Importance of Forex Market Liquidity for Your Business

By Otar Topuria

By Otar TopuriaOtar is a seasoned content writer with over five years of experience in the finance and technology niche. The best advice he received was to read, which has led him to an academic background in journalism and, ultimately, to content writing. He believes everything can be brought to life through words, from the simplest idea to the most complex innovation.

By Tamta Suladze

By Tamta SuladzeTamta is a content writer based in Georgia with five years of experience covering global financial and crypto markets for news outlets, blockchain companies, and crypto businesses. With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors. Tamta's writing is both professional and relatable, ensuring her readers gain valuable insight and knowledge.

An integral part of globalisation is the opportunity to trade currencies throughout the civilised world. Among multiple critical financial markets, the Forex market stands out as one that supports this vital opportunity.

Liquidity is the capacity to purchase or sell currency pairs in the Forex market without significantly altering prices. It is a critical factor influencing the market's stability and effectiveness. For companies that trade foreign exchange, liquidity is essential since it affects how easy and expensive it is to swap currencies.

The liquidity of the Forex market makes it possible to execute massive trading volumes swiftly and at prices that reflect genuine market value. High liquidity is defined by a deep market with quick transaction execution and slight variation between buying and selling volume. On the other hand, slower trade execution times and more considerable price differences between buy and sell can occur in an illiquid market, leading to higher trading expenses and inefficiencies.

Businesses must efficiently control trading expenses since high liquidity guarantees faster speeds and consistent pricing.

Low liquidity can result in larger spreads and pricing differences, raising transaction costs and business financial risks.

Choosing the correct FX liquidity provider is crucial for accessing high-liquidity Forex pairs and guaranteeing effective trade executions.

Central banks, financial institutions, and retail traders primarily provide a broad spectrum of liquidity that promotes market efficiency and improves conditions.

Liquidity in the Forex market is one's capacity to purchase or sell currency pairs fast enough to avoid significant price fluctuations. For companies that trade foreign exchange, this idea is essential to knowing how markets work. To comprehend Forex liquidity, let’s discuss several essential aspects below:

As we already mentioned, the speed and effectiveness with which trades are completed in the currency market are directly impacted by liquidity. Large volumes of currency pairs can be traded quickly without causing significant price changes in a highly liquid market.

This is because there are many people in the market who are always willing to buy and sell, making it possible to satisfy orders almost instantly. Thus, a market with high liquidity minimises execution delays, which is essential for traders who must rapidly modify their positions in reaction to market movements.

Currency pair prices are typically more stable in a liquid market. Liquidity keeps the spread, or difference between the purchase and sale prices, to a minimum. A small spread indicates enough market activity without large price movements, which indicates a high liquidity level. On the other hand, fewer prospective buyers and sellers result in bigger spreads in an illiquid market, which raises the cost and difficulty of trading.

Spreads can be used to assess FX market liquidity. Spreads are usually minimal in liquid marketplaces because deals may be executed quickly there. Businesses benefit from this since it lowers transaction costs and makes pricing more predictable.

Conversely, an illiquid market frequently marked by wider spreads suggests a higher trading cost and possible challenges when taking on or releasing positions without impacting market prices.

The Forex market facilitates more efficient trading of major and exotic currency pairs by upholding high liquidity. Because of the contribution of multiple market participants, the Forex market is one of the most liquid financial markets. Gaining insight into these effects enables companies to evaluate market liquidity and create strategies that fit this market, improving trading effectiveness and possibly avoiding low liquidity.

The actions of a few major players have a significant impact on the Forex market size and liquidity. Every group brings something unique to the table.

In addition to overseeing the implementation of national monetary policy, they play a crucial role in the foreign exchange market by actively engaging in Forex trading to maintain the value of their respective currencies. Central banks have the power to affect exchange rates and, consequently, the liquidity of the foreign exchange market by buying or selling their currency in bulk. They are, therefore, essential liquidity providers.

Financial organisations like banks and investment corporations are among the most active players in the currency market. Every day, they trade substantial amounts of money for their clients and themselves. Because of the significant market depth this trading activity creates, there are always two sides to the market, improving market liquidity. By continuously providing buy and sell prices, these organisations function as market makers, assisting in stabilising the market and reducing the difference between prices.

Although they trade at much lower volumes than other financial institutions, their combined influence on Forex liquidity is substantial. Because of the accessibility of online trading platforms, traders can now participate in the retail market to a greater extent, which increases the volume and liquidity of trading in the market. Retail traders provide extra layers of buy and sell orders at different price points, which deepens the market.

These crucial players' combined trading activity guarantees a liquid market that allows transactions to be completed quickly and with little effect on prices. The volume of trading in the Forex market is reflected in market depth, a measure of liquidity upheld by these big players' constant flow of orders.

