What Is AML Risk Assessment and How Does It Work?

By Constantine Belov

By Constantine BelovAs a hard-working, goal-oriented, and well-rounded person, I always strive to do quality work for every job I do. Faced with challenging tasks in life, I have developed the habit of thinking rationally and creatively to solve problems, which not only helps me develop as a person, but also as a professional.

Speaking about my professional activities, I can say that I have always been attracted to the study of foreign languages, which later led me to the study of translation and linguistics. Having great experience as a translator in Russian, English and Spanish, as well as good knowledge in marketing and economy, I successfully mastered the art of copywriting, which became a solid foundation for writing articles in the spheres of Fintech, Financial markets and crypto.

By Tamta Suladze

By Tamta SuladzeTamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

Today, the financial sector, and in particular electronic trading, has become a subject of high interest for both individual traders and prominent institutional players operating with large sums of money and setting the movement of any capital market.

On the other hand, historically, any place where large sums of money are circulated becomes an object of criminal activity, one of the most vivid examples of which is money laundering. To combat this, many tactics and solutions have been developed and implemented to reduce the risk of suspicious transactions with assets. One such tactic is a comprehensive AML Risk Assessment.

This article will explain what an AML Risk Assessment is, what steps it involves, and the benefits of practical application. Ultimately, you will learn about the obstacles companies face when conducting an AML Risk Assessment.

AML risk assessment is a set of measures, the task of which is a comprehensive and detailed analysis of potential risks associated with money laundering within a particular financial institution.

AML risk assessment provides a layered approach to assessing and reviewing all aspects of any organisation for suspicious activity regarding finances.

AML risk assessment includes a number of subsequent stages of risk analysis, the most important of which is risk identification.

An AML risk assessment is a structured series of procedures intended to detect and evaluate potential hazards related to money laundering and sponsorship of terrorism within the context of its operations. It is imperative to comprehend the nature and extent of risk linked to diverse customer types, commodities, services, and transactions. The role of Anti Money Laundering (AML) Risk Assessment in the complex world of financial operations is that of a sentinel, protecting institutions from unintentionally serving as hubs for financial crimes. Although crucial, the procedure is complicated and requires careful comprehension and deliberate application in order to reduce risks and guarantee regulatory compliance successfully.

