How to Avoid Margin Call in Trading

By Otar Topuria

By Otar TopuriaOtar is a seasoned content writer with over five years of experience in the finance and technology niche. The best advice he received was to read, which has led him to an academic background in journalism and, ultimately, to content writing. He believes everything can be brought to life through words, from the simplest idea to the most complex innovation.

By Tamta Suladze

By Tamta SuladzeTamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

There are so many options when it comes to trading, and some investors who want to maximise their returns choose margin trading. But let’s not forget that risks are also associated with it. For the past seven years, the number of crypto traders has increased from 30 million to 830 million, and the trend continues to rise.

A margin call is initiated when an investor's margin accounts equity drops below the brokerage’s minimum requirement. Any margin account investor must know how to avoid a margin call. In this article, we will try to explain the methods of preventing margin calls.

When the equity drops below, you will receive a margin call.

Your plan should choose leverage carefully, as a high number raises the possibility of a margin call.

To prevent margin calls, spread your investments and have extra funds in your account.

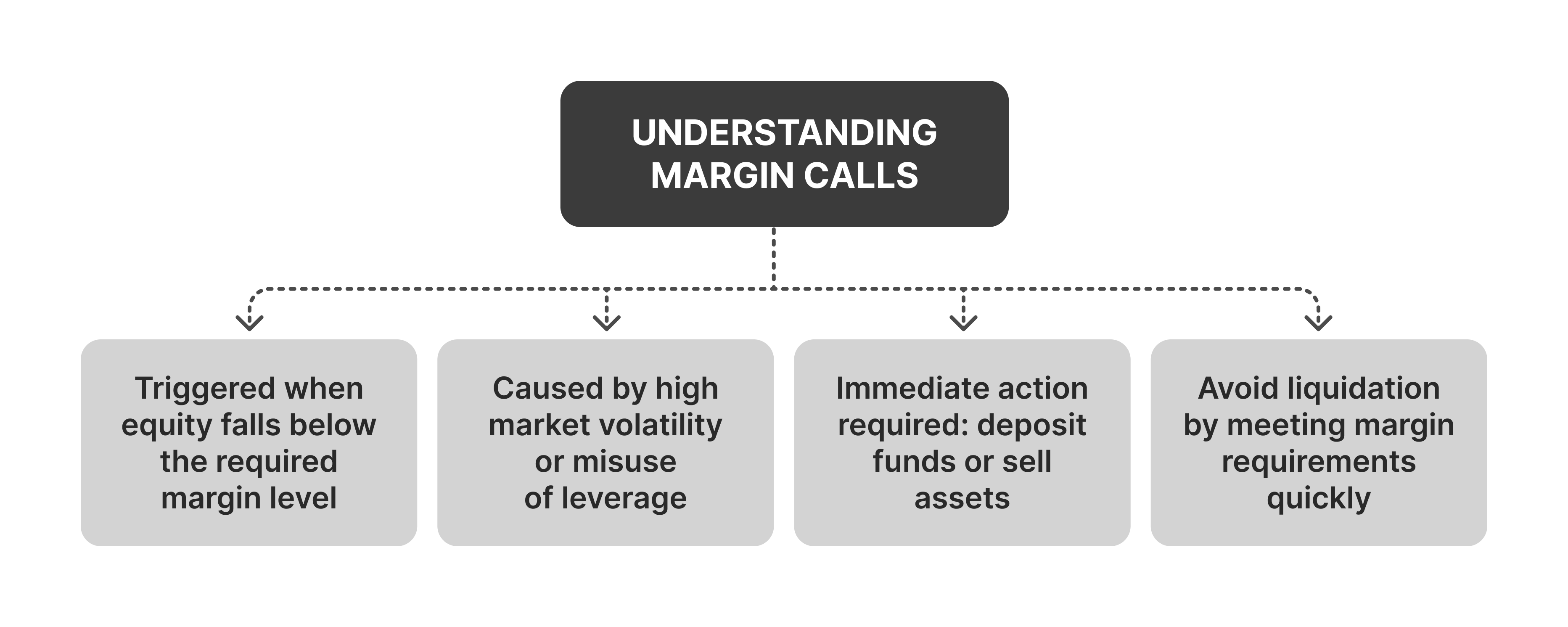

A brokerage firm will notify traders of a margin call if the equity in their account falls below the minimum required for margin maintenance. This indicates that the trader's margin or current account value is less than the minimum level the brokerage needs to support the margin loan utilised to buy stocks or crypto. To prevent the account's assets from being forcibly sold, the broker's demand for more money or marginable securities must be satisfied immediately.

