in position size as trading capital grows, ensuring steady growth while maintaining the same percentage risk levels.

The Daily Loss Limit (DLL) is a crucial risk management tool for traders to control conceivable losses and protect their trading capital. It determines how much a trader can afford to lose in a single day. DLL is based on the trader's trading history and is best determined by setting it at their average good winning day. DLLs are determined based on risk toleration, trading strategy, and account size.

To calculate the DLL, look for the midpoint between your average winning day and your best winning day. By setting yourself back less than a typical good day, the pressure will be lessened, reducing the likelihood of making mistakes.

Setting a DLL is essential for day traders in futures trading, as it helps mitigate inherent risks, such as excessive losses that could negatively affect profitability. It also encourages traders to assess and optimise the risk-to-reward ratio of their trades more carefully, considering potential losses relative to potential gains before entering into a trade.

A well-defined DLL helps bring consistency to the markets each day, limiting daily losses and preserving capital over the long run.

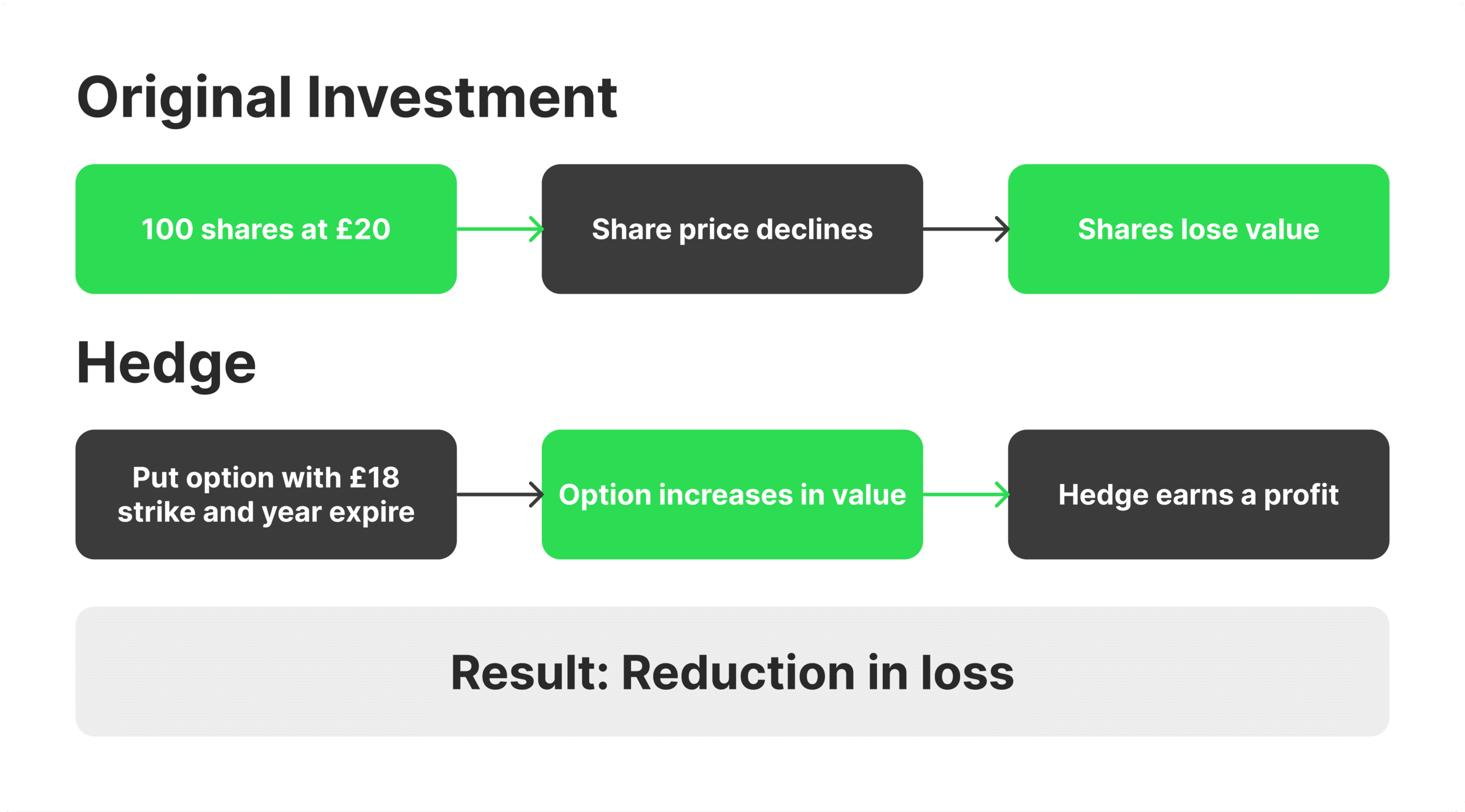

Hedging is a risk reduction strategy where traders take an offsetting position in a related security to offset potential losses. This strategy is commonly employed by traders in unsteady markets to protect their portfolios and mitigate potential losses. Hedging can be done using derivatives, insurance, futures contracts, swaps, options, and over-the-counter products.

For example, if company ABC produces cornflakes, it must ensure the price does not rise invariably during procurement. To do this, the company enters into offsetting long contracts in the corn futures market at $400/bushel.

If the spot price is $425/bushel, the company has successfully hedged this price variability by entering into a long futures contract. If the spot price is less than $400, the company still buys corn at $400/bushel, achieving a price lock of $400/bushel.

Common hedging strategies include long/short equity, pair trading, options collar, risk reversal, currency hedging, and diversification. Long/short equity involves holding long positions in stocks that are expected to increase in value and short positions in stocks that are expected to decrease in value.

Pair trading means taking long and short positions in highly correlated securities to profit from price fluxes and reduce market risk. Options collar protects against asset decline and generates income, while risk reversal maximises value increase while limiting the downside. Currency hedging protects against rate fluxes, and diversification involves investing in a range of assets to reduce overall risk.

Effective risk administration is vital in trading, ensuring secure trades and minimising losses. Knowledge of basic risk management instruments helps identify and evaluate risks, maximising gains.

Risk management tools help traders make calculated decisions against uncertainty, reducing the risk of unexpected losses. Mastery of trading threat estimation and control ensures each move on the finance battlefield is measured, leaving less chance for random actions.

It also helps maintain emotional stability, which is essential for thriving trading in volatile markets. Integrating robust enterprise risk management tools into trading processes is essential for consistent growth and minimising market event impact.

The One-Percent rule limits risk on single trades to 1% of total capital, ensuring a trader with a $10,000 account balance can only risk $100.

Trading risk-handling tools like SLOs, risk management software, protective puts, and broker-provided analytical platforms help traders limit probable losses and protect their investment capital.

The daily trading day's maximum DLL is determined by subtracting 4% from the starting balance based on the account balance at the daily candle close.

Risk exposure assesses the level of risk an investor has assumed in a specific investment, demonstrating the potential for loss.

Share your queries in the form for personalized assistance.