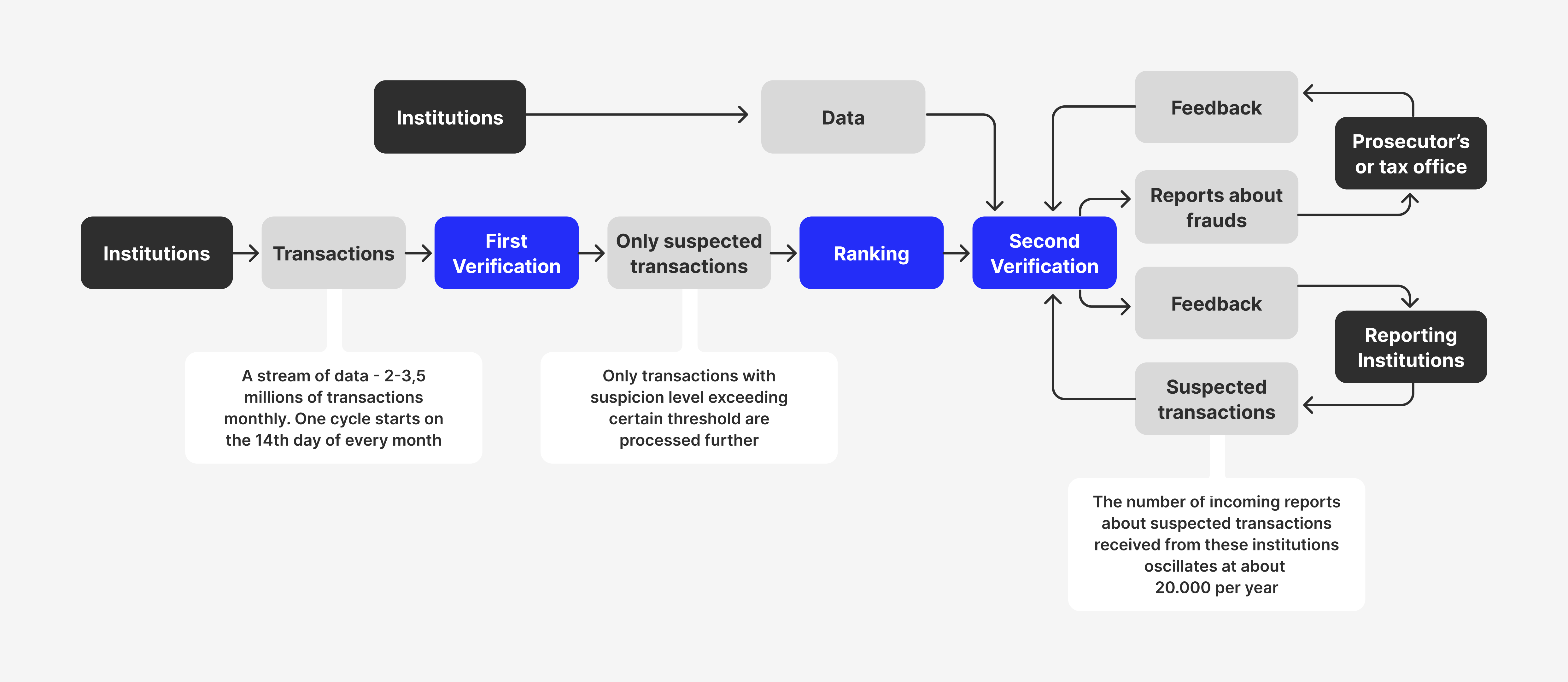

By assessing AML risk, traders can identify unusual or suspicious behaviour and transactions quickly. To identify unusual or suspicious transactions, it is necessary to monitor trading activity in real time. Transactions with counterparties in high-risk jurisdictions, frequent portfolio changes, and rapid and large transactions are all red flags that require further assessment. Detecting money laundering at this point is crucial for preventing it and ensuring that the trading ecosystem is protected.