Due in large part to the strong liquidity these important firms supply, the market can absorb massive deals without experiencing substantial price adjustments.

The high liquidity of the FX market is primarily a result of its size. The volume of daily trade in this market, which is the biggest financial market in the world, is far higher than that of any other exchange. Because of this enormous volume, numerous trades can be made simultaneously without having a significant effect on the selling price of major currency pairs. A high trading volume indicates a steady supply of liquidity, which lowers the risk associated with it and allows for faster transactions at steady pricing.

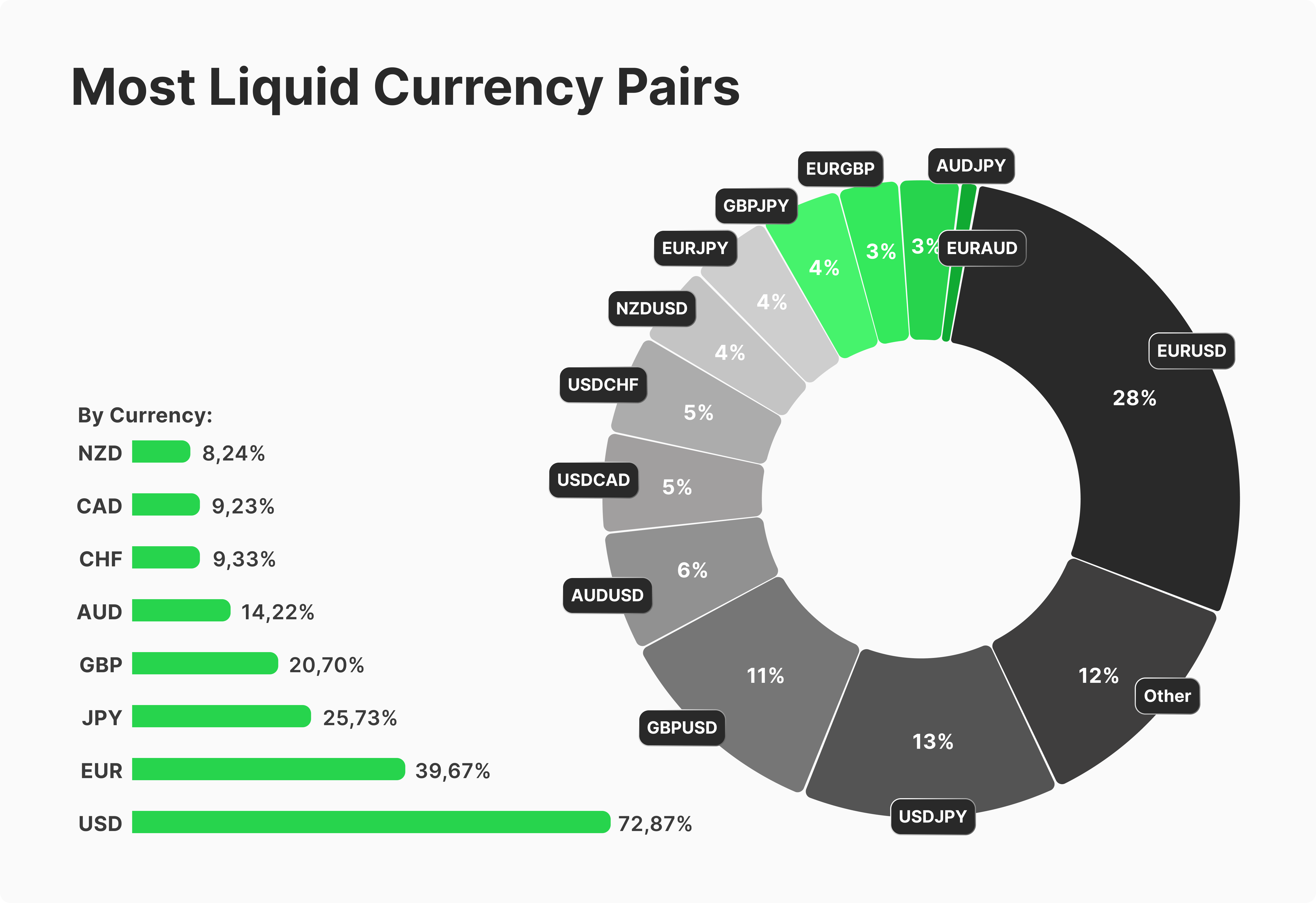

Examples of Highly Liquid Currency Pairs

The main currencies and the US dollar are usually the most liquid currency pairings on the Forex market. These are the following: AUD/USD, GBP/USD, USD/CHF, EUR/USD, and USD/JPY. There are various reasons for these pairings' high liquidity:

Robust Economies—These pairs reflect the vast majority of the world's strongest and most stable economies, which accounts for their extensive usage and substantial trading activity.

