Forex Brokerage Fees Every Trader Should Be Aware of

Alexander Shishkanov has several years of experience in the crypto and fintech industry and is passionate about exploring blockchain technology. Alexander writes on topics such as cryptocurrency, fintech solutions, trading strategies, blockchain development and more. His mission is to educate individuals about how this new technology can be used to create secure, efficient and transparent financial systems.

Tamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

When it comes to trading in the foreign exchange market, numerous factors can affect your overall profitability. One of these aspects is the fees charged by Forex brokers. These fees can vary in type and amount and, if not managed properly, can significantly impact a trader's bottom line.

In this article, we will explore the various brokerage fees that every Forex trader should know, empowering you with the knowledge to optimise your trading strategies.

Forex fees mainly include transactional and account-related charges.

Traders may also encounter non-trading charges for subscriptions and data feeds.

Minimising brokerage fees can be achieved through diligent research, broker comparison, and the effective use of trading tools.

The most obvious Forex fees that traders encounter are transactional fees, which are directly related to the execution of trades. These fees can include spreads, commissions, and rollover charges.

A spread is the difference between the bid and ask price for a currency pair. Brokers typically make money by widening this spread slightly in their favour, which means that traders pay a slightly higher price when buying and receive a slightly lower price when selling. Spreads differ between brokers and the currency pair being traded, so traders need to compare spreads across different brokers.

Commissions are another common Forex fee, and they are typically charged as a flat fee per lot traded. This fee is usually non-negotiable and can vary depending on the broker. Traders should be aware of the Forex commission fees charged by their broker, as these fees can add up quickly.

Swaps, also known as rollovers, are charges that are applied when a trader keeps a position open overnight. Forex swap fee is based on the interest rate and is implemented to balance the rate differences between the two currencies in a pair and can be either positive or negative depending on which currency has the higher interest rate. Swaps can significantly impact a trader's profits or losses, so it is important to consider them when holding positions for longer periods of time.

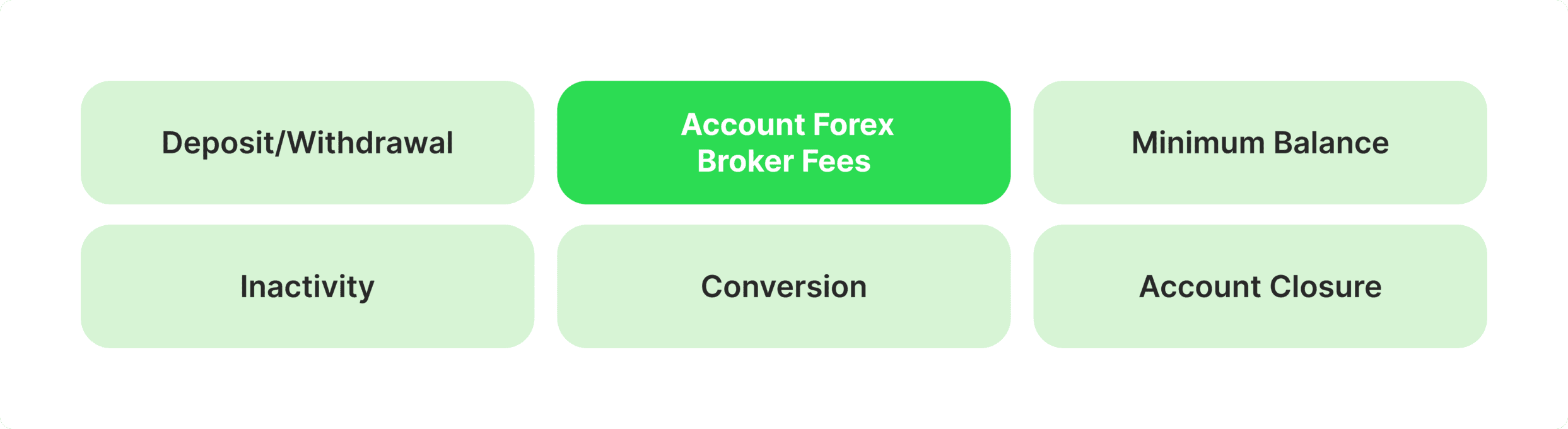

Many brokers charge various account fees in addition to transactional fees to cover the costs of maintaining a trading account. These fees include deposit and withdrawal charges, inactivity, and currency conversion charges.

Deposit and withdrawal fees are charges that traders may encounter when adding or withdrawing funds from their trading accounts. Depending on the broker and the payment method, these fees can vary in amount and type. For example, some brokers may charge a flat deposit and withdrawal fee, while others may have a percentage-based fee. Moreover, different payment methods, such as bank transfers or credit card transactions, may also incur Forex broker withdrawal fees.

Some brokers also charge inactivity fees for retail investor accounts that have been inactive for a certain period of time. This fee is usually applied monthly and can range from a few dollars to hundreds of dollars per month. Traders should carefully read the terms and conditions of their chosen broker to understand their inactivity fee policy.

For traders who trade in currencies other than their account's base currency, conversion fees may be charged when converting profits or losses back to that currency. How are these Forex trading fees calculated? These Forex trading costs can differ based on the instruments used.

Minimum balance fees are charges that some brokers apply when a trader's account falls below a certain amount. These fees are meant to encourage traders to maintain a minimum balance in their accounts and can also serve as a source of revenue for the broker.

In addition to the fees mentioned above, many brokers charge a fee when clients close their trading accounts. The broker may justify this fee as necessary for administrative work involved in securely and compliantly closing an account, including verifying transactions and transferring holdings to another institution or back to the client.

Fast Fact

Trusted brokers offer comprehensive contract details on their websites, while proprietary trading platforms display thorough information within each trade ticket.

In addition to transactional and account fees, Forex traders may also encounter non-trading fees that are not directly related to executing trades. These can include platform fees, data feed charges, and software subscriptions.

Data feed charges are fees that brokers may charge for providing real-time financial market data and price quotes to traders. Some brokers offer free data feeds, but these may not always be the most reliable or comprehensive.

Some brokers also charge platform fees for using their trading software. These fees depend on the features offered by the trading platform and can be a fixed monthly fee or based on trading volume.

In addition to platform fees, traders may also encounter software subscription fees for advanced trading tools or plugins. These can include automated trading programs, technical analysis tools, or other proprietary software offered by a broker.

With the Forex market now more accessible online, managing brokerage fees has become essential. Novice and seasoned traders need strategies to reduce these costs and enhance their trading success. Here are some important methods to consider:

First, research the market to find a broker whose fee structure matches your trading preferences and goals. Then, conduct a brokerage fees comparison: compare spreads, commissions, and other fees across different brokers to ensure you are getting the best deal. Consider the overall reputation of the low-fee Forex broker as well, as low charges may not always equate to high-quality service.

While some brokers advertise zero fees, they often make money through other methods like wider spreads. Thus, scrutinise these no-fee Forex broker houses' fee structures to verify if the total costs are genuinely lower than those of conventional brokers.

Stop and limit orders are great tools for traders to manage their brokerage charges. These orders usually come with Forex trading fees vs. market orders and can be used to minimise slippage costs by controlling the price at which your order is executed. Using them is especially helpful during volatile market conditions where slippage can be significant.

The success in trading relies on many factors, including one's trading style, risk management practices, and market analysis. While brokerage fees are a crucial consideration, they should not be the sole focus. A trader's skill and strategy ultimately have a more significant impact on their profitability in the long run.

Share your queries in the form for personalized assistance.