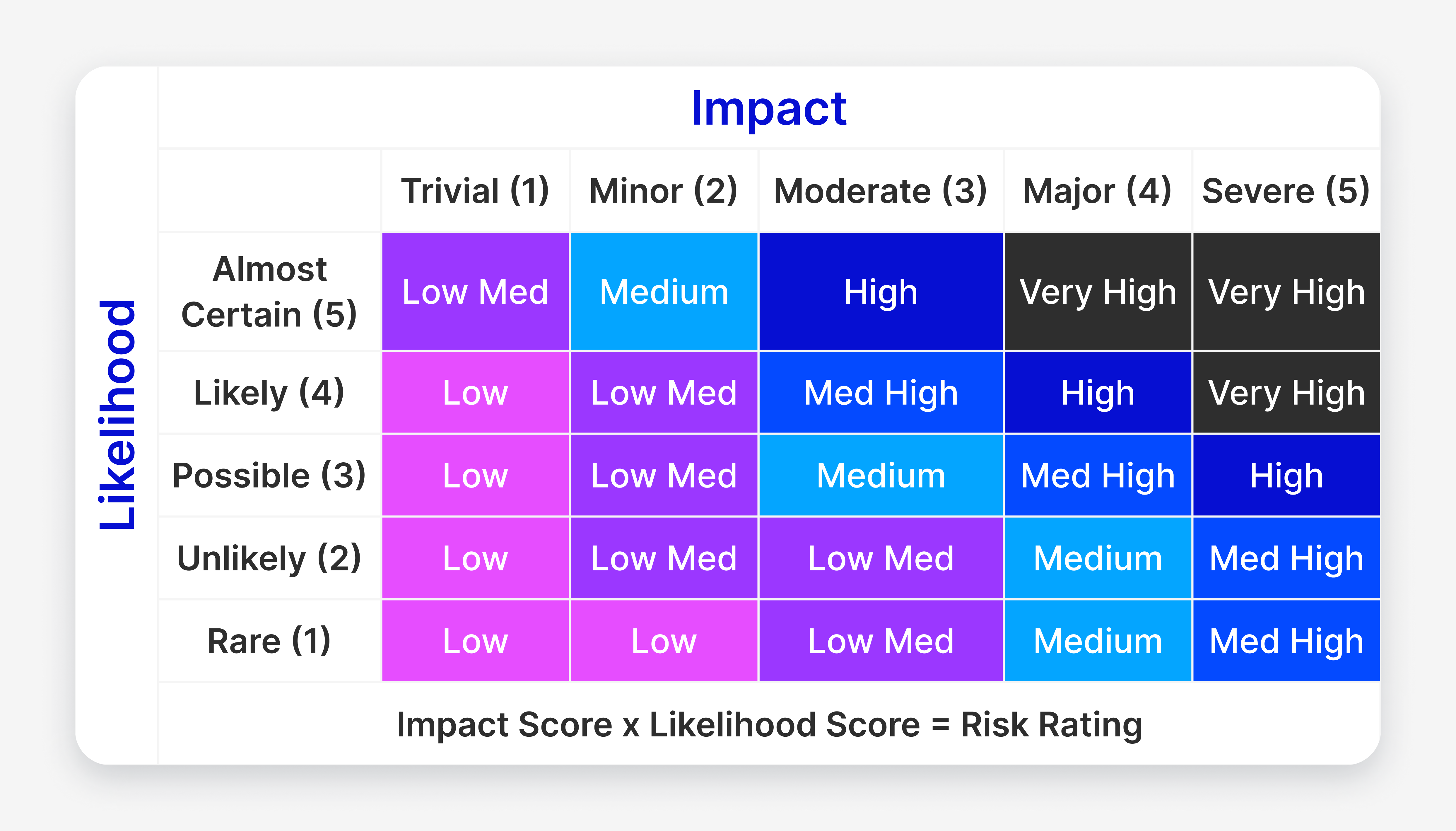

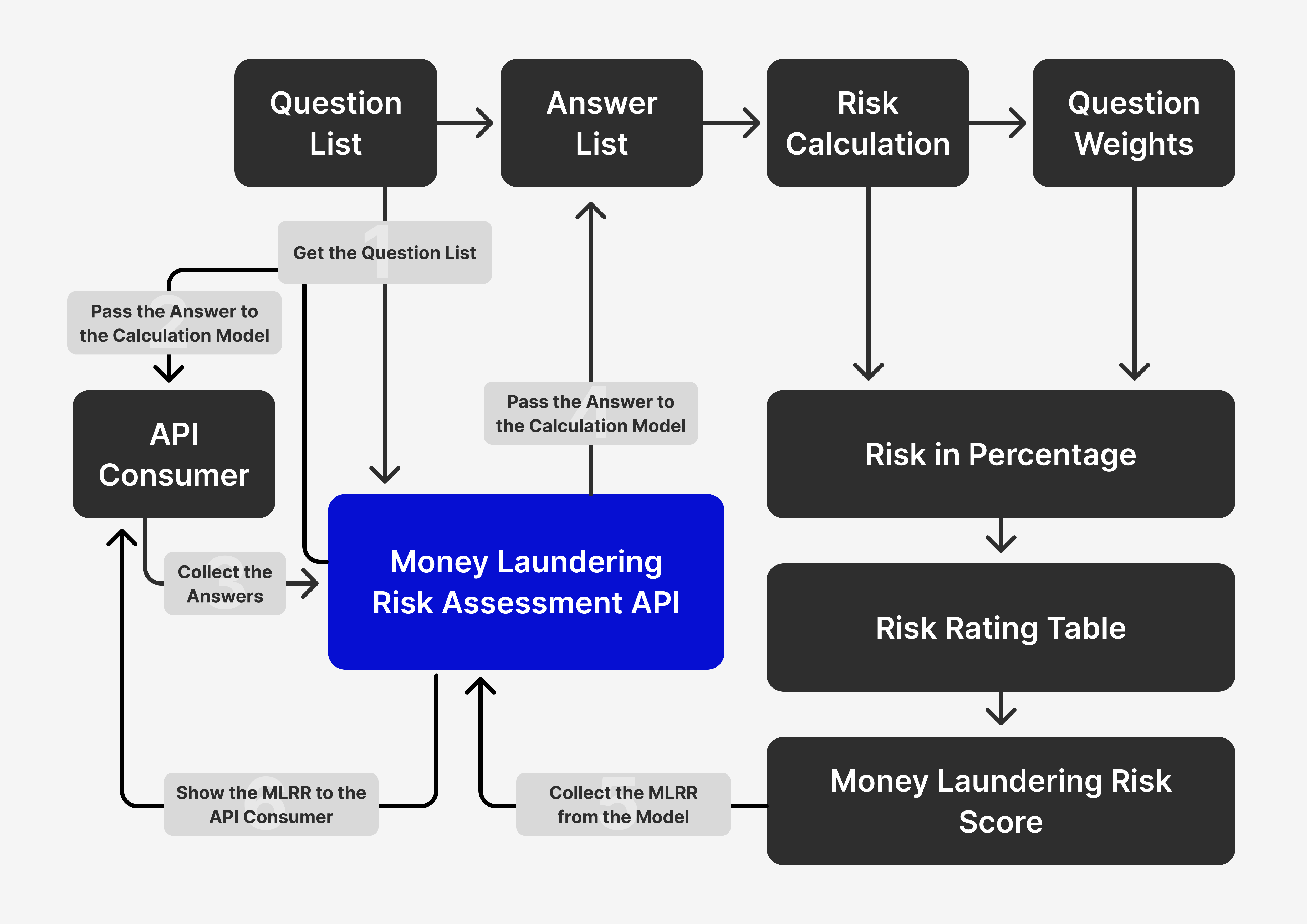

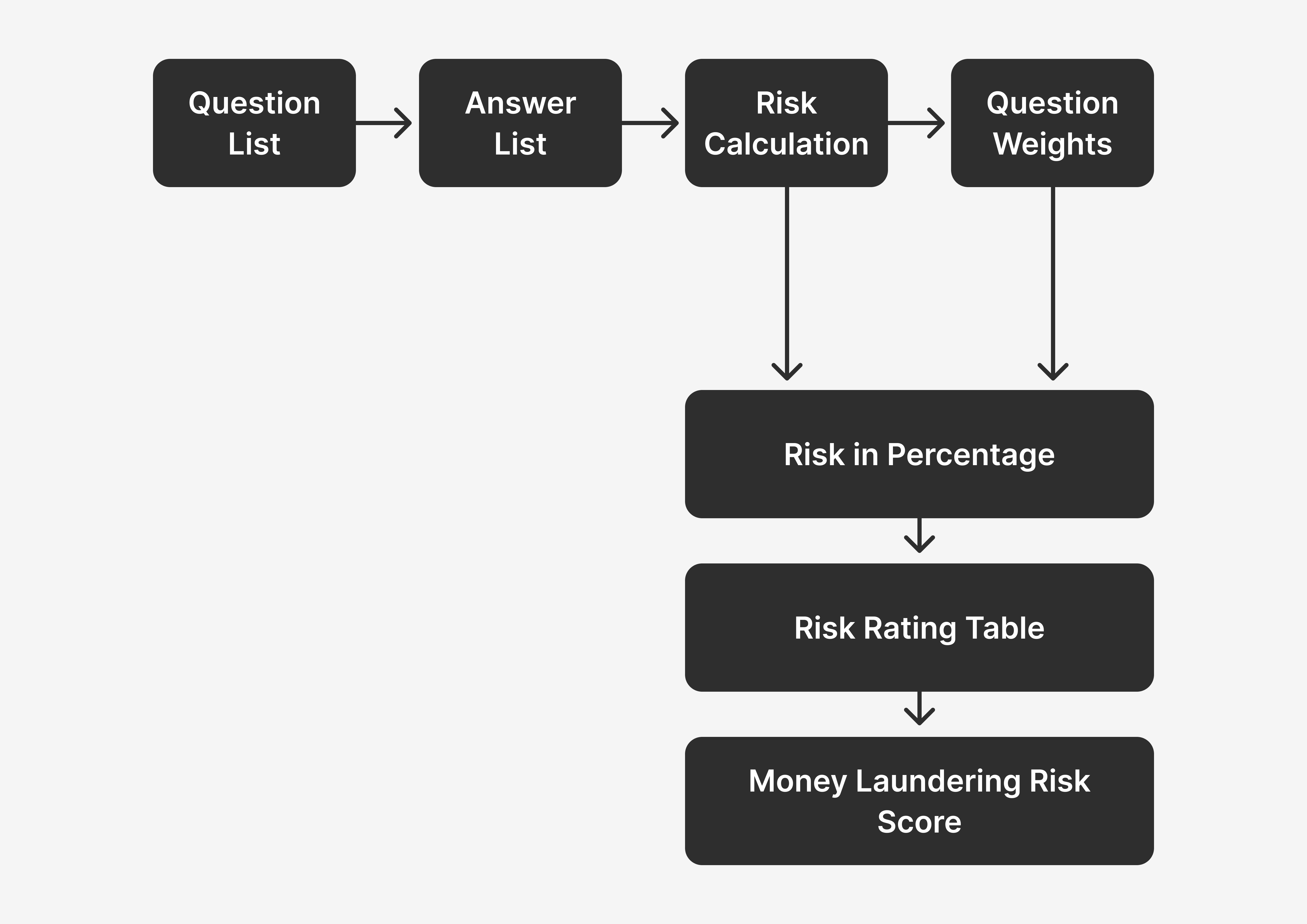

A risk model is an integral part of the customer AML risk assessment, and it calculates a risk score, which can be expressed as high, medium, or low, depending on the severity of the risk and based on AML screening. By using this score or rating, the AML Officer and the business line will be able to gain a clear understanding of the risks associated with the customer relationship and its activities.

Fast Fact

AML risk assessment is an important part of the KYB procedure, which involves checking companies for the legality of doing business.

AML risk assessment process, in its essence, is a universal and multifunctional solution for detecting signs of suspicious financial activity, its ranking by the degree of suspicious activity, identification, data structuring and comparative analysis with statistical historical data of detected fraud cases with pronounced associated risk factors, among which we can highlight terrorist financing as one of the main types of financial crime from which financial institutions suffer.

Below are a number of advantages that AML risk assessment has, whether it is integrated into a financial security platform solution or conducted independently within a financial organisation. Some of these benefits include:

The practical application of AML risk assessment within the framework of determining money laundering risks is a solid foundation on the basis of which it becomes possible to determine the patterns and principles of development of unfavourable situations resulting in financial crimes related to money laundering of various sizes.