Large Market Participation—Various traders are drawn to major currency pairs, which adds to the market's depth.

Significant Interest and Usage—Due to their widespread use in international trade and finance, there is always a demand for and a supply of these currencies, which results in high liquidity.

Market's Liquidity and Efficiency

The size of the Forex market increases its efficiency by providing liquidity. A smooth market flow results from transactions in highly liquid marketplaces completed quickly and with little price difference between subsequent trades. Because liquidity providers are encouraged to join based on volume and income potential, liquidity levels are maintained even during market volatility.

Use of Liquidity Ratios and Indicators

Liquidity ratio and Forex liquidity indicator are frequently used by traders and analysts to evaluate liquidity. These instruments are crucial for organising trading strategy and aid in determining how simple it is to execute deals. Lower liquidity ratios indicate that assets can be swiftly turned into cash with little effect on pricing in a highly liquid market.

To sum up, the size of the Forex market directly affects its liquidity, which makes it a highly liquid market with efficient trading of key currency pairings. This quality is essential for preserving market efficiency and stability and promoting global finance and trade.

Fast Fact

According to some sources, introducing the gold standard in 1880 marked the start of modern international exchange.

Finding liquidity in Forex requires using a variety of instruments and indicators that represent the simplicity and speed of placing transactions. Spreads, or price gaps, are one of the main ways to measure liquidity.

Generally speaking, narrow spreads point to a highly liquid market with efficient processing of high trading volumes. Another important indicator is trading volume, which calculates the total amount of currency moved in a specific time frame and gives proper information.

Liquidity assessment is aided by market depth, which provides information on the volume of buy and sell orders at various price points. Deeper market depth indicates a more liquid market, where big orders may be filled with little price difference, lowering the risk of liquidity problems and enabling more seamless transactions. Companies preparing their Forex trading plans ought to keep an eye on these metrics and understand the importance of liquidity, as it dramatically impacts trading results.

Businesses can optimise their financial operations by better planning entry and exit locations, managing price gap risks, and coordinating their trading strategies with market circumstances by knowing these indicators.

Business trading tactics benefit significantly from high liquidity in the Forex market, which provides better pricing, faster execution, and less slippage. A liquid market usually has narrow spreads, which reduces transaction costs and leads to better pricing.

High liquidity allows trades to be completed more quickly by guaranteeing that counterparties are always accessible to fulfil orders promptly. Because orders are filled nearly at the appropriate prices even in rapidly moving markets, there is less slippage in liquid markets.

However, risks associated with low liquidity in the FX market might impact corporate operations. Greater spreads and price gaps are typical in illiquid markets, resulting in increased transaction costs and even unfavourable price movements that affect the company's financial results.

Businesses can use techniques such as trading financial markets during peak market hours, when liquidity is higher, utilising limit orders to restrict execution prices, and keeping trading plans flexible to adjust to shifting market liquidity to reduce these risks.

Knowing how liquidity impacts FX trading can help businesses more effectively control their exposure to liquidity risk and match their trading tactics to optimise market operations.

Businesses that trade Forex must choose their FX liquidity provider carefully. The appropriate provider improves trading efficiency with reasonable spreads, robust market access, and dependable execution speeds. Here, we review Forex liquidity providers that stand out for their dedication to improving the environment and high-calibre service.

B2Prime is a certified PoP Multi-Asset LP serving professional and institutional customers. B2Prime, well-known for its cutting-edge technology and wide range of connectivity choices, provides brokerage businesses, exchanges, and investment firms with customised solutions.

B2Prime's rapid execution speeds and round-the-clock technical assistance benefit clients by guaranteeing successful and efficient trading operations. The provider ensures smooth integration and dependable financial data interchange with various services.

The company offers liquidity for over 225 instruments across six asset classes: Forex, Crypto CFD, Spot Indices, Precious Metals, Commodities, and NDFs, all of which are available through cutting-edge platforms like the OneZero Hub, PrimeXM X-Core, and the FIX API.

With its approach to FX liquidity services, LMAX Exchange is well known for providing precise, accurate, and reliable execution. Leading FX MTF under Financial Conduct Authority regulation, it offers a distinct perspective of fairness for all market players.

The platform ensures high transparency and liquidity through order-driven execution, low latency, and complete transaction data publication. Because of this, LMAX is a desirable choice for traders seeking direct, equitable market access.

The extensive electronic trading platform provided by Interactive Brokers (IB) makes it easy to trade various products, including FX. IB, well-known for its robust trading technology and extensive access to international markets, offers traders direct, markup-free access to liquidity from 17 of the biggest foreign exchange dealers in the world, guaranteeing competitive spreads and significant liquidity.