Various factors may trigger a margin call. One of the leading causes is high market volatility since abrupt price declines can result in a sharp decline in the account's value. Margin shortage can also result from improper trading tactics that use excessive leverage or fail to consider market changes. When leverage is misused—when an investor takes on more debt than they can afford—the account's equity frequently drops too low, leading to a margin call.

To further clarify the concept, imagine you have $1,000 in your cryptocurrency exchange account and choose to purchase a coin with a 5x leverage. This implies that you have control over $5,000 in this coin. Your initial investment will yield a 50% profit if the coin’s price grows by 10%. On the other hand, your account equity will be lost entirely if the price declines by 20%.

A margin call is necessary in this situation. Your position's worth will drop dramatically if the coin's price declines significantly. The exchange will issue a margin call, requiring you to sell your position or deposit additional funds to your account to protect itself against losses.

For example, your position value will drop to $4,250 if the coin's price lowers by 15%. Your $1,000 initial investment is now worth only $250 due to a 5x leverage. A margin call will occur if your account is undermargined and the exchange's maintenance margin requirement is 30%. At that point, you have to decide whether to risk having your position liquidated or deposit more money to satisfy the margin requirement.

A margin call can occur quickly due to abrupt changes in the market, particularly in times of high market volatility. The market value of a trader's margin account is impacted when there are sudden swings in purchase securities in volatile markets. For instance, if a trader borrows $50,000 to buy $100,000 worth of assets, their initial balance in a margin account would be $50,000.

If the market value of those securities drops by 10%, the total market value will be reduced to $90,000. When the trader's account does not meet the 25% margin maintenance requirement, it triggers a margin call. The trader might have to sell crypto or make extra cash deposits to bring the account up to the needed margin level to meet this margin call.

Leverage increases potential wins and losses for traders by enabling them to manage a more prominent position with a smaller quantity of their own money. However, mishandling leverage dramatically increases the likelihood of a margin call.

For example, in margin trading, even a tiny 5% decline in the market value reduces the account's equity to $40,000. This is because if a trader loans $150,000 to buy $200,000 in assets with an initial balance of $50,000. A 25% margin maintenance requirement would mean the trader must keep a minimum of $50,000 in equity. Due to the $10,000 shortage, there would be a margin deficiency, and the trader would be forced by the broker's demand to sell assets from the account or make new deposits.

Traders with little expertise frequently make rapid decisions that result in margin calls. For instance, a trader may make hasty choices that are out of line with their risk tolerance if they respond to market rumours without conducting adequate research. If a trader buys erratic crypto without realising the risks, the account's market value may drop quickly.

Let's say a trader borrows $100,000 to purchase high-risk currency, which loses 15% of their value within a week. At $85,000, the account value would decline and might no longer meet the requirements for margin maintenance. The brokerage may sell securities without warning and cause the trader to suffer significant financial losses if they cannot meet the margin call formula or make further cash deposits.

Fast Fact

The fatal consequences of margin calls at times of market instability are evident in the Wall Street Crash of 1929. Many investors who had purchased shares on margin were forced to sell at a loss when stock prices fell, and they were faced with imminent margin calls. This tremendous sell-off not only made the crisis worse but it also instantly wiped out wealth.

After understanding the concept of margin calls and the factors that may trigger them, it is time to discuss several methods to avoid them.

Make sure you always have more money available to cover margin requirements. This keeps your assets from being forcibly liquidated. You can manage market swings and prevent margin calls by maintaining a cash reserve in your margin account.

For example, keeping a cash reserve of $3,000 can protect you against market swings if you borrow $10,000 to buy crypto. In the event of a margin call, you can utilise this additional money to deposit funds into your margin account, avoiding the forced liquidation of your assets.

Distribute your money among several asset classes. Extreme market volatility has less of an effect on your portfolio when you have diversification. This approach can shield you from significant losses that could result in a margin call and assist in reducing risk.

By distributing your investments among several asset types, you can reduce risk. Consider distributing your investments equally among bonds, equities, and cryptocurrency. A decline in one asset class has less of an overall effect on your portfolio. By keeping the value of your margin account over the required minimum, this diversification technique might lessen the chance of a margin call.

Pay particular attention to the margin balance on your trading account. Check your account frequently to see the margin status and make any necessary corrections. By taking a proactive stance, you may react fast to any modifications in the margin needs.

Choose an amount of leverage suitable for your investment's size and risk tolerance. High leverage should be used cautiously as it can magnify gains and losses. Leverage has to be adjusted to fit your investing plan and financial circumstances.