Taking into account the peculiarities of this procedure within different financial companies and institutions, it is possible to develop and implement regulatory documents defining cybersecurity standards, in other words, to standardise and unify AML risk management processes in order to increase the efficiency of detection of suspicious cases of handling financial funds and assets.

Thanks to the multi-level AML assessment procedure, companies using it in practice have the opportunity to conduct a comprehensive analysis of all transactions conducted within the framework of trading in financial assets on a particular individual trading account. Moreover, thanks to the AML procedure, it becomes possible to monitor and systematise data obtained on the basis of different financial metrics within a particular transaction for the exchange of fiat or other currencies, which allows you to track suspicious activity.

This advantage of AML risk assessments is the ability to analyse data obtained from systems based on KYC and KYB solutions, which in turn are the fundamental tools for working with the processes of identification of individuals and verification of data provided by them for the purpose of work (transaction execution) on the financial markets.

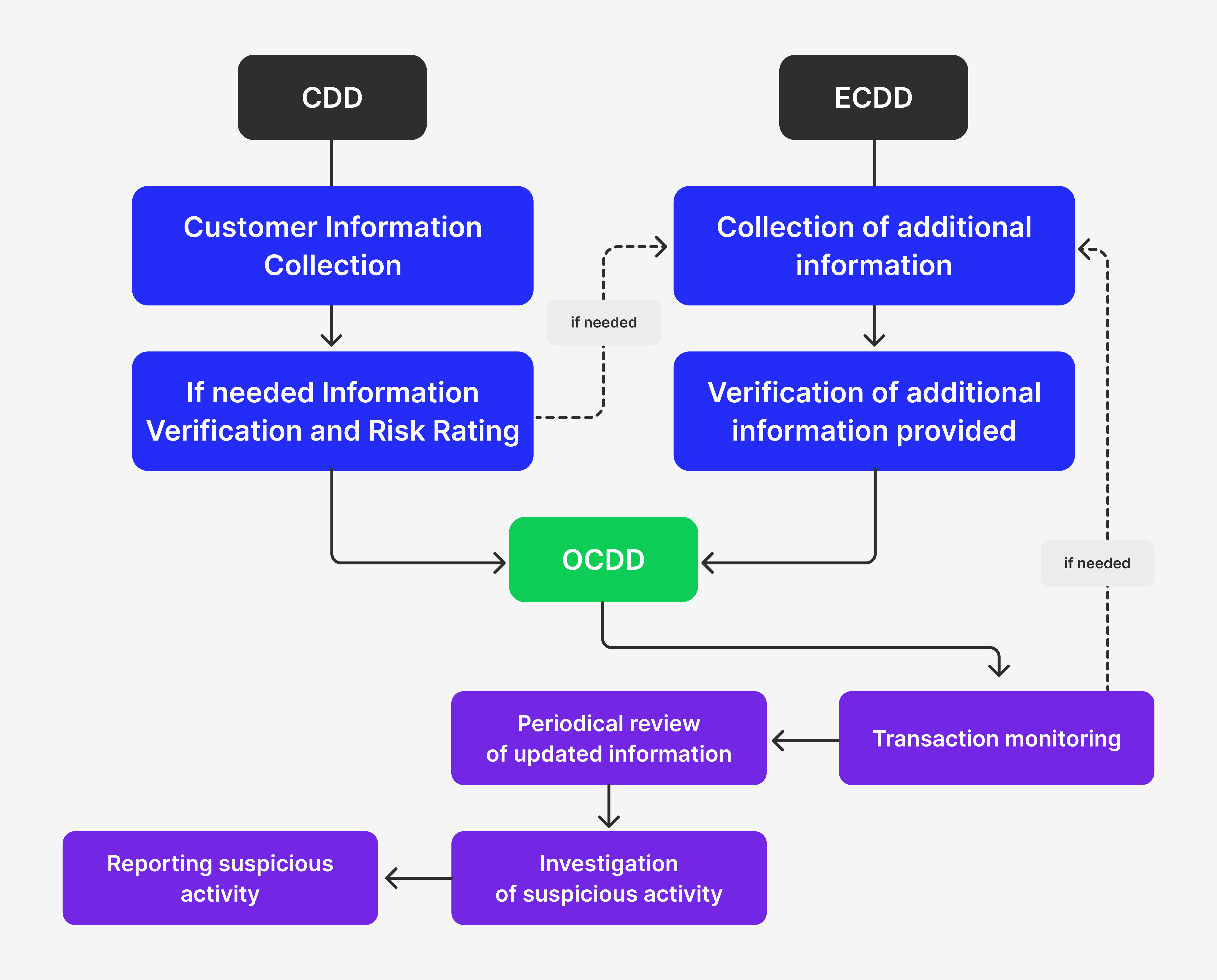

In addition, the AML risk assessment is used within the CDD (Customer Due Diligence) procedure, which helps to ensure a high level of efficiency in the management of the various components of the system of identity verification, documentation for compliance with the type and level of risk associated with money laundering in the framework of cooperation between customers and financial institutions.