Trading immediately benefits from high liquidity since it lowers transaction costs and market risks. However, the drawbacks of low liquidity, such as higher spreads and possible price gaps, call for careful consideration when choosing trading windows and liquidity sources, as well as strategic planning.

Enterprises may provide a dependable trading environment through collaboration with reputable LPs such as those listed above. In addition to providing institutional Forex liquidity needs and trading of the most liquid currency pairs, these providers offer access to liquid markets and a strong technology foundation.

Liquidity is necessary for everyone. High liquidity markets promote quick purchases and sales, which boost the economy. Conversely, markets with less liquidity have the potential to stall and raise prices. When trading cryptocurrencies or stocks, it's essential to understand liquidity.

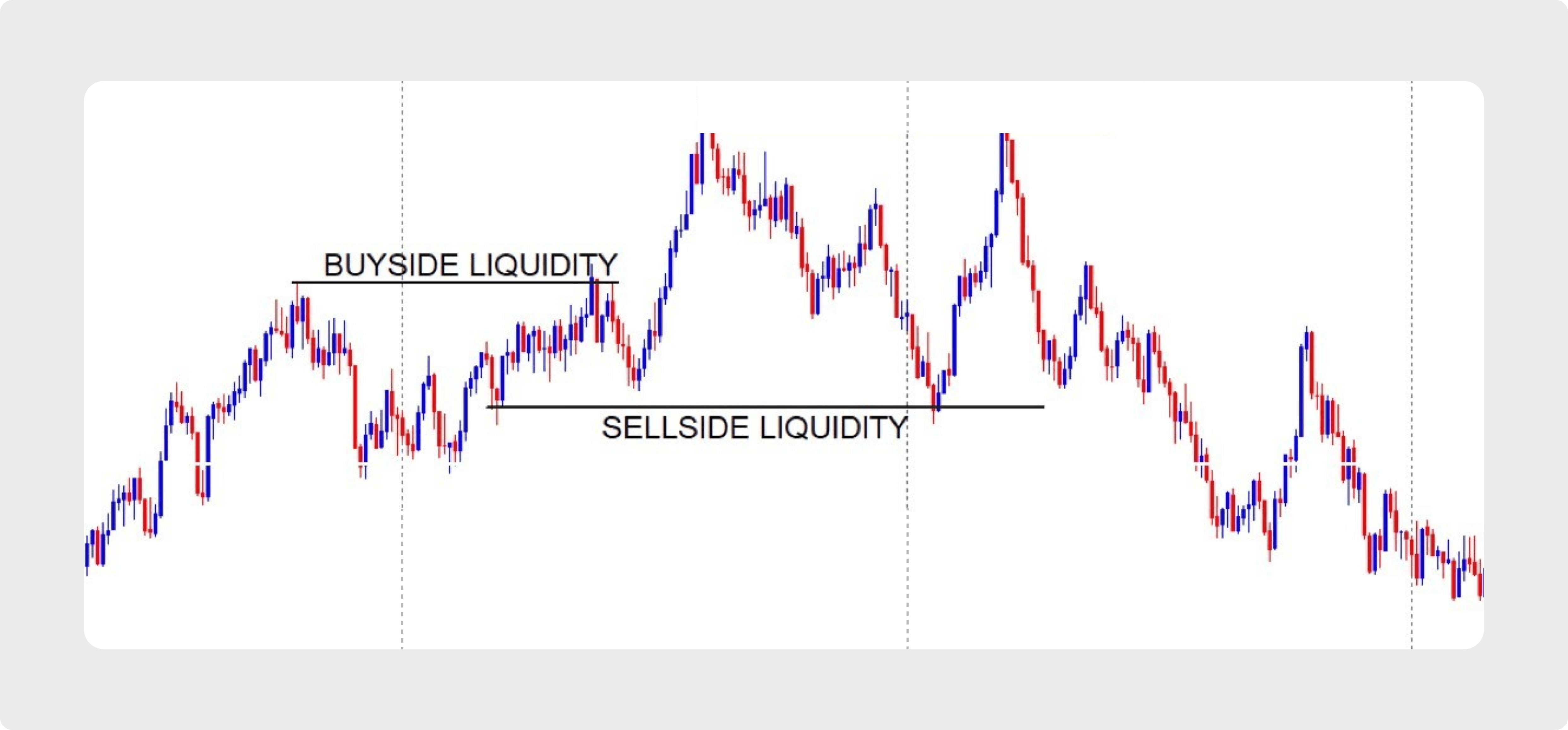

Liquidity zones are places where buying or selling a particular currency pair is in great demand. Recognising these zones can help traders understand potential market patterns and price changes.

Foreign exchange deals of around $5 trillion are made daily, or $220 billion per hour.