Leverage can increase profits, but it can also increase losses. A margin call is more likely when excessive leverage is being used. For example, taking out a $10,000 loan to invest $50,000 in a single currency puts you in danger of losing money if the price declines. When choosing a level of leverage, evaluating your risk tolerance and the possible effects of market volatility is critical.

To control your risk, use limit orders and stop loss orders. To reduce possible losses, stop loss orders and automatically sell your position when it hits a specific price. Limit orders help you avoid taking on excessive losses that can result in a margin call by setting a preset price to purchase or sell.

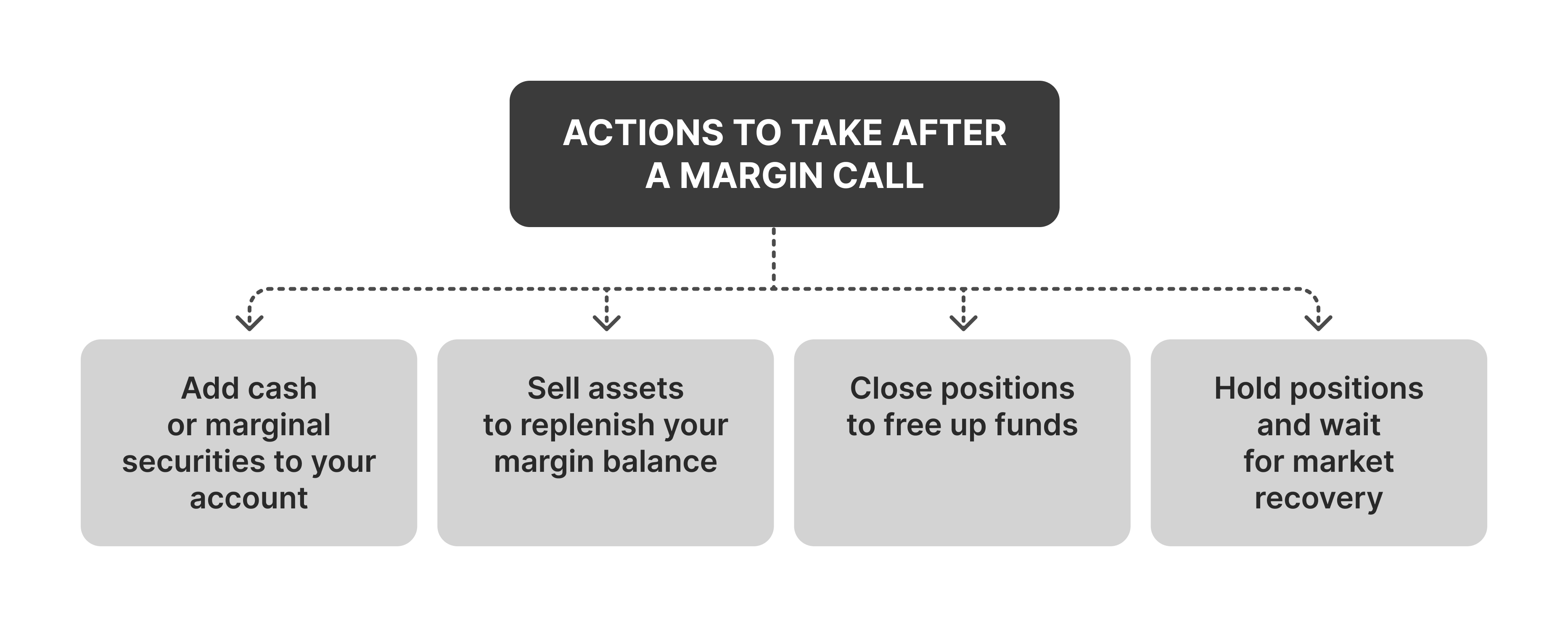

As we mentioned, you must promptly add more money to your margin account if you get a margin call. This keeps your assets from being forcibly liquidated and raises your account balance to fulfil the necessary margin requirements. The extra money may come in the form of marginal securities or cash.

Closing some positions or selling some of your current assets are other options. Cash generated by this activity can be utilised to replenish the margin balance. Select investments or positions that generate enough cash flow without affecting your portfolio's diversification or investment plan.

You could wait for the market to rebound if you can't afford to sell assets or make more deposits; using this strategy, you keep onto your positions until the value of the present market improves. However, this approach is not without risk, as the market may remain unfavourable for a long time.

As we’ve discussed, understanding margin calls and using methods to prevent them is essential. If not promptly handled, they may lead to losing money. Being proactive and knowledgeable will help you protect your investment portfolio and efficiently meet margin obligations, whether trading crypto or handling margin loans.