Practical application of the AML risk assessment system within a financial institution allows for the advantage of improved reputation and regulatory policy concerning financial transactions conducted, which are based on general concepts of ensuring the safety of work with financial instruments, including third parties offering or receiving services related to payment transactions, such as P2P trading on crypto exchanges. This procedure helps to create the necessary regulatory conditions for financial transaction non-compliance, which can be suppressed and penalised with subsequent investigation.

Risk assessments based on AML analysis procedures are an excellent basis for the creation, development and practical application of new forms and tools aimed at improving CDD and EDD systems for more in-depth analysis of information sources and data of users interacting with a financial institution. This helps to form new standards in the field of financial security by using new methods of analysing the degree of risk that a client may potentially have in cooperation.

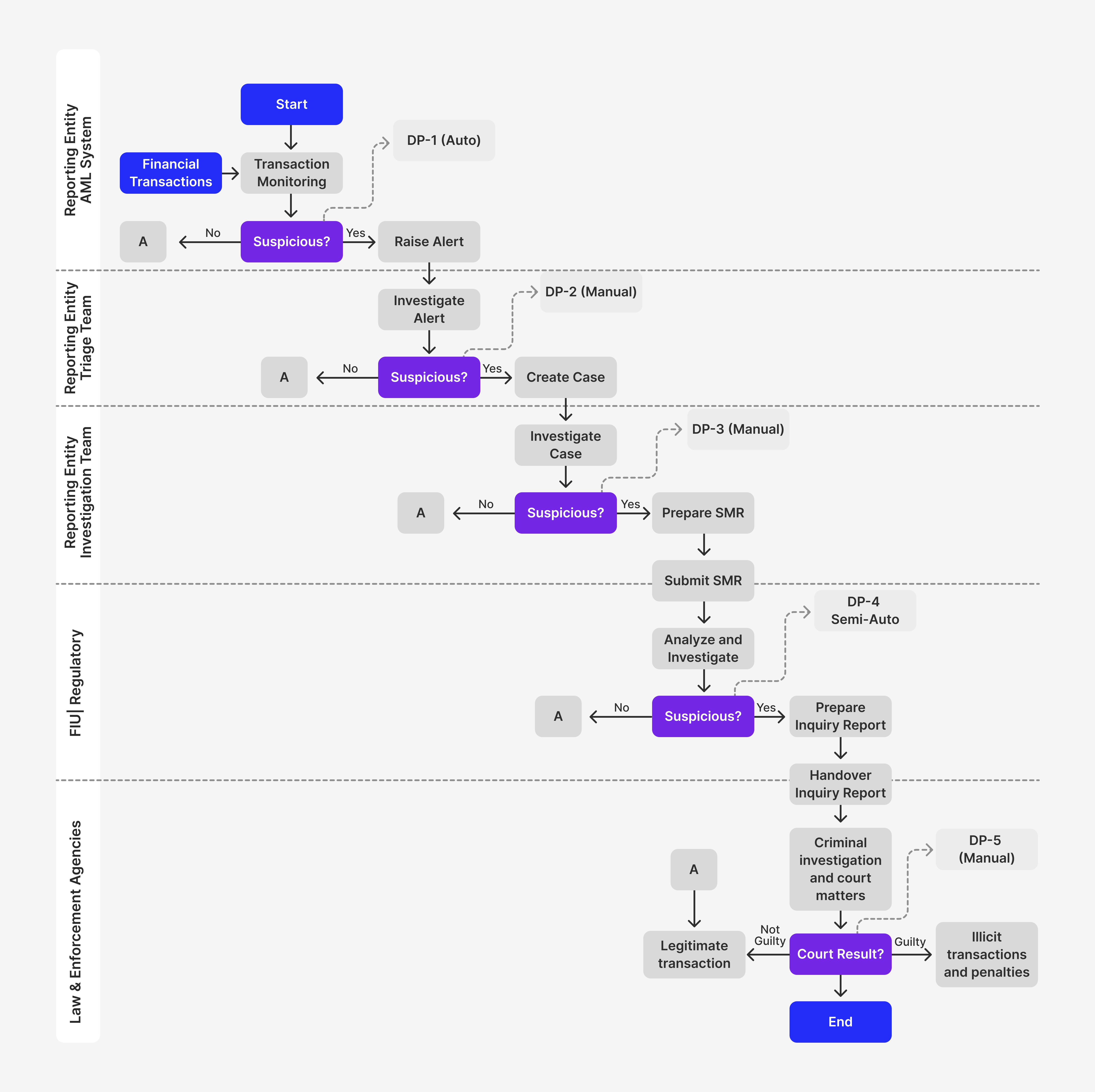

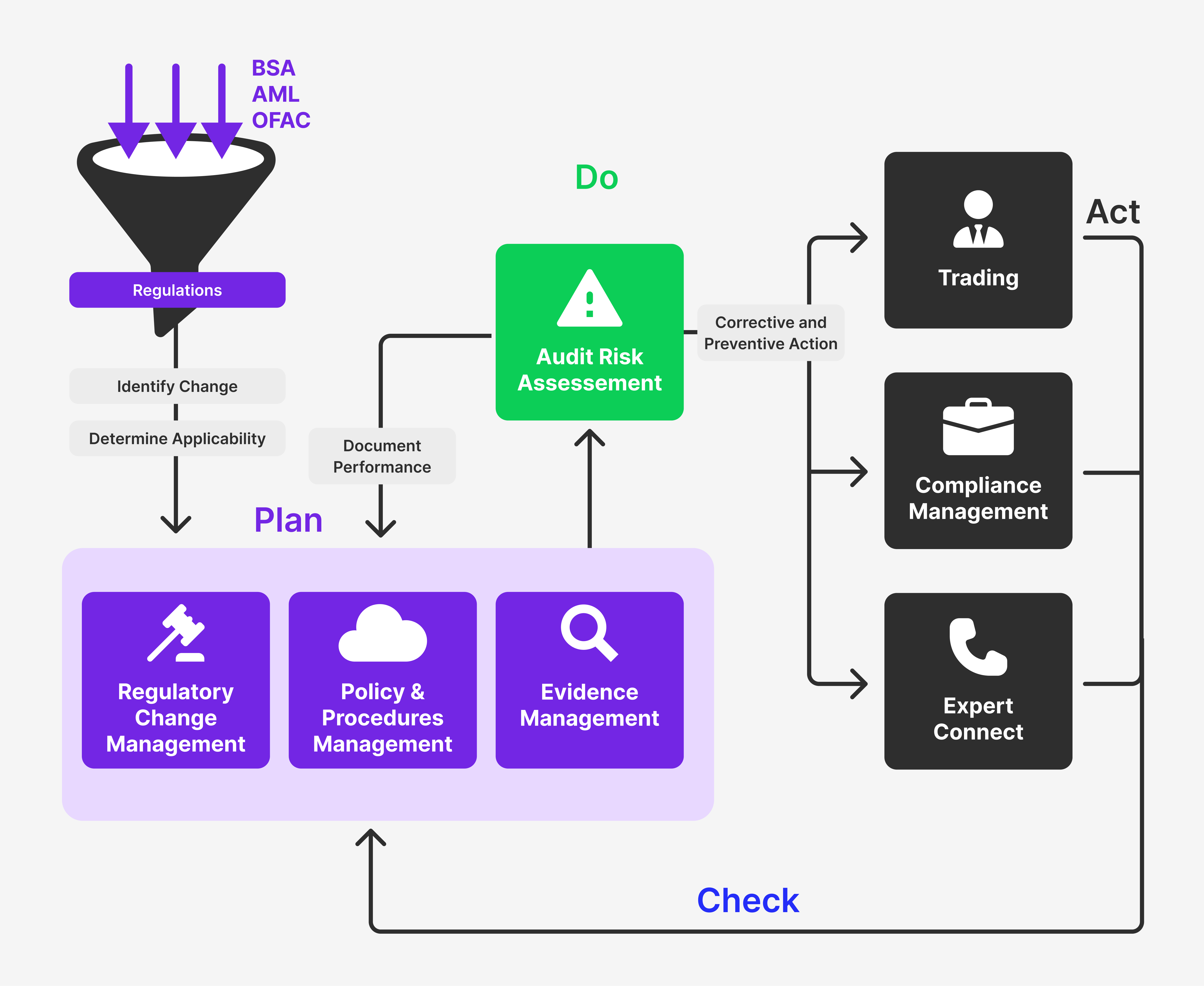

As mentioned above, the AML risk-based approach (assessment) is a tool for comprehensive examination, monitoring, verification and suppression of any suspicious activity related to financial transactions and is not limited to money laundering checks alone. Nevertheless, this set of financial activity assessments has a complex step-by-step algorithm, the effectiveness of which depends on taking into account the following steps.

The first step of the AML risk assessment procedure is the collection, accumulation, processing, and systematisation of information on potential risks that may occur within the framework of transactions conducted with money. This stage is important because it helps to structure the received information about risks in order to analyse further their types, forms, origin, conditional criteria of occurrence, etc. This accelerates the process of forming an idea about the risks. This speeds up the process of constituting an idea of how to identify the risk correctly.

After analysing the risk data, the procedure includes a system of tools to help identify the risk according to a number of parameters and indicators. Since there are many types of financial crimes related to money laundering today, their diversity makes it necessary to develop a system capable of identifying the origin of the risk, its degree and the degree of possible consequences in case of its unavoidable occurrence. Thanks to money laundering risk assessment, it becomes possible to have a clear picture of the nature of any risk associated with financial transactions.

At this stage, all identified risks are categorised, which includes the distribution and systematisation of the array of information about existing security problems into categories depending on the criteria on the basis of which they are assessed. Such criteria may include the geographical location of the risk subject, triggers that provoke it, the degree of danger it creates, the degree of damage to financial enterprises from a particular risk and the history of measures to prevent it. Further, depending on the risk category, the risk is assessed according to different characteristics and parameters.

This stage is the most important and accounts for a large percentage of the valuable work that is carried out as part of this set of measures aimed at identifying, analysing and preventing potentially dangerous situations related to fraud and money laundering within a particular financial institution.

Within this stage, a comprehensive analysis of each category of identified risks is carried out in order to understand the potential negative impact on business processes and trading operations within the firm, as well as to predict the likelihood of their recurrence for prompt response and prevention through the use of solutions that make up a system of solutions that provide multi-level targeted protection of both personal and confidential financial data of users.

After completion of the multi-stage process of analysis and identification of risks in accordance with the criteria and other parameters defining their nature, the process moves to the stage of development or application of an already developed plan or strategy aimed at reducing the likelihood of negative consequences resulting from the occurrence of a particular risk to prevent the implementation of a targeted action on the part of a fraudulent organisation or person to create the necessary conditions for money laundering. The existence of a clear strategy to prevent money laundering activities is the basis for a quick and effective response in cases of recurrence of suspicious activity.

Once, as a result of applying a certain strategy to eliminate the risk associated with money laundering, a stage is carried out within which full and detailed reporting is compiled related to the results of procedures aimed at its identification, categorisation, the process of prevention, analysis of the degree of exposure of the company to the recurrence of the same risk, accounting of methods and means used to minimise or eliminate it, etc.

In addition, at this stage, statistical reports are generated that will be used in the future as part of repeated AML risk assessments to compare all the upsets that have occurred before with the risks that are currently occurring. This will help to understand the pattern of occurrence of such risks and improve the methods of dealing with them thanks to the available data describing their characteristics, similarities, and differences.

After the reporting and all relevant documents on the results of all the above stages have been prepared, the final stage is the application of measures aimed at regular checks and monitoring of financial activity on the basis of statistical data and key risk indicators generated at the stages of risk assessment and categorisation. As a result of the application of AML monitoring, it becomes possible to track suspicious illegal activity in real time for more effective prevention in the future.

Despite its importance and fairly high efficiency in matters related to ensuring all the conditions for systematic monitoring and eliminating signs of identifying suspicious activity in relation to funds and other financial assets, this practice is not without flaws in that some obstacles in the process of its practical application reduce its effectiveness of use. Here are some of them:

The quality and reliability of data obtained from various sources on money laundering risks is the first issue that strongly affects the performance of the entire AML assessment system. Since AML risk assessment depends on the availability of accurate and complete data on customers and transactions, inadequate, inconsistent or inaccurate data may hinder the effectiveness of the procedure and, therefore, undermine the reputation of companies offering AML solutions.

The integration of data from different internal and external sources, such as customer databases and transaction records, typically occurs in different formats, systems and resources. This creates problems with the interconnectivity and sometimes the interpretation and processing of different sets of information. In addition, there is incorrect analysis of already available data due to differences between systems dealing with different operations based on categorisation and clustering of data into different groups.

The effectiveness of the risk assessment depends entirely on the reliability and performance of the assessment models, which are designed to ensure the accuracy and validity of the assessment and to avoid errors that may occur as a result of failures. These models are continually tested and refined to ensure that their performance requirements are met in accordance with established standards of computational quality and accuracy.

Since the ability to update risk profiles in real-time based on continuous monitoring, including transaction analysis, screening against lists and assessment of changes in customer attributes, is key to dynamic AML risk assessment, current systems that are imperfect in this regard are provided with new modules that provide the entire system with a comprehensive set of necessary tools to help detect, prevent and eliminate the likelihood of money laundering risks in real-time.

To be able to use a reliable technological infrastructure and access reliable data sources, various types of resources are required in an amount sufficient for the normal functioning of all elements of such infrastructure. Unfortunately, today, many companies do not have sufficient resources to maintain the correct operation of the entire AML risk assessment system, which becomes a major obstacle to ensuring a safe environment for conducting financial transactions.

AML risk assessments, required in all cases related to financial transactions within a financial organisation, is a powerful and indispensable tool that has all the necessary means of analysis, monitoring, and prevention of any risks associated with money laundering, whether it is within the framework of trading on financial markets or making financial settlements.